July 12, 2023

June Inflation - Cools to 3%, Better Than Expected

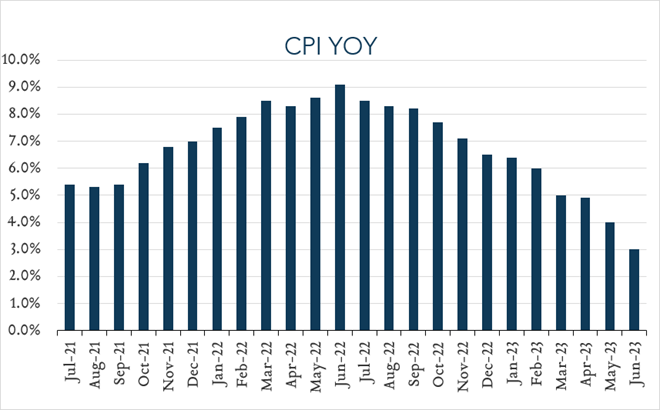

June inflation data showed overall annualized price increases slowing for a twelfth straight month to 3.0% – down from a June 2022 peak of 9.1% and to the lowest level in more than two years. Overall, inflation appears to be cooling, aided by more than a year of interest rate increases implemented by the Fed. Still, inflation remains higher than policymakers would like and against a backdrop that includes a yet-strong labor market, we continue to expect officials to resume hiking later this month after pausing in June.

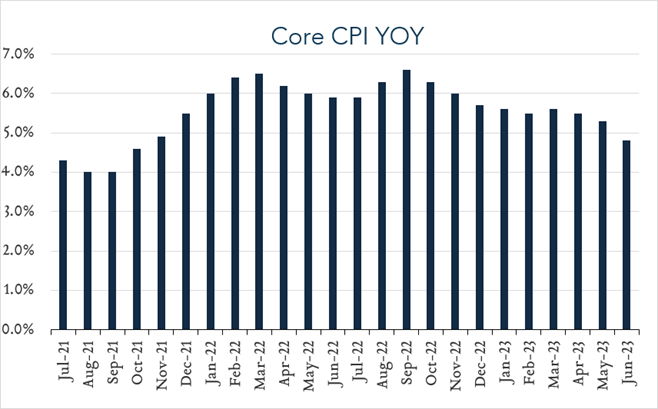

- Consumer prices (CPI) increased 3.0% year-over-year. In June, the consumer price index (CPI) increased 3.0%, decelerating from 4.0% in May to the lowest level since March 2021. Expectations ranged from 2.8% to 3.3% with a median of 3.1%. Shelter costs (+7.8%), transportation services (+8.2%), and food (+5.7%) were key contributors to the overall increase, more than offsetting declines in energy (-16.7%) and used vehicles (-5.2%). We continue to keep a close eye on shelter costs, which represent nearly one third of the consumer price index and tend to impact the index with a lag. Core CPI (excludes food and energy) increased 4.8% year-over-year, down from 5.3% in May and below expectations of 5.0%.

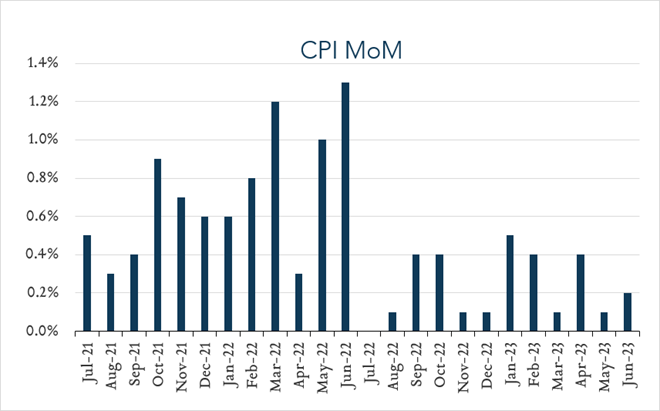

- Consumer prices (CPI) increased 0.2% month-over-month. In May, consumer prices rose 0.2% compared to may. Expectations ranged from +0.1% to +0.4% with a median of +0.3%. Prices for used cars and trucks declined 0.5% while shelter costs, which represent nearly one-third of the index, increased 0.4% for the month and remained the largest contributor to the overall outcome. Core CPI (excludes food and energy) also increased 0.2% compared to may, down from 0.4% in May and below expectations of 0.3%.