August 14, 2024

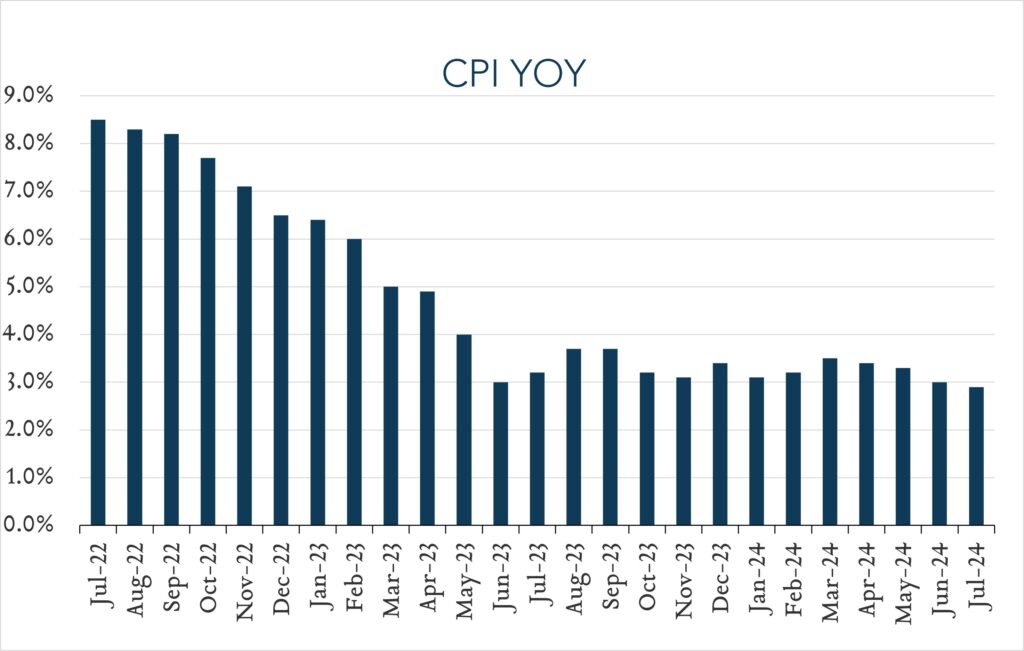

July Inflation - Easing Continues, September Cut On Track

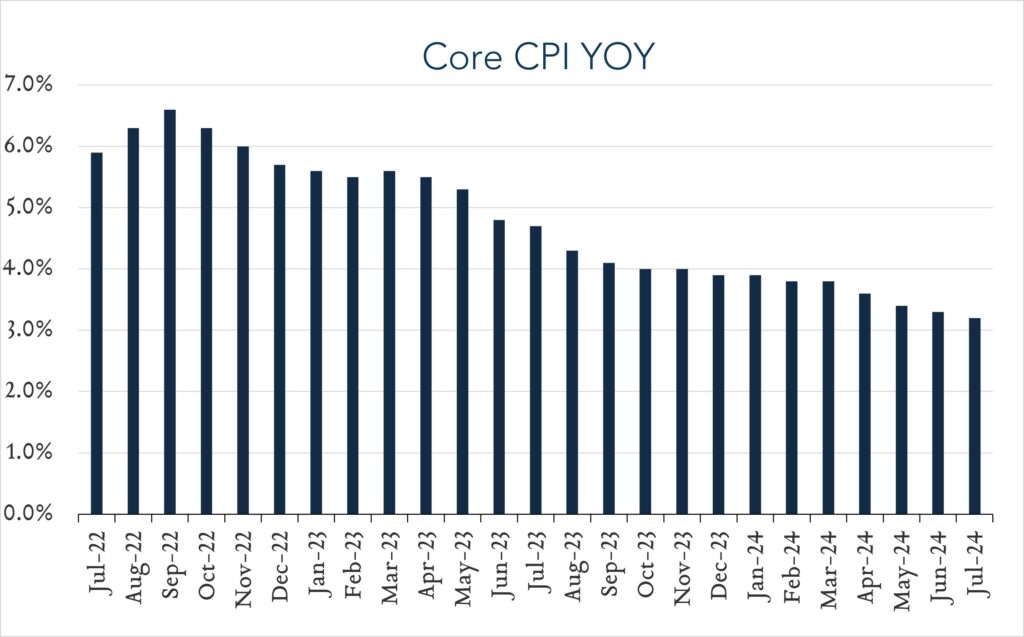

In July, consumer prices rose 2.9% compared to a year ago, decelerating 0.1% compared to June and below expectations of 3.0%. This marks the fourth consecutive month of deceleration and keeping Fed policymakers on track to lower interest rates next month. Today’s report adds to evidence that inflation remains on a downward trend. Combined with a softening labor market, the FOMC is widely expected to begin lowering interest rates at its next meeting in September. The size of the first cut is still a topic of debate. Bond traders place even odds on a 0.25% or 0.50% cut in September.

