June 11, 2025

May Inflation - Another Tame Report

Today’s report suggests that thus far, companies are finding ways to limit how much of tariff-related are being passed through to consumers. Looking forward, economists expect businesses are likely to raise prices more meaningfully if higher tariffs are implemented. For its part, the Federal Reserve remains in wait and see mode until there is more clarity on the Trump administration’s policy agenda and the trajectory of inflation. Investors are still pricing in two quarter point rate cuts this year, the first of which is not expected until at least September.

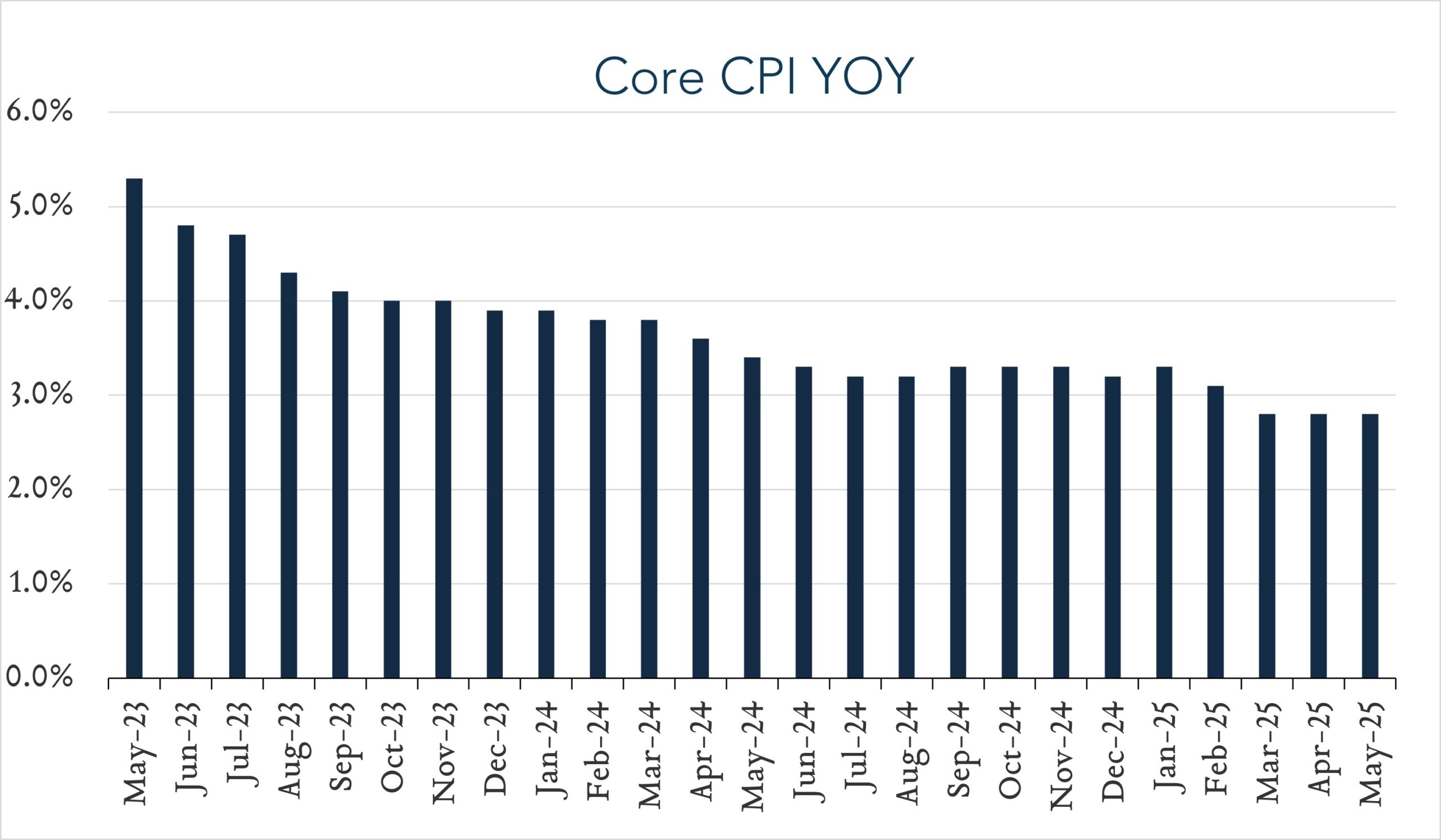

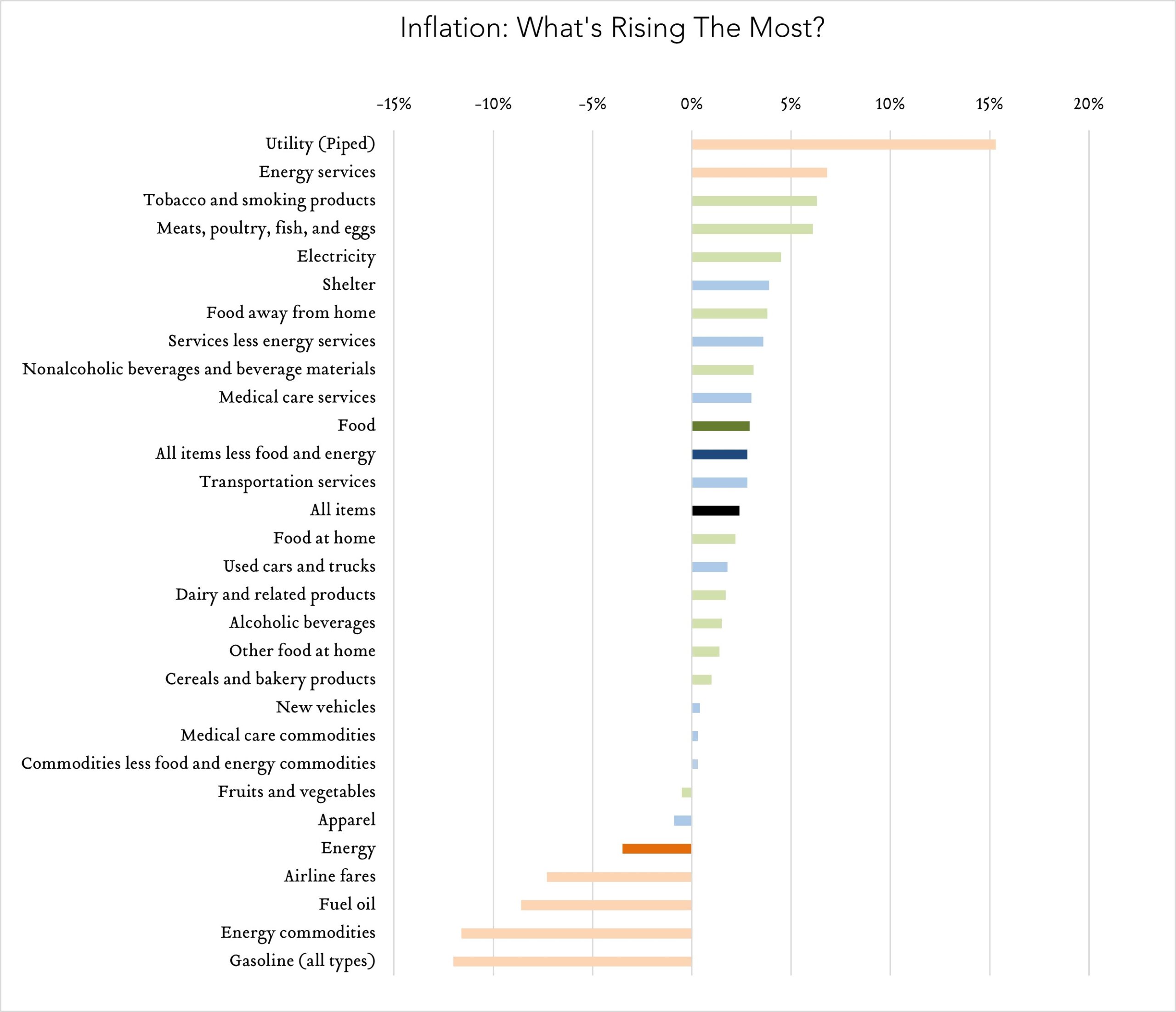

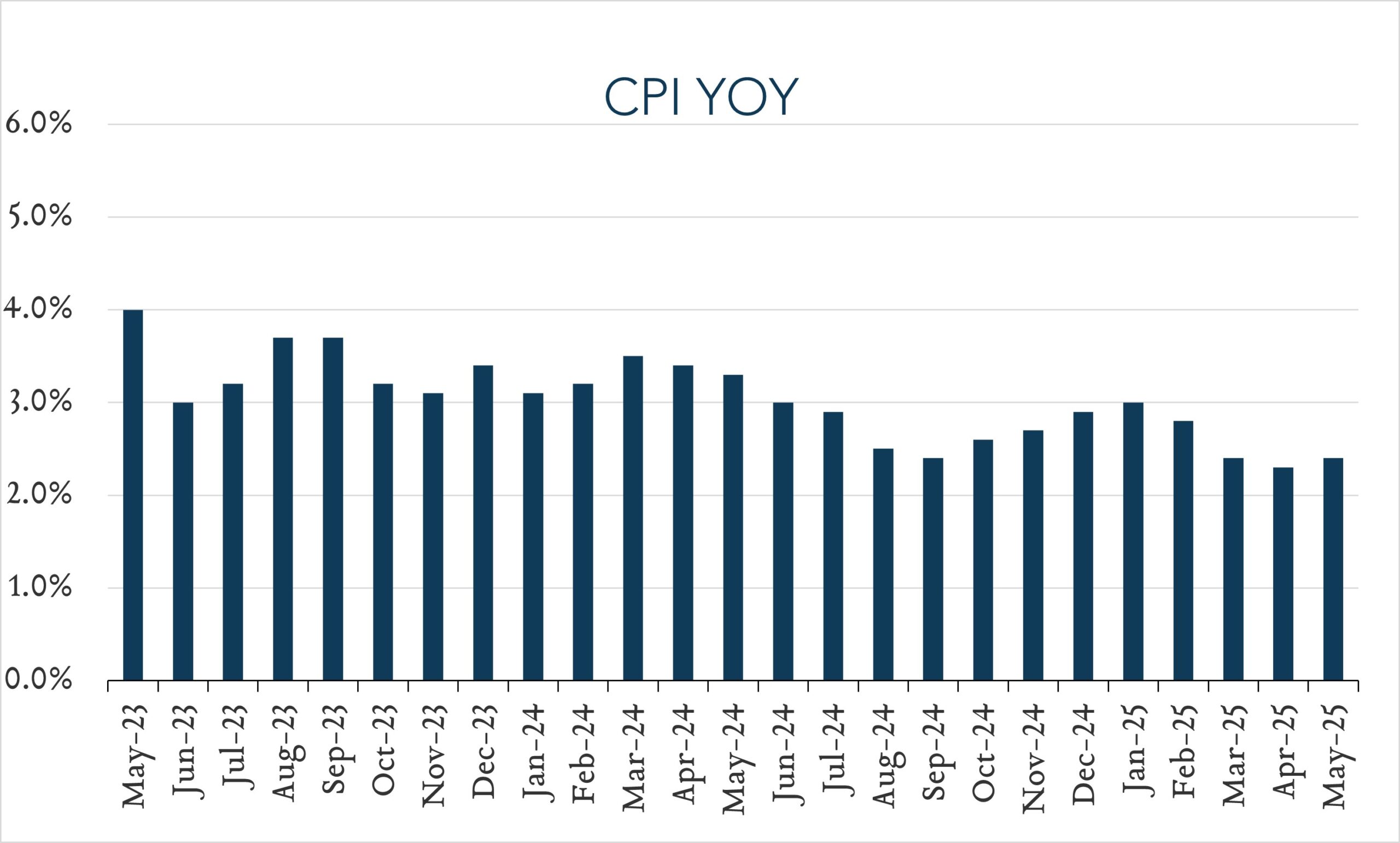

- Consumer prices (CPI) increased 2.4% year-over-year. In May, the consumer price index (CPI) increased 2.4% – in line with expectations and up from 2.3% in April. The cost of food (+2.9%) and shelter (+3.9%) were key contributors to the overall increase, more than offsetting declines in gasoline (-12.0%). We continue to keep a close eye on shelter costs, which represent nearly one third of the consumer price index and tend to impact the index with a lag. At +3.9% year-over-year, shelter inflation decelerated modestly from April 2025, and is down from a peak of 8.2% in March 2023. Core CPI (excludes food and energy) increased 2.8% year-over-year, unchanged from April March and below expectations for 2.9%. This is the lowest reading since March 2021.

