June 6, 2025

May Jobs - Better Than Expected; Gradual Moderation

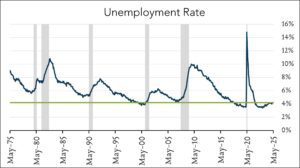

May hiring exceeds expectations, trade policy uncertainty remains. Nonfarm payrolls increased 139K in May (vs. consensus of +126K) after a combined 95K in downward revisions to the prior two months. The unemployment rate was unchanged at 4.2%. Overall, today’s report suggests employers remain cautious about growth prospects amid trade policy uncertainty but have yet to significantly alter hiring plans. For now, a moderating but generally balanced labor market provides the Federal Reserve flexibility to respond to developments that may arise from evolving federal trade and fiscal policy. The Fed’s next meeting is scheduled for June 18th. At the moment, investors are pricing in 2 cuts in 2025 and 2 cuts in 2026 though Fed policymakers are widely expected to hold rates steady later this month.

- 139k jobs added in May – above expectations. The U.S. labor market added 139k jobs in May compared to expectations for +126K. April job gains were revised downward to +147K from +177K originally reported. April’s outcome places year-to-date results roughly in line with expectations entering 2025. Thus far, monthly job gains have averaged 124K in 2025 compared to expectations for 121K per month when the year began and compared to average gains of +150K over the prior 12 months. Job gains trended higher in health care, leisure and hospitality, and social assistance. Federal government employment declined by 22K in May and is down 59K since January as the new administration has endeavored to reduce Federal spending.

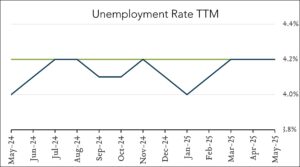

- 4.2% unemployment – unchanged for a third straight month. The U.S. unemployment rate was unchanged at 4.2% in May. The unemployment rate has remained in a narrow range of 4.0% to 4.2% since May 2024. The labor force participation rate declined slightly to 62.4% from 62.6% in April. Wage growth accelerated slightly to 3.9% year-over-year (vs. 3.8% in April) and +0.4% month-over-month (vs. 0.2% in April). Collectively, data suggests continued balance between labor supply and labor demand.