February 3, 2023

January Jobs - Huge Print

Blockbuster jobs report keeps pressure on the Fed. U.S. employers added significantly more jobs than expected in January and the unemployment rate edged down to a 53-year low. Today’s report highlights the continued resiliency of the labor market in the face of the most aggressive Fed tightening campaign in memory. Demand for workers continues to outpace supply, which threatens to keep wage growth elevated despite rising borrowing costs, a pullback in consumer demand and an uncertain economic outlook. While Wednesday’s Fed commentary suggested the disinflationary process was underway, robust job growth may complicate the path forward for policymakers.

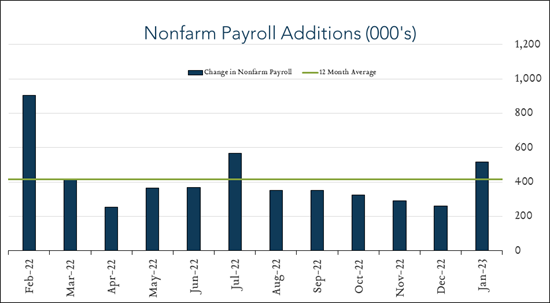

- 517K jobs added in January – demolishing expectations. The U.S. labor market added 517k jobs in January compared to forecasts ranging from +130K to +320K with a median of +188K. Following a December that marked the smallest number of monthly job gains in 2022, January marked the largest gain in payrolls since last summer. Job growth was widespread, led by gains in leisure & hospitality (+128K), professional and business services (+82K) and health care (+58K). Remaining sectors also posted gains or were essentially unchanged.

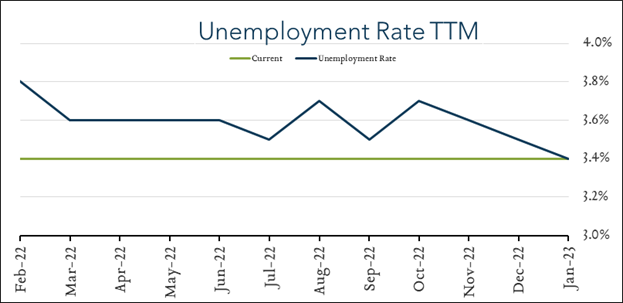

3.4% unemployment – 53 year low. The U.S. unemployment rate ticked down to 3.4% in January from 3.5% a month ago. Forecasts ranged from 3.4% to 3.7% with a median of 3.6%. The labor force participation rate increased slightly to 62.4% but remained largely consistent with the 2022 average. Hourly earnings increased 4.4% over the last year (compared to expectations of +4.3%) and 0.3% month-over-month, as expected.