July 18, 2023

June Retail Sales - Below Estimates

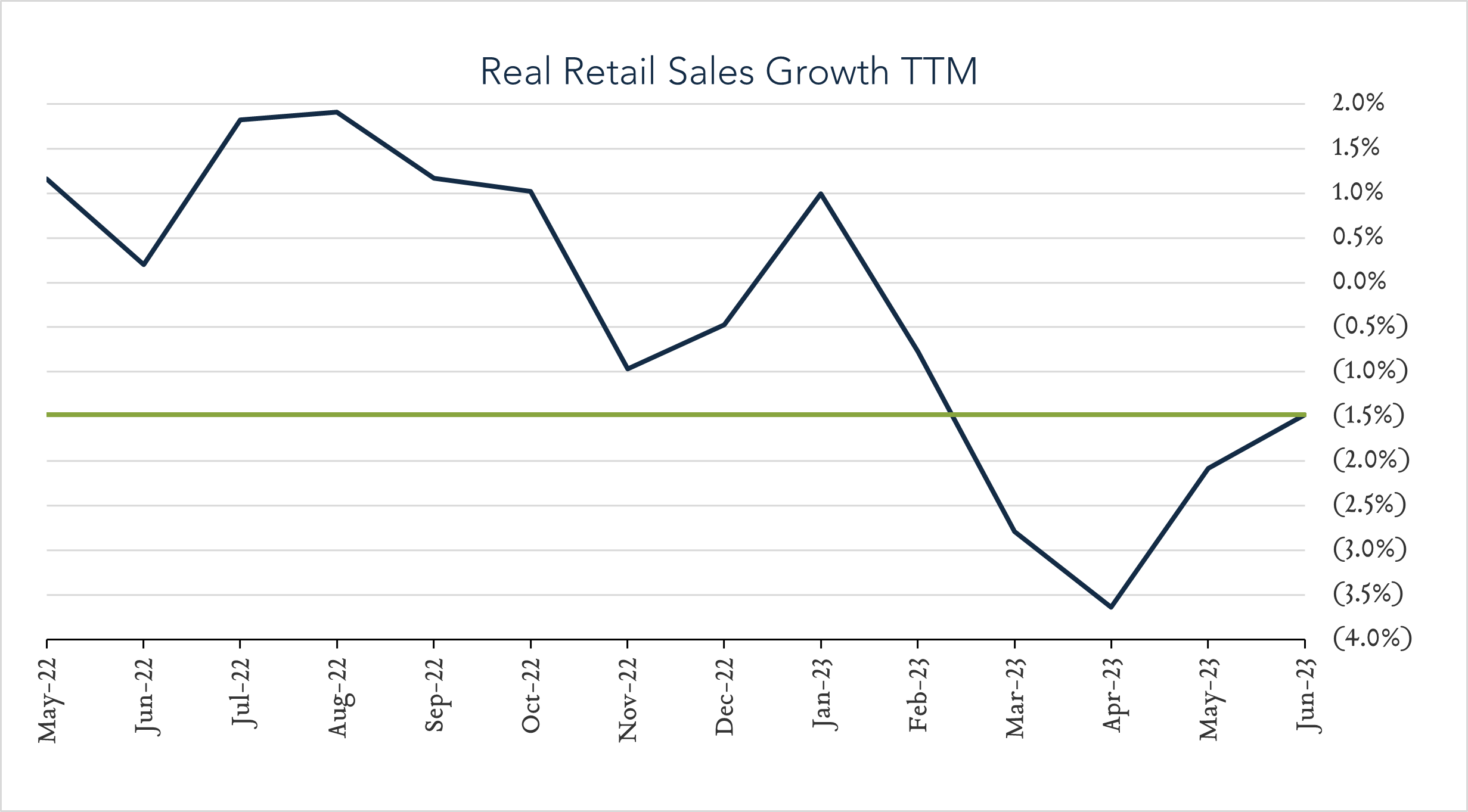

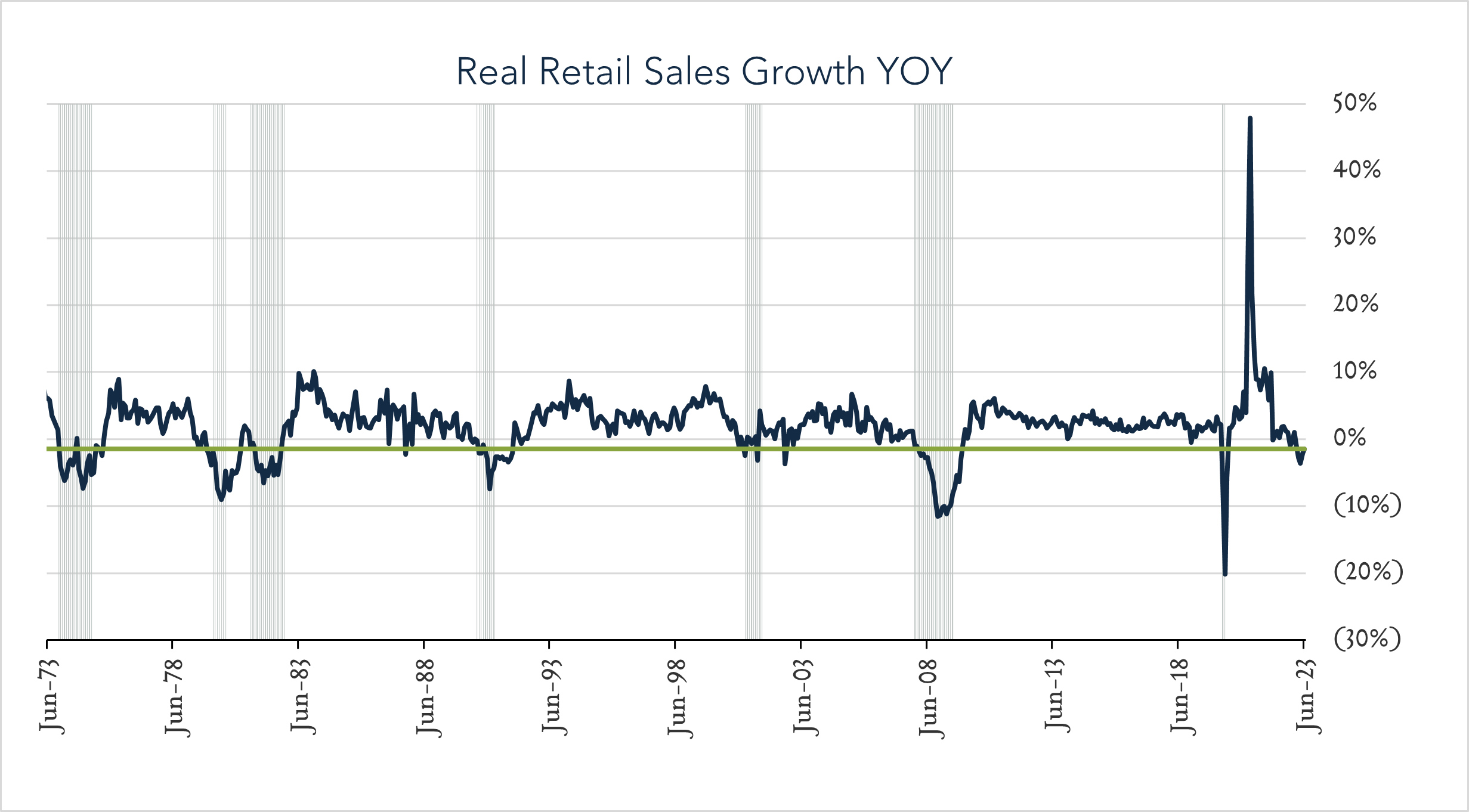

U.S. retail sales came in below expectations on a month-over-month basis, and remained soft year-over-year. In real terms, retail spending was unchanged compared to May and declined 1.5% year-over-year. Monthly data helps to highlight current trends, however we focus more closely on year-over-year results as a recession indicator. Real (inflation adjusted) declines in retail spending can indicate increased recession risk as the consumer represents the lion’s share of the U.S. economy. Real year-over-year spending has now declined for five consecutive months by an average of 2.2%. Today’s result (-1.5% YoY) suggests moderating consumer demand as inflation persists and monetary policy continues to tighten.