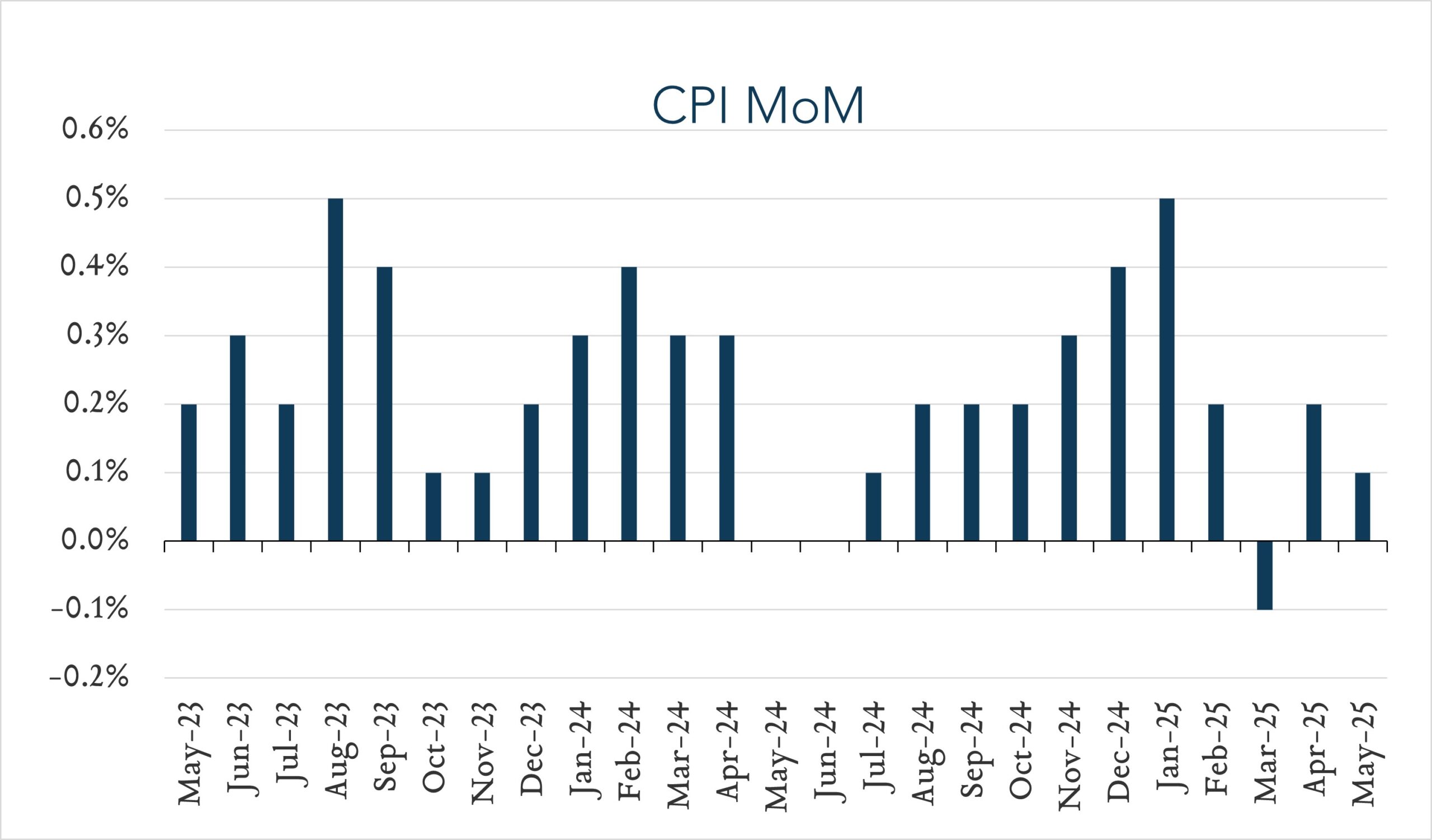

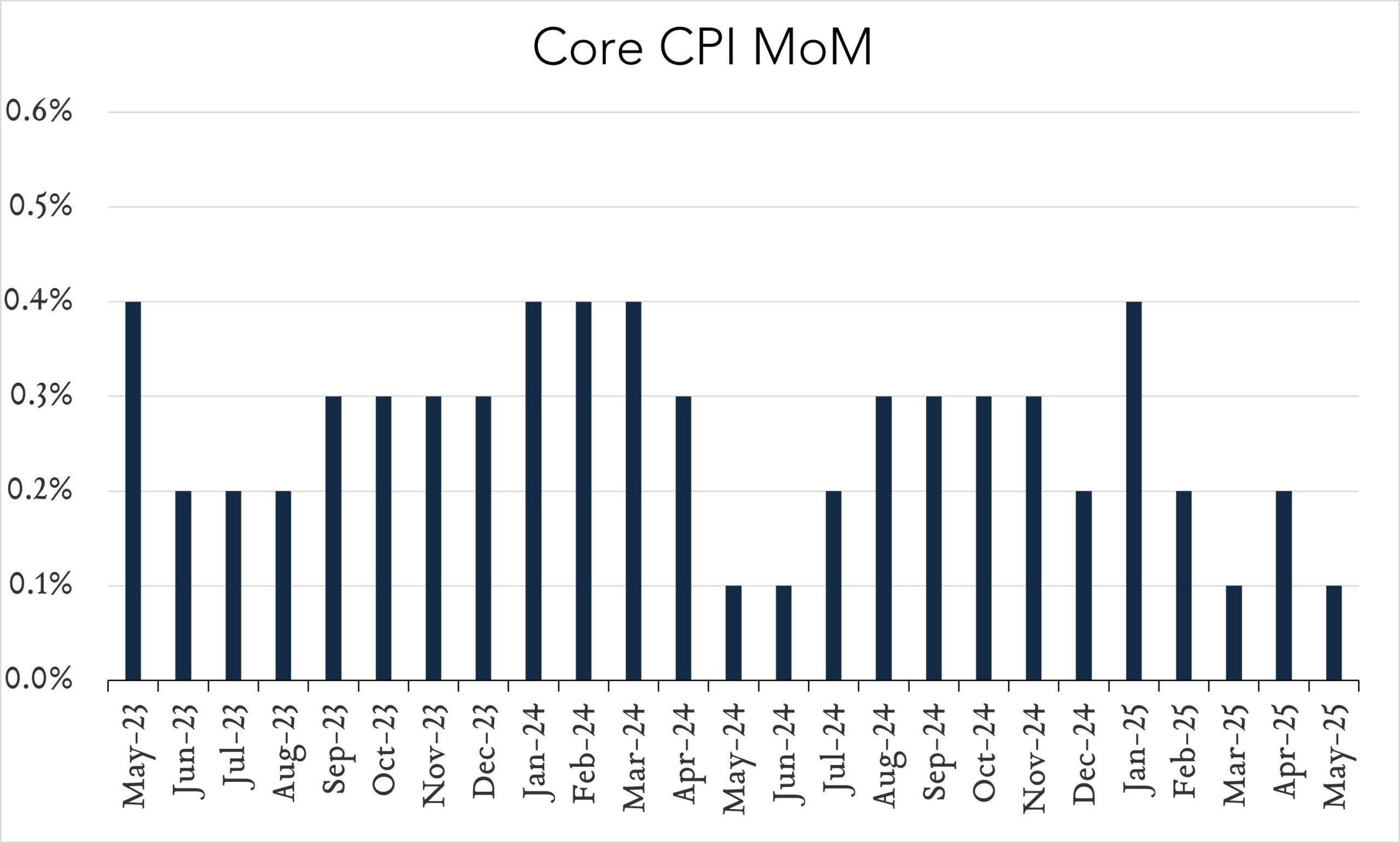

- Consumer prices (CPI) rose 0.1% month-over-month. In May, consumer prices rose 0.1% month-over-month down from 0.2% in April and below expectations for the same. Core CPI (excludes food and energy) also increased 0.1% month-over-month, down from 0.2% in April and below expectations for +0.3%.