July 11, 2024

June Inflation - Broadly Cooler!; Cuts To Come?

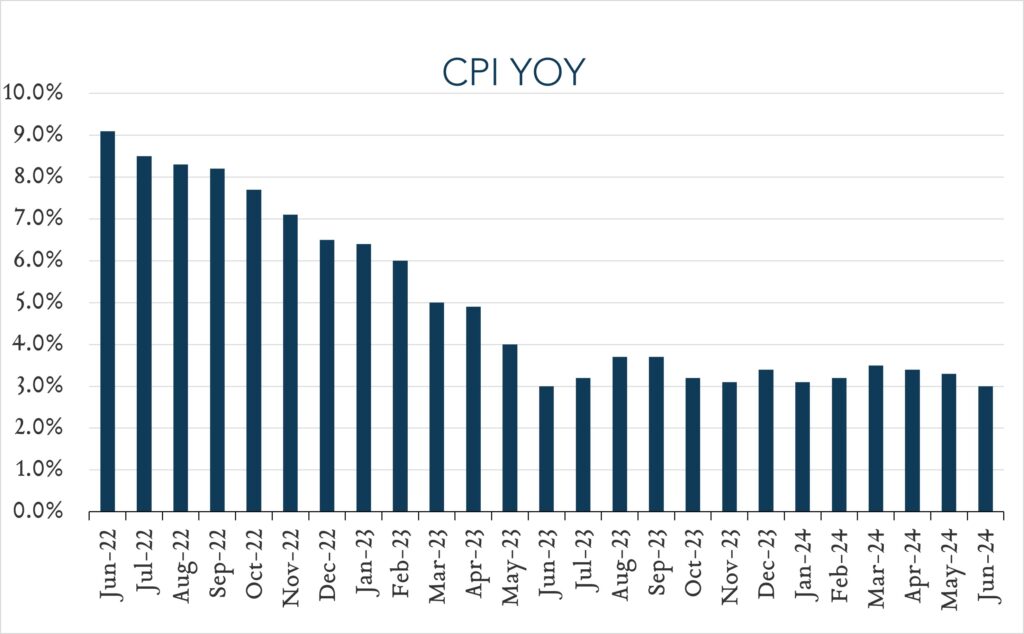

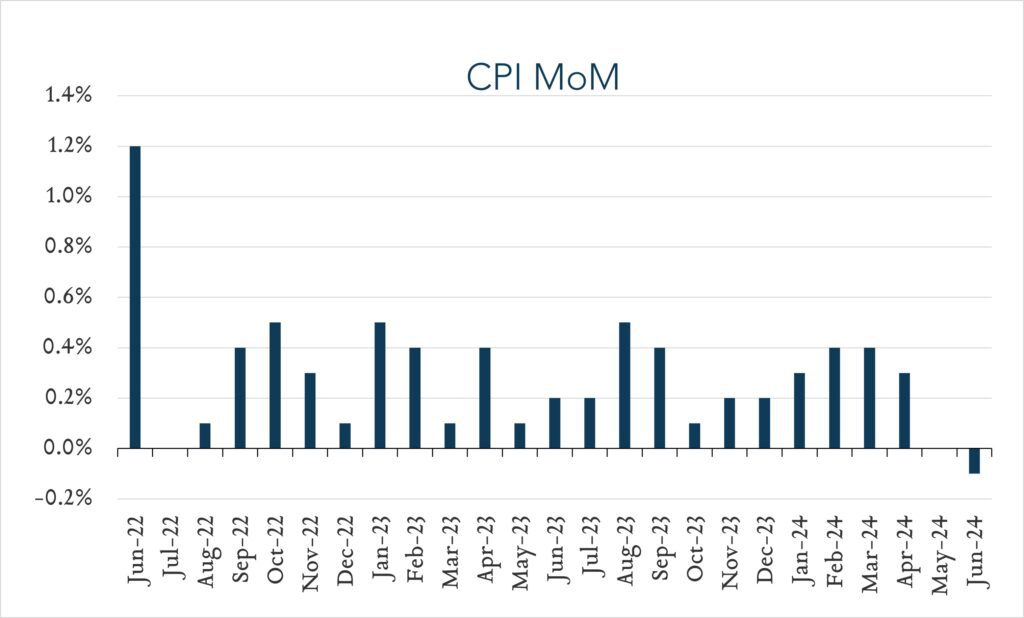

In June, consumer prices rose 3.0% compared to a year ago, down 0.3% compared to May and below expectations of 3.1%. This marks the third consecutive month of deceleration and another positive sign for Fed policymakers. Month-over-month, consumer prices FELL 0.1%, marking the first monthly decline since May 2020. Importantly, Core CPI (excludes food and energy) also decelerated from a month earlier. Today’s report adds to evidence that inflation has resumed its downward path after accelerating somewhat to start the year. Combined with last week’s jobs report that showed a third straight month of rising unemployment, it would reason that policymakers could justify lowering interest rates later this year, though a July cut would arguably be premature.

