April 16, 2025

March Retail Sales - Up Big on Motor Vehicle Purchases Ahead of Tariffs

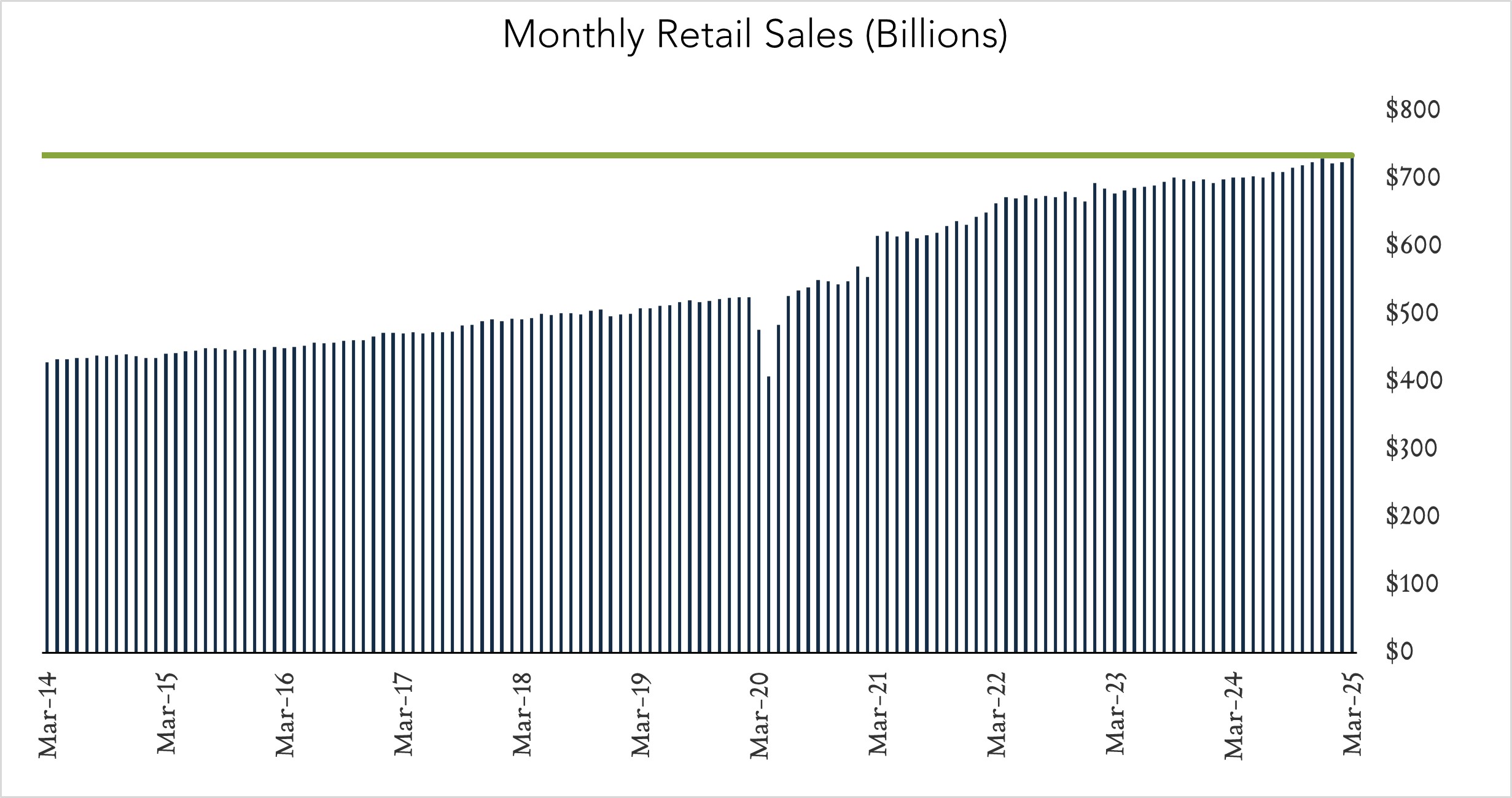

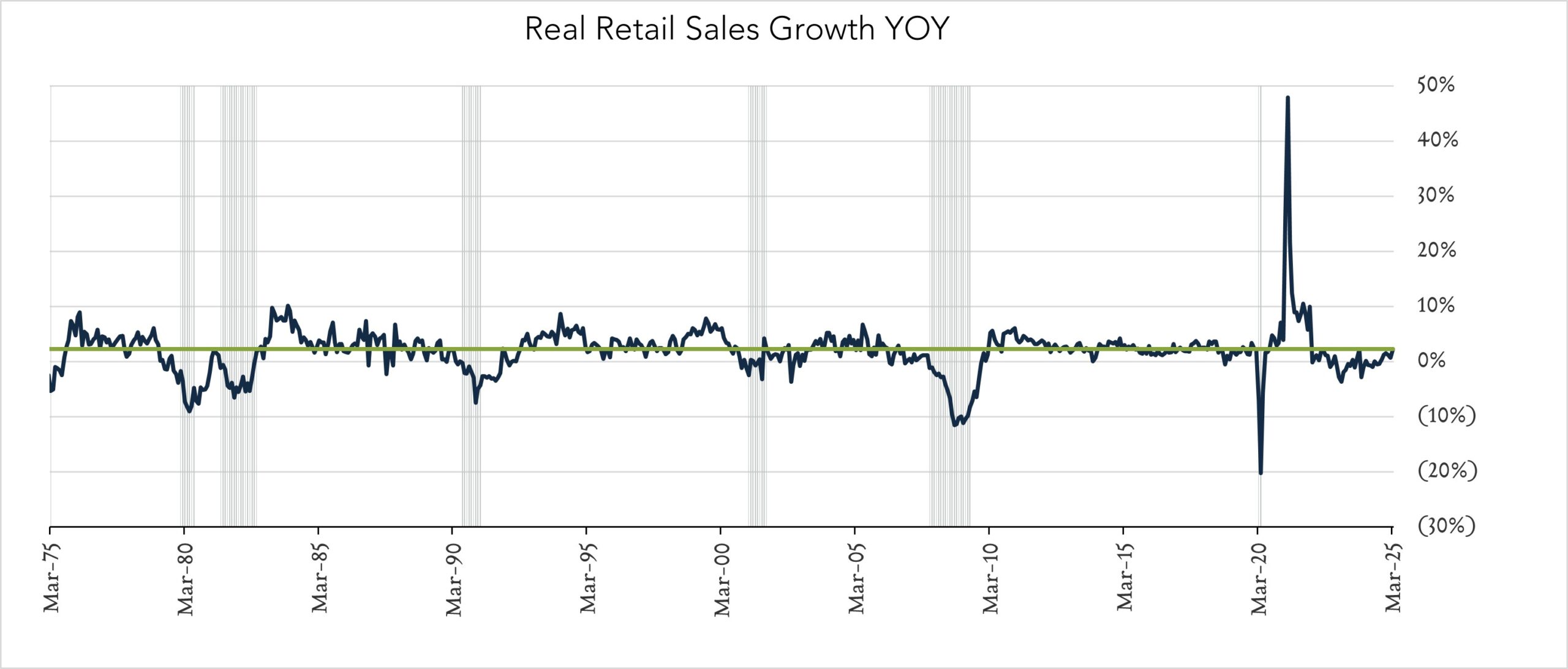

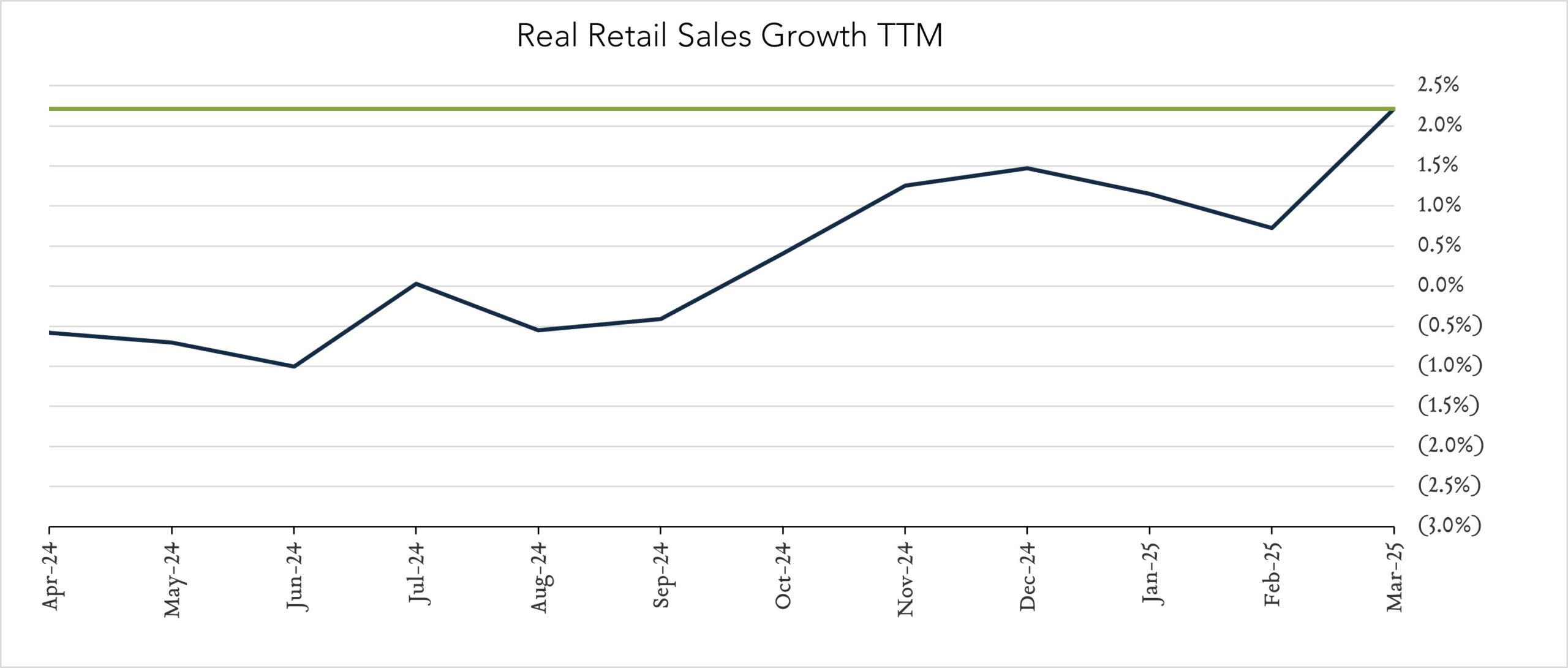

In nominal terms, U.S. retail sales jumped 1.4% month-over-month and 4.6% year-over-year – the most in over two years. Adjusting for inflation, spending advanced 1.5% month-over-month and 2.2% year-over-year. Following two months of moderating outlays amid tariff uncertainty and ongoing inflationary pressures, today’s report suggests consumers made a mad dash to buy cars and other high-ticket items before tariffs take effect. The eventual breadth and severity of tariffs remains highly uncertain and has weighed heavily on consumer and business sentiment in recent weeks. The March jump likely represents a spending pull forward driven by tariff fears and could be followed by more subdued spending regardless of how the tariff narrative evolves.

- Real (inflation adjusted) retail sales advanced 2.2% year-over-year. In March, retail sales grew 4.6% nominally netting growth of 2.2% after adjusting for 2.4% inflation. Higher spending on motor vehicles (+8.8%) as well as brick and mortar (+4.7%) and online retail (+4.8%) and restaurant dining (+4.8%) was partially offset by a declines at the pump (-4.3%). Eleven of thirteen categories advanced in real terms.

- Real (inflation adjusted) retail sales advanced 1.5% month-over-month. In March, nominal retail sales levels grew 1.4% compared to February, in line with forecasts and netting 1.5% growth after adjusting for 0.1% deflation in the month. Higher spending on motor vehicles (+5.3%) and restaurant dining (+1.8%) was partially offset by declines at the pump (-2.5%). Eleven of thirteen categories advanced in real terms.