March 6, 2025

Investing Wisely: Avoiding Common Traps to Secure Your Financial Future

Investing is a powerful tool for building wealth and securing your financial future, but it is not without its challenges. Even seasoned investors can fall into common traps that can hinder their progress. Whether you are just starting your investment journey or looking to refine your strategy, understanding and avoiding these pitfalls is crucial. By being aware of these mistakes and taking proactive steps to avoid or mitigate them, you can stay on track toward achieving your financial goals.

Common Investment Trap #1: Market Timing

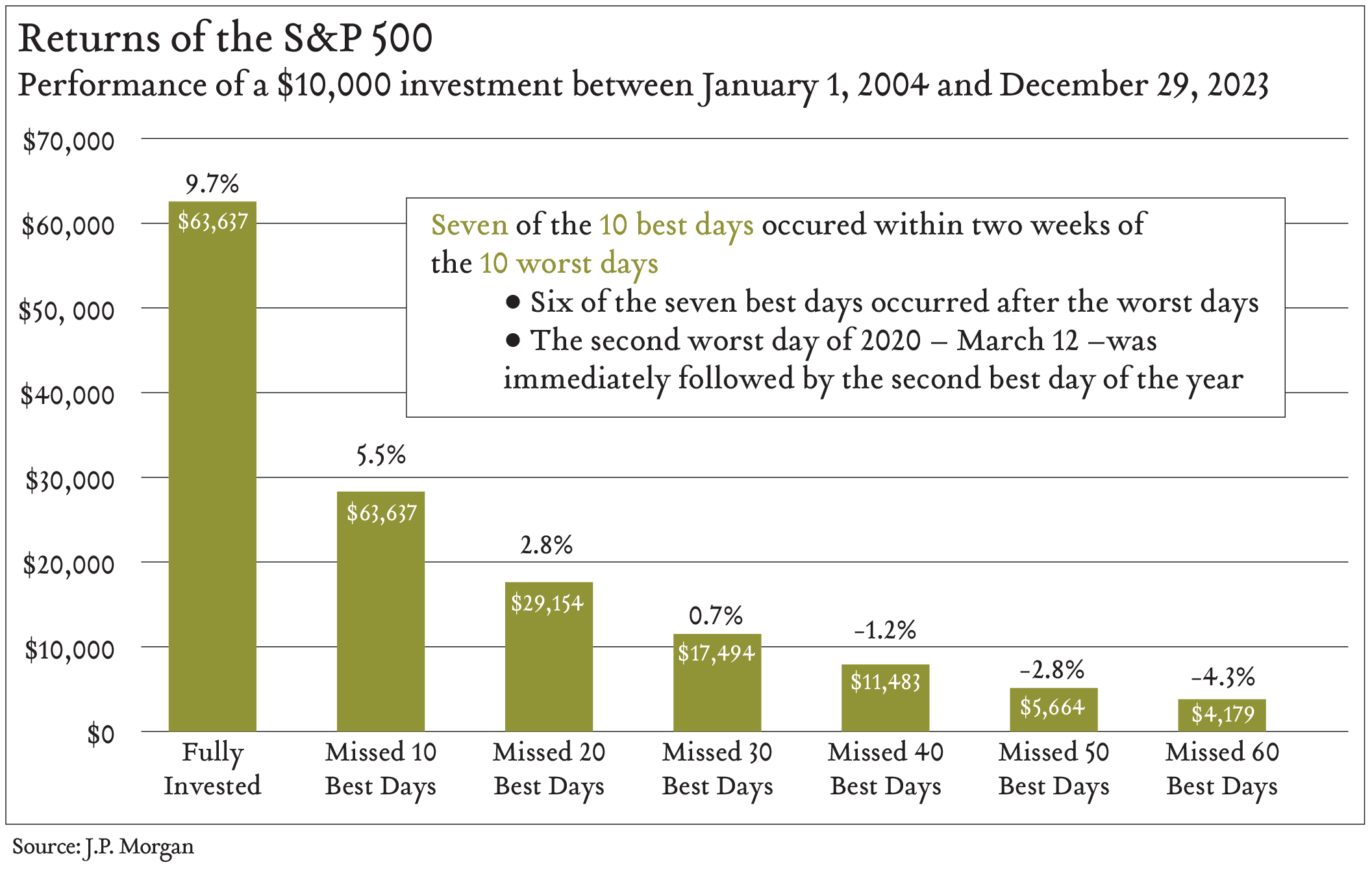

Accurately forecasting the market’s direction over short periods of time is essentially a guessing game, and missing even a short period of strong market performance can significantly reduce your long-term wealth. Yes, losses hurt more than gains feel good. But do not let emotions get the best of you. History shows that staying invested for the long term is the best recipe for success. Time in the market, not timing the market, is what matters.

Common Investment Trap #2: Lack of Diversification

One of the most frequent errors is putting all your eggs in one basket by investing in a single asset, sector, or geography. Over-relying on one investment exposes you to unnecessary risk, and if that asset or sector performs poorly, your entire portfolio could suffer. Diversification involves spreading your investments across various asset and sub-asset classes. It helps ensure that all of your investments do not move in lock-step, especially when the market declines. When market uncertainty hits as it is certain to do, portfolio diversification is often the best defense.

Common Investment Trap #3: Failing to Rebalance

Over time, some investments may grow faster than others, causing your portfolio to drift away from your target asset allocation. Regularly reviewing your portfolio and rebalancing it to maintain your desired asset allocation is considered a best practice for portfolio hygiene. If stocks outperform bonds, you may need to sell some stocks and buy more bonds to restore balance. In after-tax accounts, this may result in realized capital gains. Although it is important to be mindful of taxes, it should not be the primary driver of your investment strategy – i.e. don’t let the tax tail wag the investment dog.

Common Investment Trap #4: Overconfidence

Relying too much on your own knowledge without seeking broader perspectives can lead to poor investment choices. These choices could be excessive trading resulting in higher transaction costs, overlooking fees or fund expenses ratios, underestimating risk, or ignoring contradictory evidence leading to confirmation bias (naturally favoring information that confirms your existing beliefs).

Common Investment Trap #5: The Perfect Solution

Be wary of investments that promise unrealistically high returns or have overly complex structures. While the figures do not lie, liars often figure. If it sounds too good to be true, it probably is. There are no guarantees when it comes to investing.

Successful investing does not have to be complicated. By creating a well-thought-out plan, avoiding common investment traps, and staying focused on your goals, you can build a resilient portfolio that stands the test of time. When challenges arise, remember to focus on what you can control and stay disciplined. If you are feeling unsure about your investment strategy, we stand ready to assist. Taking proactive steps today can help you avoid costly missteps and build a brighter financial future.