August 15, 2024

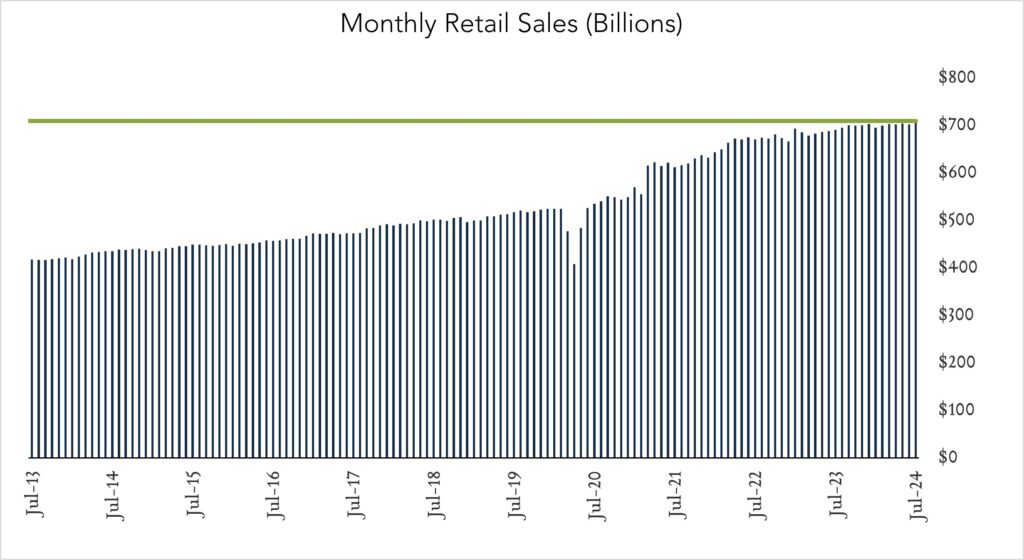

July Retail Sales - Broad Advance Tops Forecasts

July retail spending accelerated by more than expected compared to June in a broad advance aided somewhat by a recovery in auto sales after a cyberattack on dealerships led to a sizeable drop last month. Today’s report contradicts a recent trend pointing to gradual erosion of consumer strength amid higher borrowing costs and a cooling labor market, suggesting the economy’s main driver is holding up better than expected as inflation recedes and Fed policymakers consider rate cuts. In response to the report, as well as favorable jobless claims data out this morning, traders notched expectations towards a single 0.25% rate cut in September. As recently as yesterday, markets were pricing even odds on one or two cuts at the next Fed meeting.

- Real (inflation adjusted) retail sales declined 0.2% year-over-year. In July, retail sales grew 2.7% nominally netting a decline of 0.2% after adjusting for 2.9% inflation. Higher spending at online retailers (+6.7%) and on restaurant dining (+3.4%) was partially offset by lower spending on building supplies (+0.4%) and gas stations (+0.5%). Seven of thirteen categories declined in real terms.

- Real (inflation adjusted) retail sales grew 0.8% month-over-month. In July, nominal retail sales levels increased 1.0% compared to June (consensus +0.4%) netting a 0.8% increase after adjusting for 0.2% inflation. Higher spending on motor vehicles (+3.6%) was partially offset by slower growth at online retailers (+0.2%) and gas stations and gas stations (+0.1%). Only four of thirteen categories declined in real terms.