August 16, 2023

July Retail Sales - Tops Forecasts

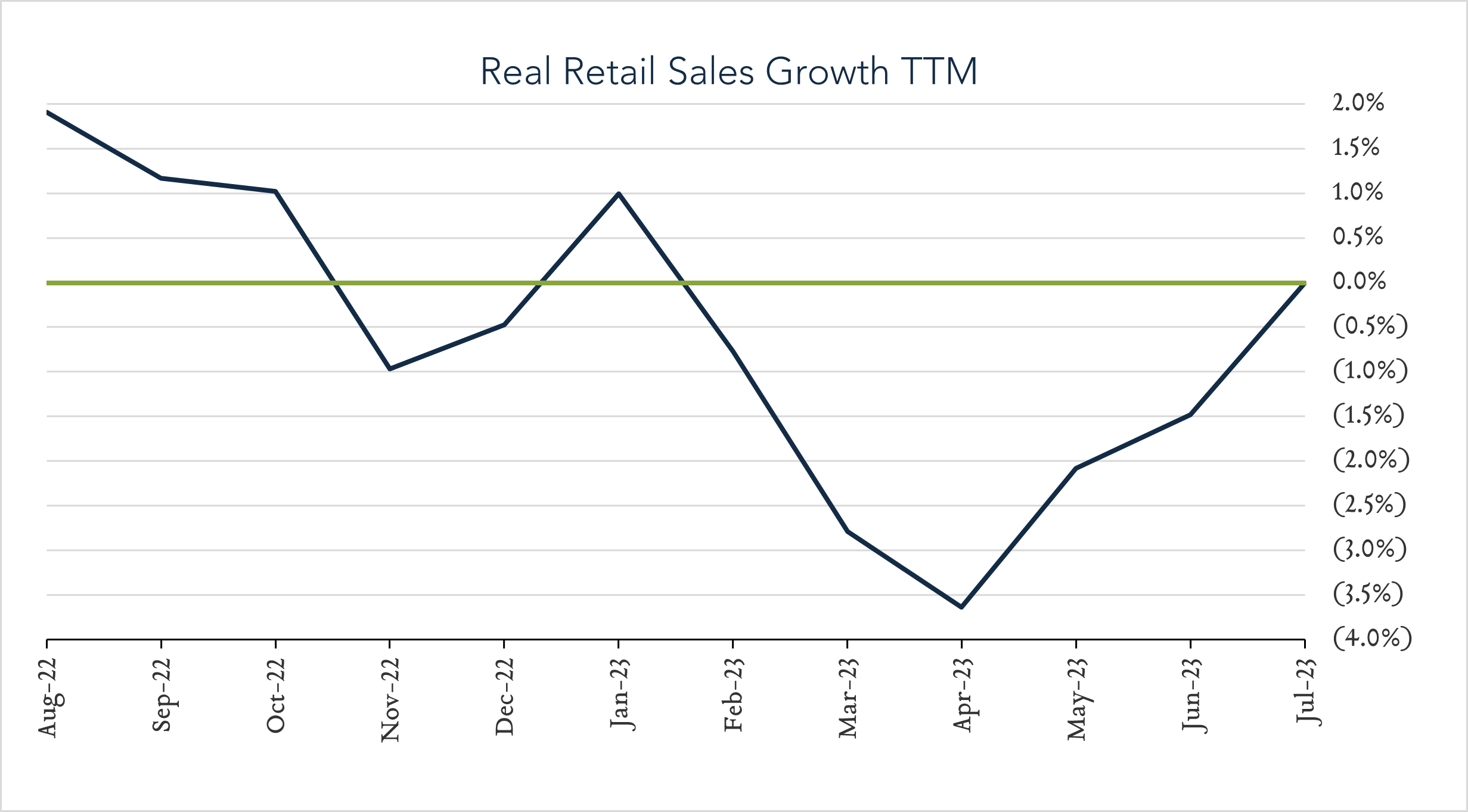

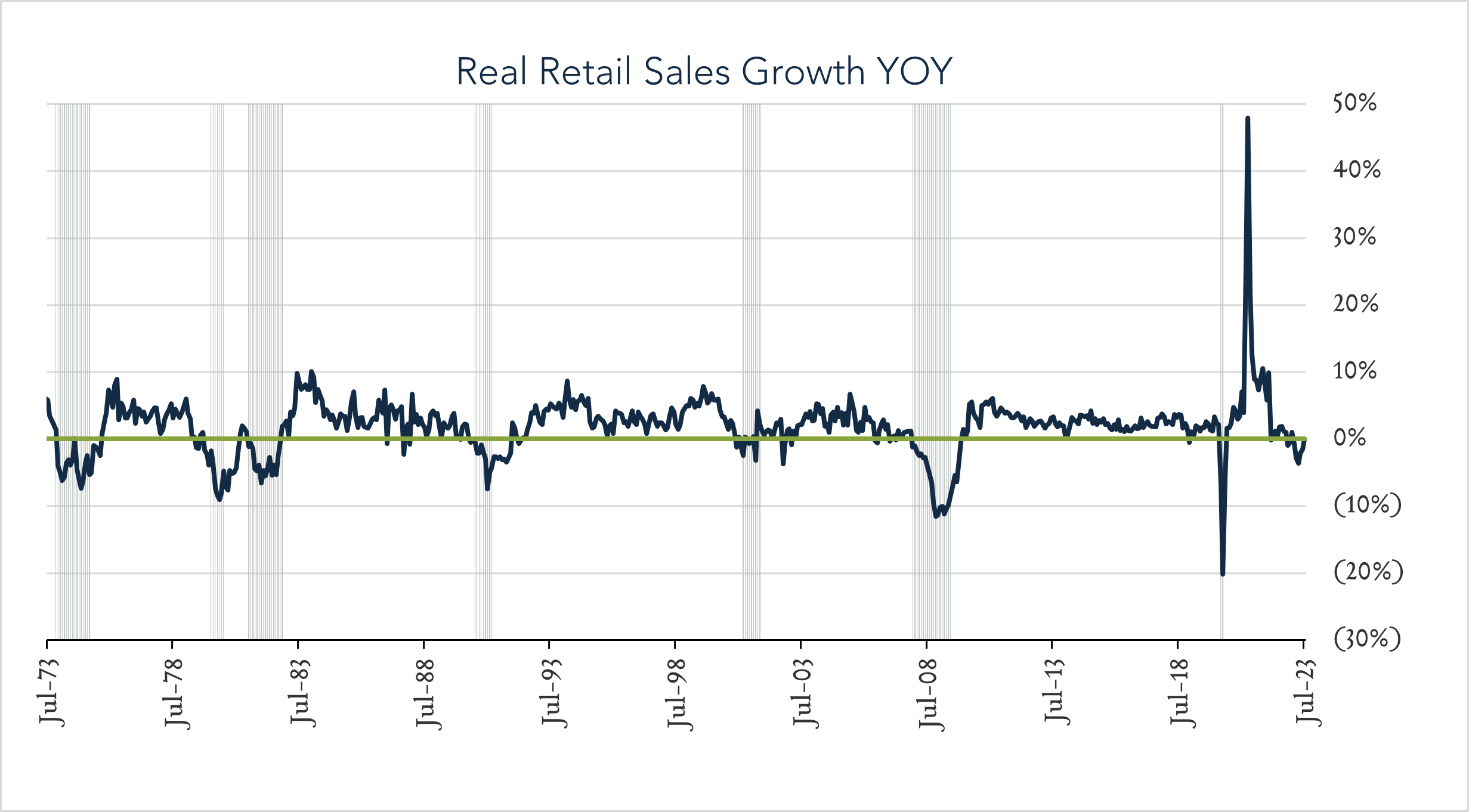

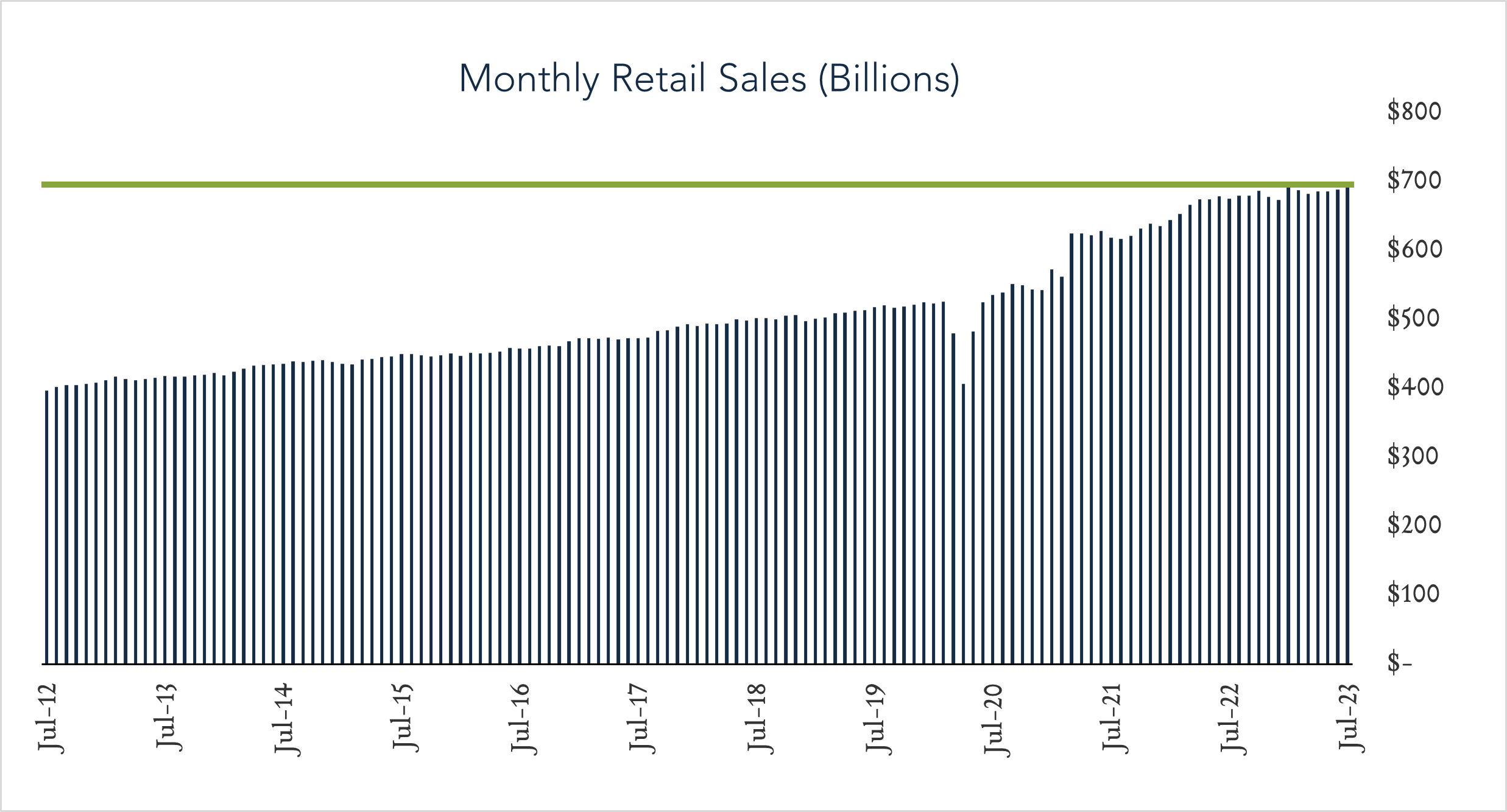

U.S. retail sales came in better than expected on a month-over-month basis, and posted the strongest year-over-year growth since February indicating consumer resilience in the face of inflationary pressures and increasing interest rates. In real terms, retail spending increased 0.5% compared to June and was unchanged year-over-year. Today’s report suggests that American consumers, supported by a strong labor market and rising wages, continue to support a growing economy despite tightening monetary policy. That said, if inflationary pressures do not continue to moderate, Fed officials could pursue more aggressive policy measures.

- Real (inflation adjusted) retail sales unchanged year-over-year. In July, retail sales grew 3.2% nominally netting no change in real terms after adjusting for 3.2% inflation. Higher spending at restaurants (+11.9%), online retailers (+10.3%), and health and personal care stores (+8.1%), and was partially offset by lower spending at gas stations (-20.8%), furniture stores (-6.3%), and building materials suppliers (-3.3%). Five out of thirteen categories showed growth in real terms.

- Real (inflation adjusted) retail sales increased 0.5% month-over-month. In July, nominal retail sales levels increased 0.7% compared to June (consensus +0.4%) netting 0.5% growth in real terms. Increased spending at online retailers (+1.9%), sporting goods & hobby stores (+1.5%) and restaurants (+1.4%) was partially offset by lower spending at furniture and electronics retailers (-1.8%; -1.3%). Nine out of thirteen categories showed growth in real terms.