February 12, 2025

January Inflation - Comin' in Hot

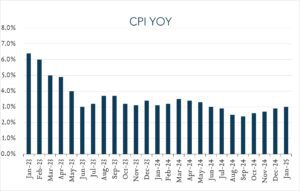

In January, consumer prices as measured by CPI, rose 3.0% compared to a year ago, up from 2.9% in December and above expectations for the same. Core CPI (excludes volatile food and energy prices) rose 3.3%, up from 3.2% in December and 0.2% above forecasts. While price pressures have subsided from the pandemic-era peak of 9.1%, progress appears to have leveled off more recently and may be at risk of reversing. This, combined with a solid labor market, supports the Fed’s stance that it does not need to be in a hurry to cut interest rates. Fed policymakers cut rates by a total of 1.00% in 2024 and projected two 0.25% cuts in 2025. Investors had been pricing in even odds of one or two 0.25% rate cuts in 2025, but following today’s report, are now pricing in just one cut this year.

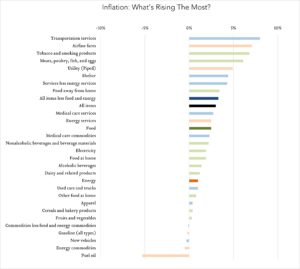

- Consumer prices (CPI) increased 3.0% year-over-year. In January, the consumer price index (CPI) increased 3.0% – slightly above expectations for 2.9% and continuing an upward trajectory after touching a low of 2.4% in September 2024. Transportation services (+8.0%), shelter (+4.4%), and energy (+3.4%) were key contributors to the overall increase, more than offsetting declines for new vehicles (-0.3%). We continue to keep a close eye on shelter costs, which represent nearly one third of the consumer price index and tend to impact the index with a lag. At +4.4% year-over-year, shelter inflation decelerated from +4.6% in December, down from a peak of 8.2% in March 2023. Core CPI (excludes food and energy) increased 3.3% year-over-year, up from 3.2% in December and above expectations for 3.1%.

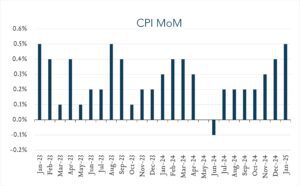

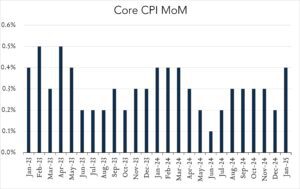

- Consumer prices (CPI) increased 0.5% month-over-month. In January, consumer prices rose 0.5% month-over-month up from 0.4% in December. Expectations ranged from +0.2% to +0.4% with a median of +0.3%. Shelter costs increased 0.4% (up from +0.3% in December). Core CPI (excludes food and energy) increased 0.4% month-over-month, up from 0.2% in December and above expectations of 0.3%.