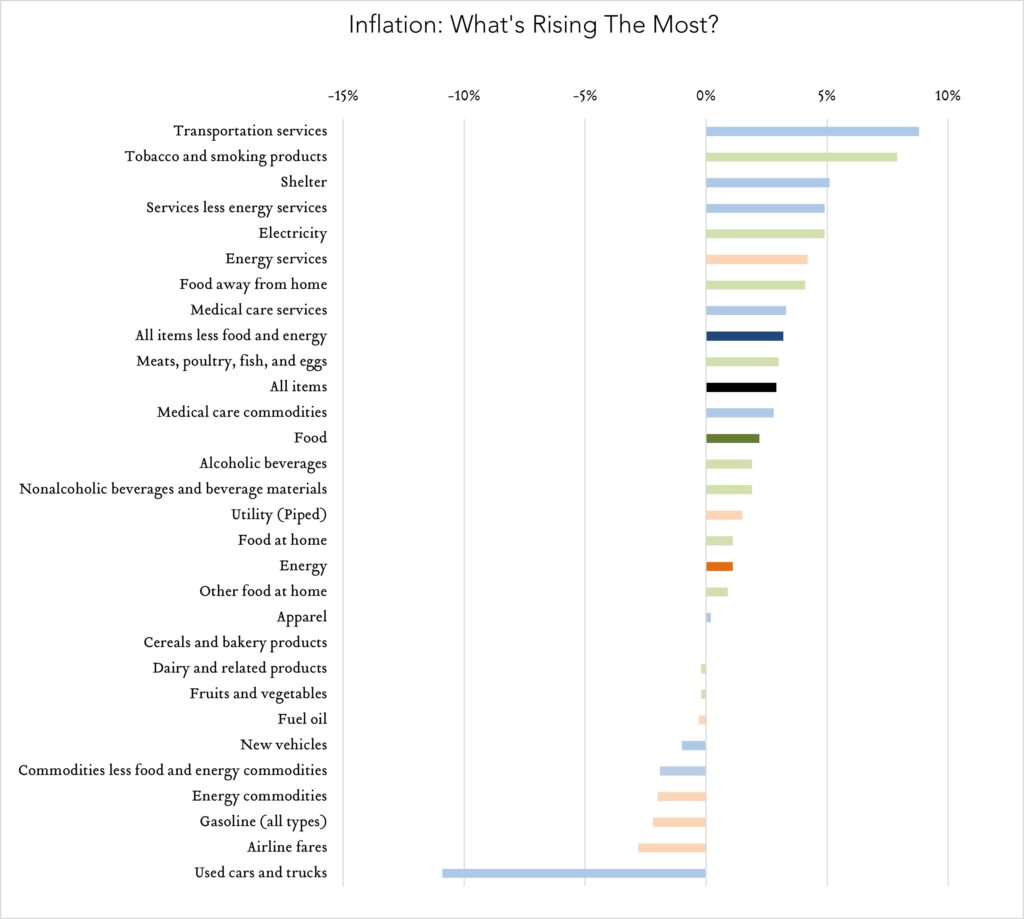

- Consumer prices (CPI) increased 2.9% year-over-year. In July, the consumer price index (CPI) increased 2.9%, down from 3.0% in June and below expectations of 3.0%. Transportation services (+8.8%) and shelter (+5.1%) were key contributors to the overall increase, more than offsetting declines for used vehicles (-10.9%). We continue to keep a close eye on shelter costs, which represent nearly one third of the consumer price index and tend to impact the index with a lag. At +5.1% year-over-year, shelter costs decelerated 0.1% from June and are down from a peak of 8.2% in March 2023. Core CPI (excludes food and energy) increased 3.2% year-over-year, decelerating from 3.3% in June.