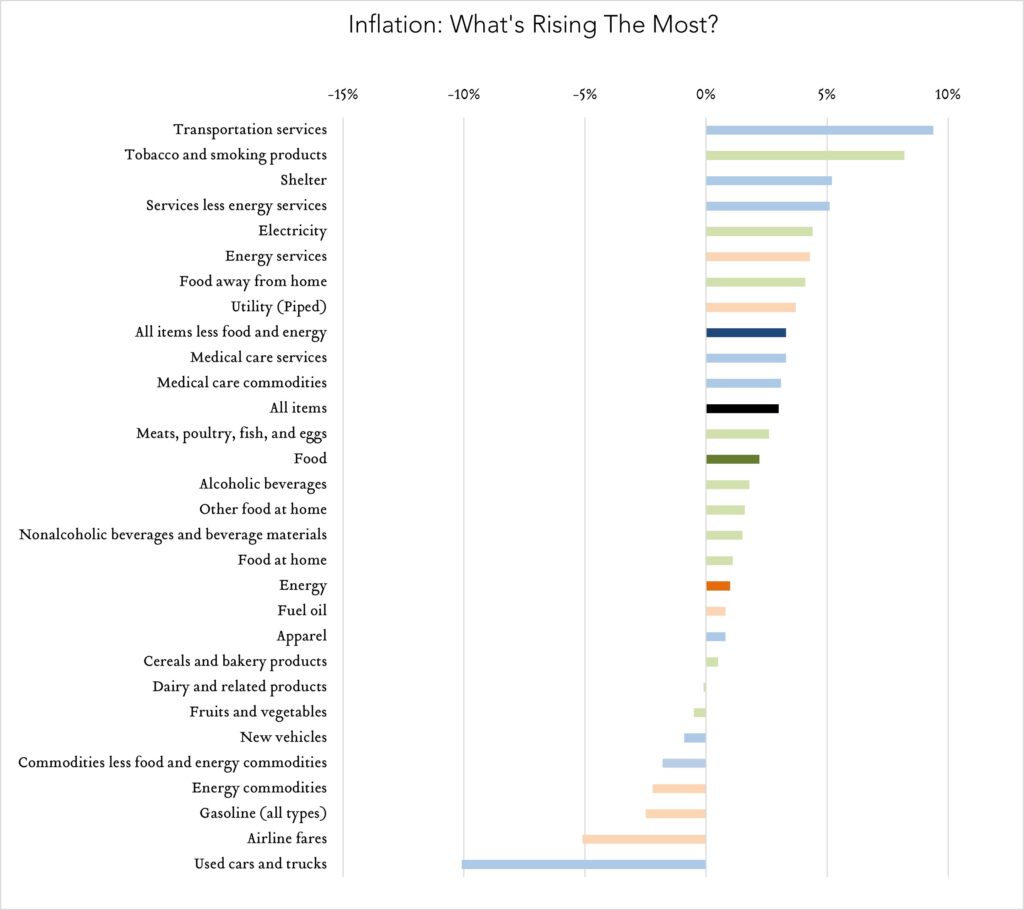

- Consumer prices (CPI) increased 3.0% year-over-year. In June, the consumer price index (CPI) increased 3.0%, down from 3.3% in May and below expectations of 3.1%. Transportation services (+9.4%) and shelter (+5.2%) were key contributors to the overall increase, more than offsetting declines for used vehicles (-10.1%). We continue to keep a close eye on shelter costs, which represent nearly one third of the consumer price index and tend to impact the index with a lag. At +5.2% year-over-year, shelter costs decelerated 0.2% from May and are down from a peak of 8.2% in March 2023. Core CPI (excludes food and energy) increased 3.3% year-over-year, decelerating from 3.4% in May.

- Consumer prices (CPI) declined 0.1% month-over-month. In June, consumer prices FELL 0.1% compared to May. Expectations ranged from +0.0% to +0.2% with a median of +0.1%. Shelter costs increased 0.2%, down from +0.4% in May, while used vehicles and energy fell 1.5% and 2.0%, respectively. Core CPI (excludes food and energy) increased 0.1% month-over-month, down from 0.2% in May and below expectations of +0.2%.