June 12, 2024

May Inflation - Broadly Cooler With Fed Ahead

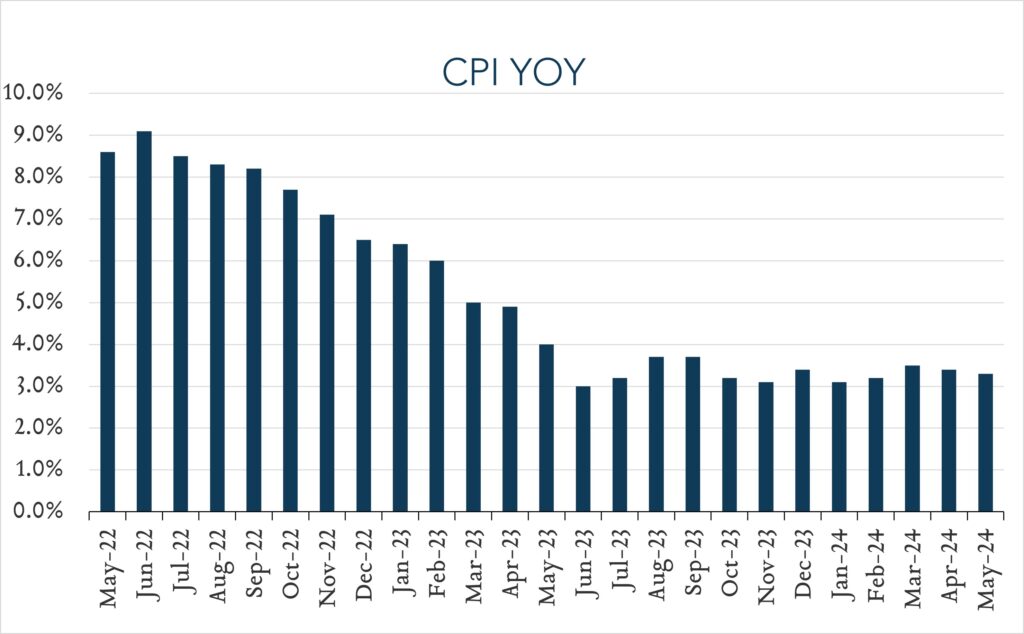

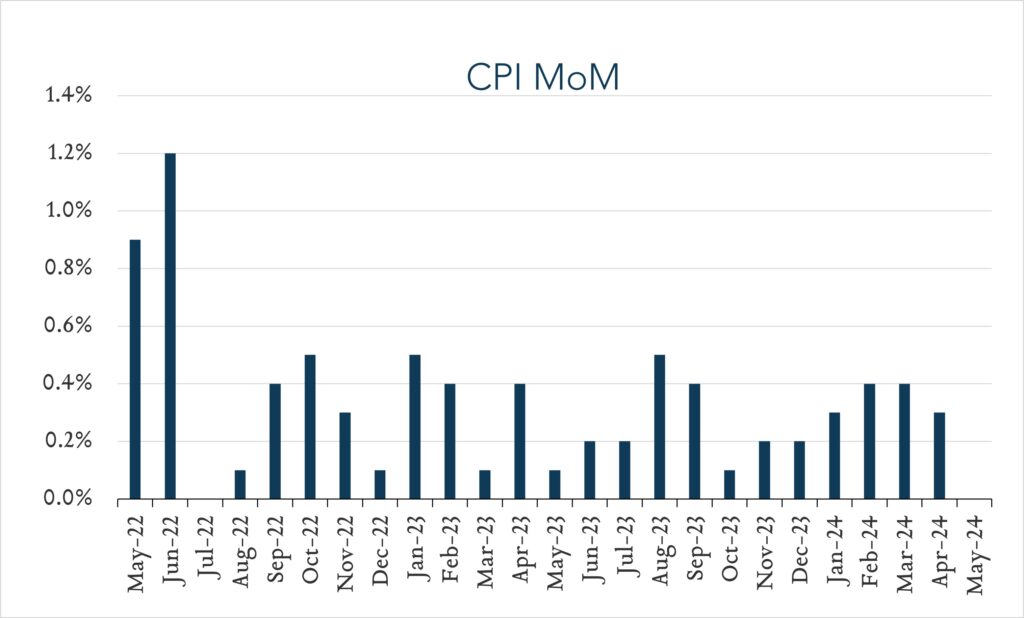

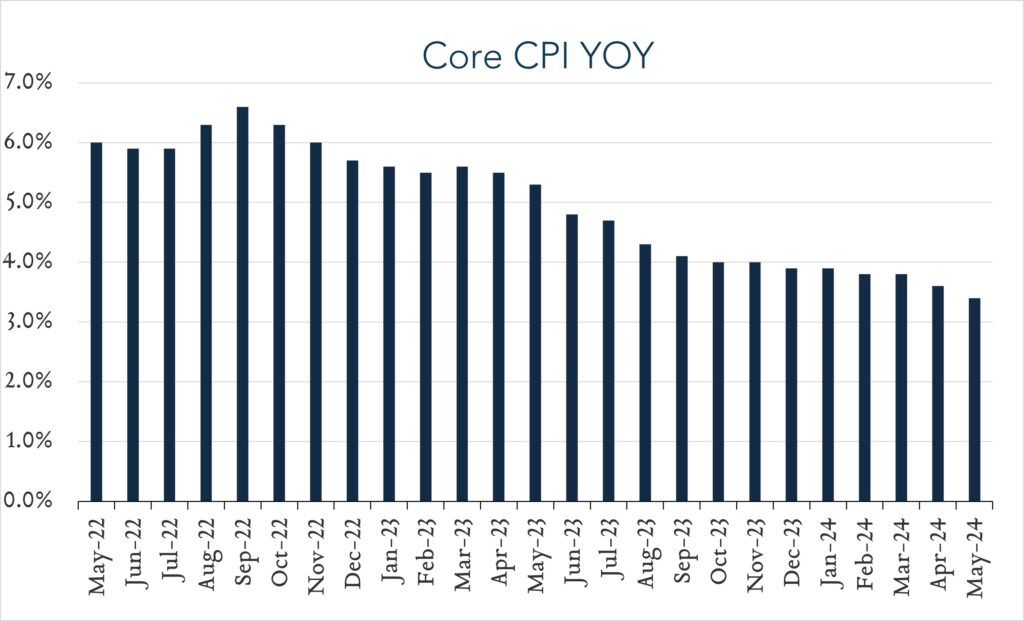

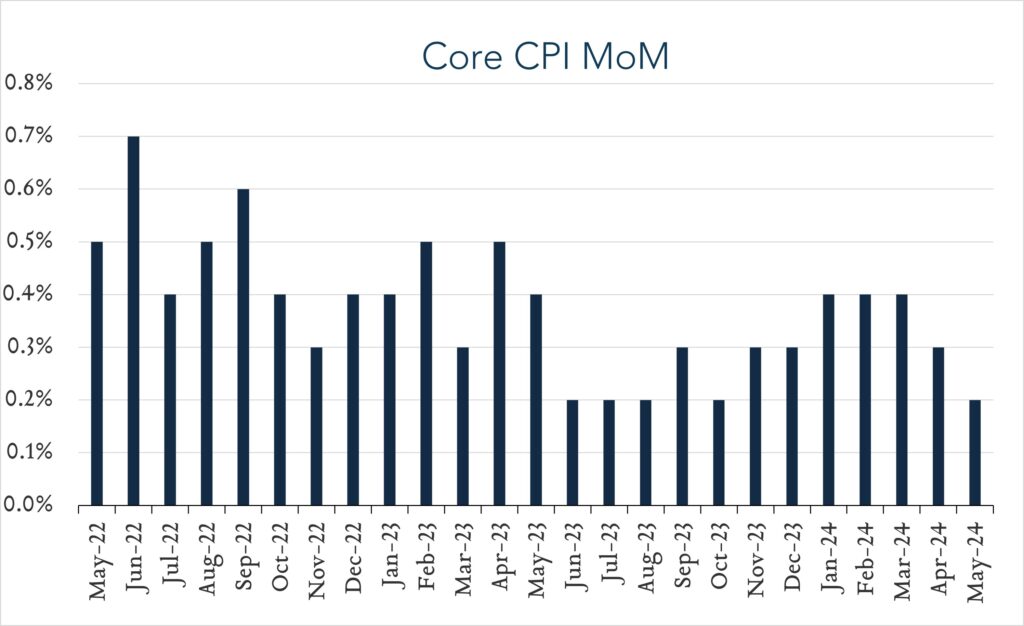

In May, consumer prices rose 3.3% compared to a year ago, down 0.1% compared to April and below expectations. This marks the second consecutive month of deceleration – a positive sign for Fed policymakers. Month-over-month, consumer prices were unchanged, marking deceleration from a 0.3% increase in April. Importantly, Core CPI (excludes food and energy) also decelerated from a month earlier, a possible indication that persistent price pressures are gradually subsiding. While Fed projections (provided in March) call for three 0.25% rate cuts this year, commentary out of the most recent FOMC meeting indicated the prospect for cuts would be based on incoming data that either supports higher confidence that inflation is decelerating or highlights unexpected weakness in the economy. Following today’s report, investors quickly adjusted expectations pricing for two full 0.25% cuts in 2024, up from one to two cuts prior to the release. This afternoon, the FOMC will provide updated insights into policymakers’ outlook. While there is little chance of a rate adjustment this month, we expect an update on the Fed’s plans for quantitative tightening and the committee will deliver an updated summary of economic projections (SEP), which details forward expectations for GDP growth, inflation, and unemployment and includes an updated dot plot highlighting committee members expectations for the forward path of policy rates.