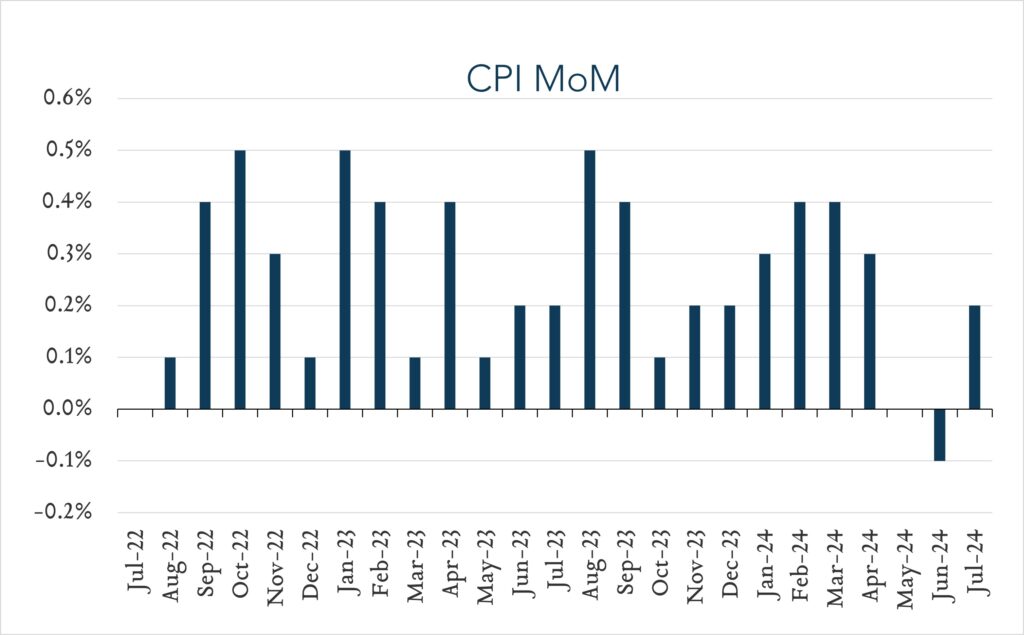

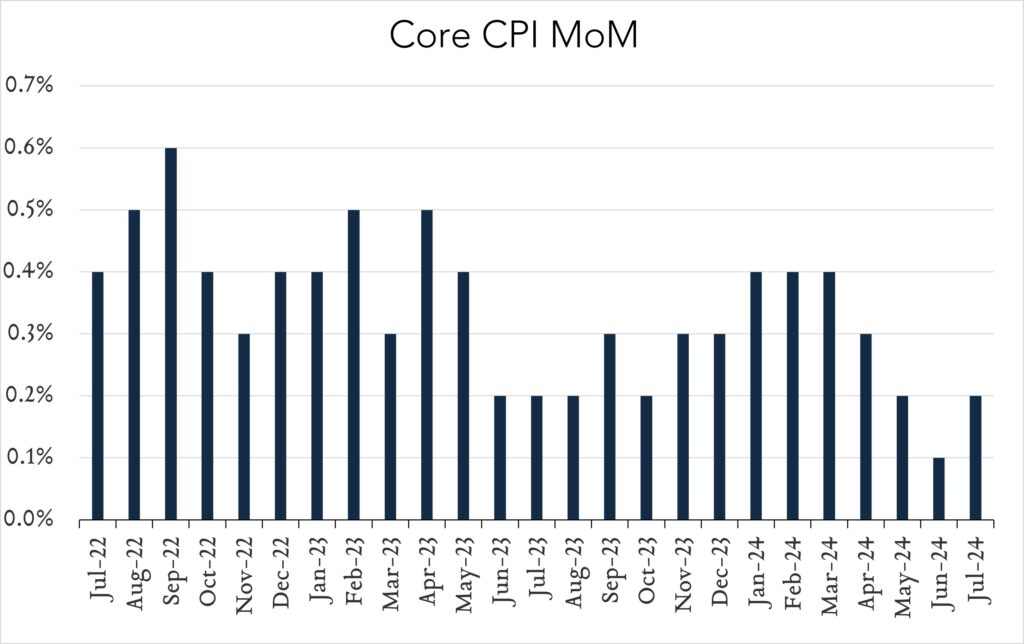

- Consumer prices (CPI) increased 0.2% month-over-month. In July, consumer prices rose 0.2% compared to June. Expectations ranged from +0.0% to +0.3% with a median of +0.2%. Shelter costs increased 0.4%, while used vehicle prices fell 2.3%. Core CPI (excludes food and energy) increased 0.2% month-over-month, up from 0.1% in June and in line with expectations.