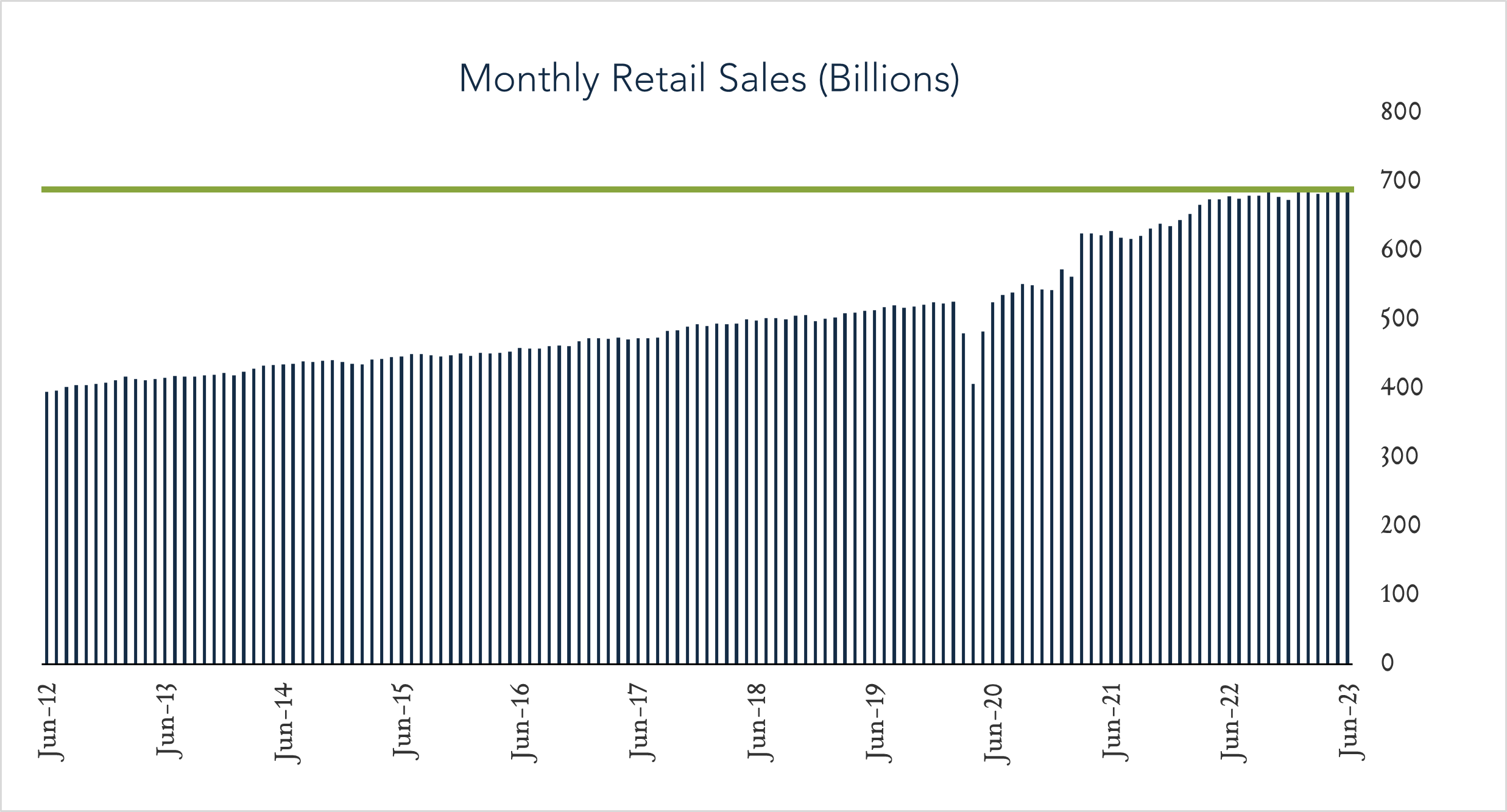

- Real (inflation adjusted) retail sales down 1.5% year-over-year. In June, retail sales grew 1.5% nominally and declined 1.5% after adjusting for 3.0% inflation. Today’s result marked a fifth straight month of real declines with an average annual decline of 2.4% over the last three months. Higher spending with non-store retailers (+9.4%), restaurants (+8.4%), and health and personal care stores (+6.3%), and was partially offset by lower spending at gas stations (-22.7%), furniture stores (-4.6%), and building materials suppliers (-3.2%). Nine out of thirteen categories declined in real terms.

- Real (inflation adjusted) retail sales unchanged month-over-month. In June, nominal retail sales levels increased 0.2% compared to May (consensus +0.5%) netting 0.0% growth in real terms. Increased spending at brick and mortar retailers (+2.0) and online retailers (+1.9%) was partially offset by lower spending at gas stations (-1.4%) and building materials suppliers (-1.2%). Seven out of thirteen categories showed growth in real terms.