February 15, 2024

January Retail Sales - Womp Womp

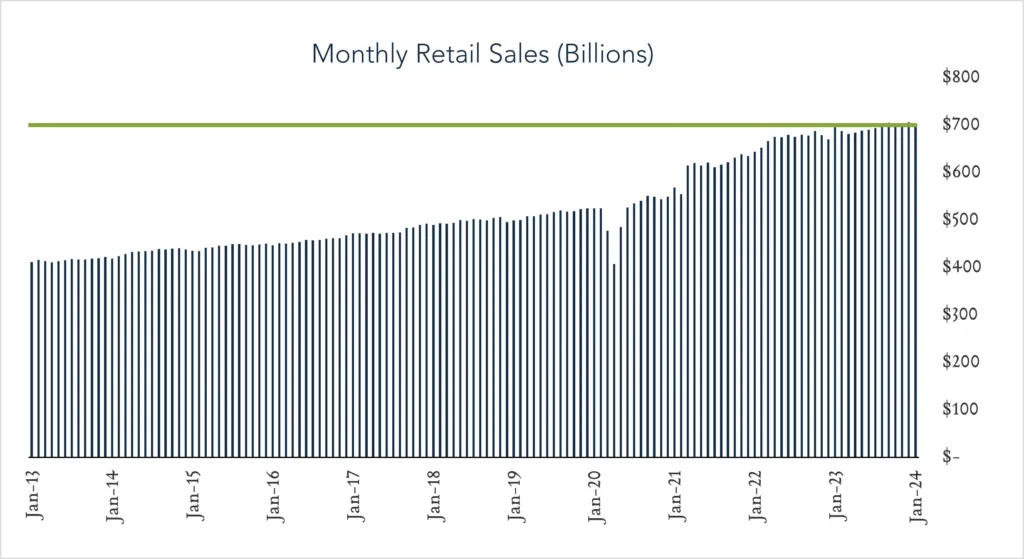

On the heels of a robust holiday shopping season, U.S. retail sales decelerated sharply in January falling short of expectations. While severe winter weather may have played a role in the slowdown, today’s report does raise questions about how household spending will hold up in the new year. Supported by a strong labor market, consumers have played a key role driving continued economic growth and keeping the U.S. out of a recession over the past year. While wage growth has started to decelerate, the labor market remains strong in spite of tighter monetary policy aimed at reducing inflation.

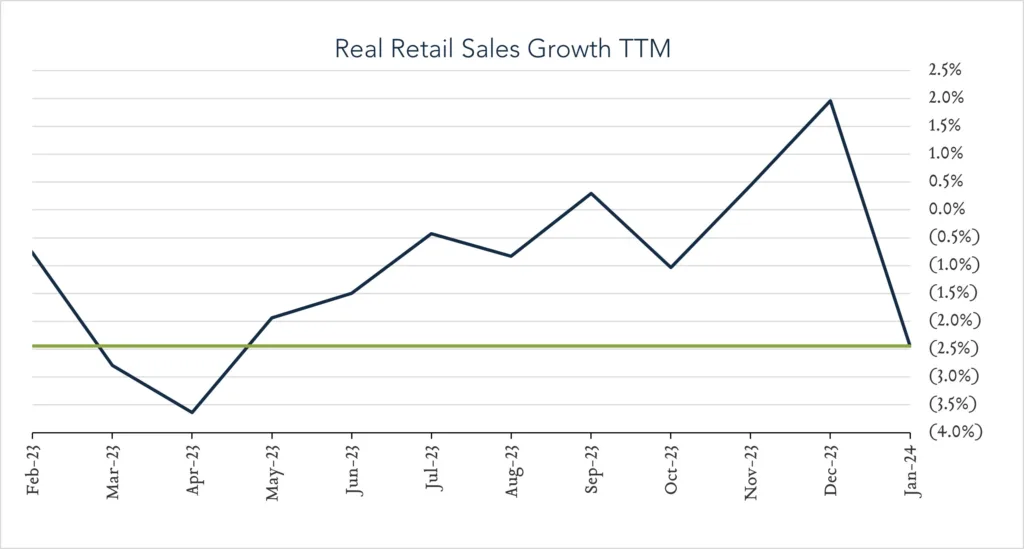

- Real (inflation adjusted) retail sales declined 2.5% year-over-year. In January, retail sales grew 0.6% nominally netting a 2.5% decline after adjusting for 3.1% inflation. Healthy spending at online retailers (+6.4%) and on restaurant dining (+6.3%) was more than offset by lower spending on building materials (-8.3%) and gasoline (-7.5%). Only three out of thirteen categories showed growth in real terms.

- Real (inflation adjusted) retail sales declined 1.1% month-over-month. In January, nominal retail sales levels declined 0.8% compared to December (consensus -0.2%) netting a 1.1% decline in real terms. Increased spending on restaurant dining (+0.7%) was a bright spot that was more than offset by declines in building materials (-4.1%), motor vehicles (-1.7%) and gasoline (-1.7%). Only two out of thirteen categories showed growth in real terms.