July 5, 2024

June Jobs - Gradual Deceleration Continues

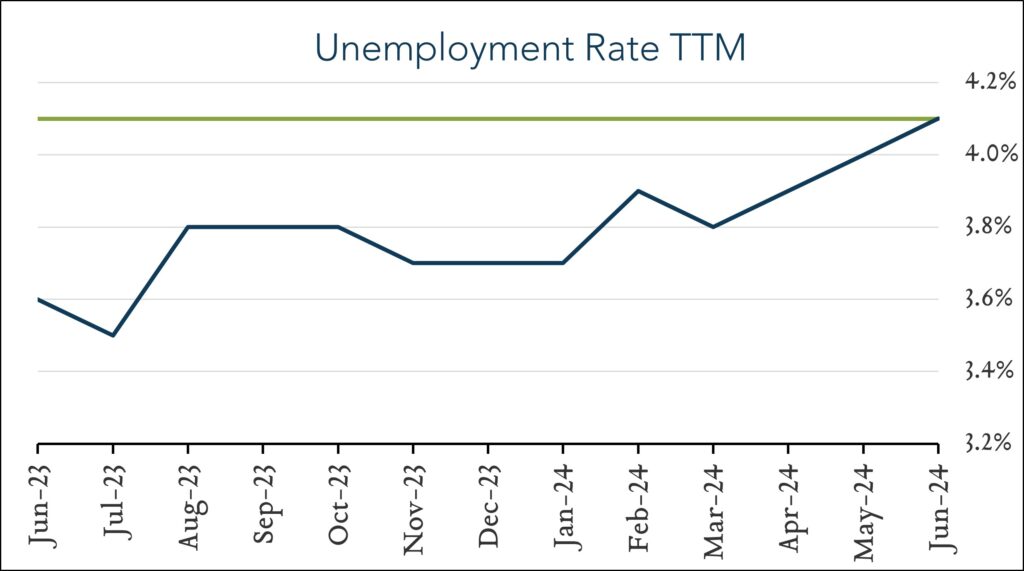

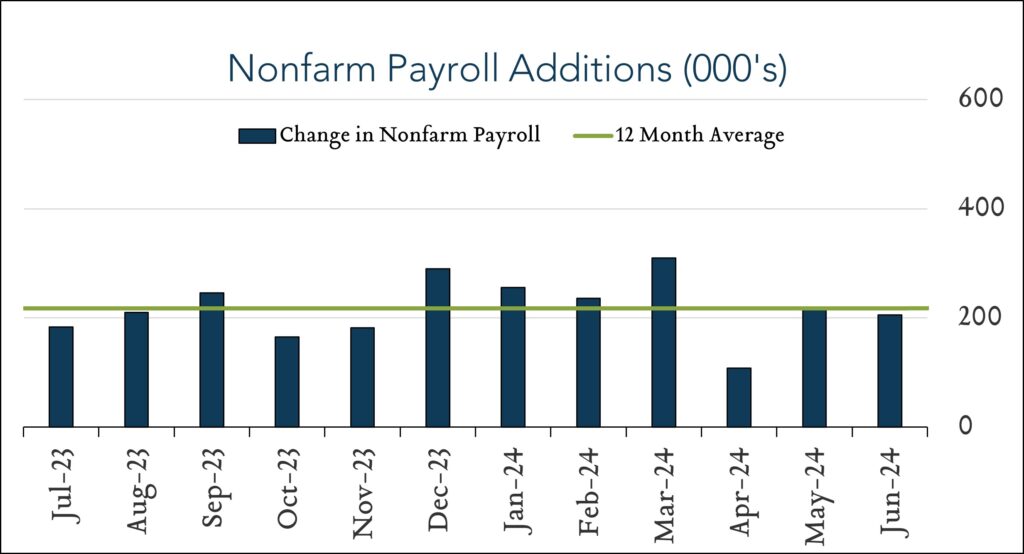

Job gains lower; unemployment higher. Hiring and wage growth decelerated in June and the unemployment rate ticked up adding support to the case for interest rate cuts in the coming months. The labor market added 206K jobs in June compared to +218K (revised) in May and expectations of +190K. The unemployment rate ticked up 0.1% to 4.1%. Today’s report underscores a gradually decelerating labor market consistent with other indications of lower job openings and rising unemployment claims. Investors are pricing in two interest rate cuts in the second half of 2024, while Fed projections (provided in June) call for just one. While a July cut remains unlikely, a sustained slowdown in hiring combined with apparent moderation in inflation increases the likelihood of a cut in September or November.

· 206K jobs added in June; May revised lower. The U.S. labor market added 206K jobs in June compared to expectations for +190K. May job gains were revised down by 67K to just +218K from +272K originally reported. Hiring was more pronounced in government (+70K), health care (+49K), social assistance (+34K) and construction (+27K).

· 4.1% unemployment – up from 4.0%. The U.S. unemployment rate rose 0.1% to 4.1% in June, marking a second consecutive monthly increase and the first time unemployment has exceeded 4.0% since November 2021. Forecasts ranged from 3.9% to 4.1% with a median of 4.0%. The labor force participation rate was rose slightly to 62.6% from 62.5% in May. Year-over-year, wage growth decelerated to 3.9% from +4.1% in May. Month-over-month, wages increased 0.3% compared to +0.4% in May.