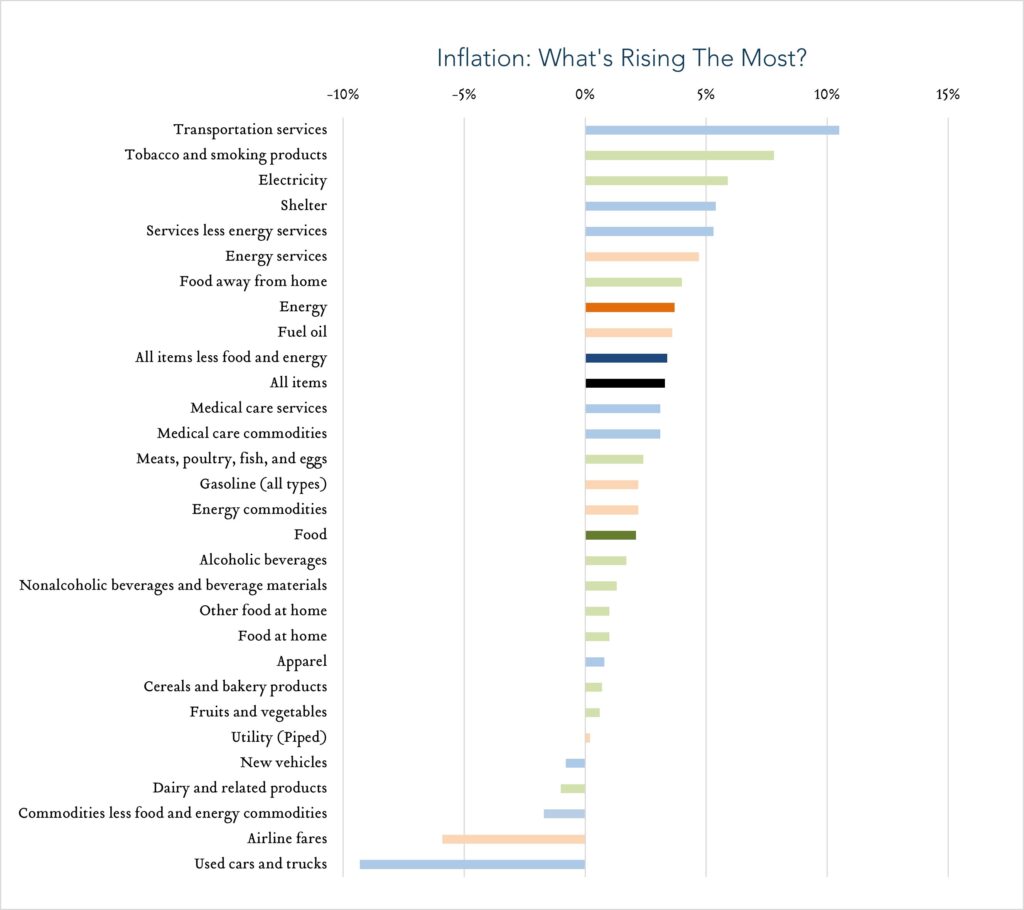

- Consumer prices (CPI) increased 3.3% year-over-year. In May, the consumer price index (CPI) increased 3.3%, down from 3.4% in April and below expectations of 3.4%. Transportation services (+10.5%) and shelter (+5.4%) were key contributors to the overall increase, more than offsetting declines for used vehicles (-9.3%). We continue to keep a close eye on shelter costs, which represent nearly one third of the consumer price index and tend to impact the index with a lag. At +5.4% year-over-year, shelter costs decelerated 0.1% from April and are down from a peak of 8.2% in March 2023. Core CPI (excludes food and energy) increased 3.4% year-over-year, decelerating from 3.6% in April.

- Consumer prices (CPI) was unchanged month-over-month. In May, consumer prices were unchanged compared to April. Expectations ranged from +0.1% to +0.2% with a median of +0.1%. Shelter costs increased 0.4%, consistent with April, while energy costs fell 2.0%. Core CPI (excludes food and energy) increased 0.2% month-over-month, down from 0.3% in April and below expectations of +0.3%.