May 3, 2023

Fed Raises 0.25%; Last One?

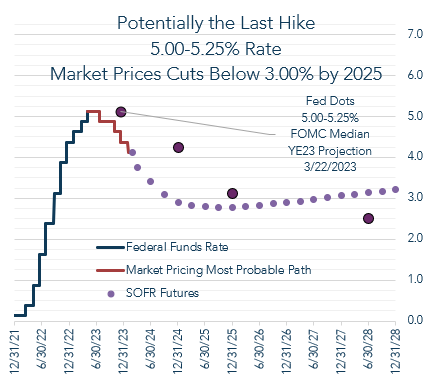

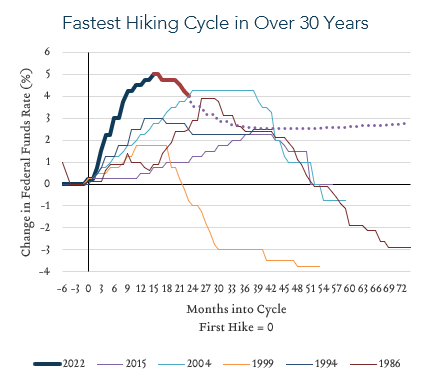

Fed raises interest rates by 0.25%, bringing the Fed Funds Rate range to 5.00-5.25%. This has the potential to be the last rate hike as the Fed Funds Rate now matches the 2023 year-end dot plot from the March meeting.

Key takeaways:

- The Fed raised interest rates 0.25%, as expected, to a range of 5.00-5.25%

- The bond market is anticipating this will be the last rate hike. Markets are pricing in just a 10% chance of a hike in June before projecting cuts in the 2nd half of 2023.

- Chair Powell emphasized that future policy changes will be data-dependent. He described an expectation that economic growth will remain modest in the coming quarters.

- Again, Powell focused on the Fed’s role in creating stable prices. He stated an expectation that the process to returning inflation back to 2% will be long.

- A variety of price categories have shown decelerating inflation, but current inflation levels remain significantly higher than the 2% target.

- Ultimately, this may indeed be the last rate hike of this cycle. The focus will likely turn to the prospect for future rate cuts including the timing and magnitude.

Messaging at the press conference:

Powell’s characterization of the economy did not change significantly from the March meeting. He emphasized:

- The banking sector is sound & conditions have broadly improved since early March.

- The labor market remains very tight but is showing some signs of coming into better balance:

- Evidence of improvement in labor-force participation,

- Nominal wage growth is slowing, and

- Job vacancies are declining.

- Going forward, decisions will be made on a meeting-by-meeting basis and the Fed is prepared to do more.

Market reaction:

The market was slightly up before the statement and has been volatile during Q&A, but is currently higher.

Yields were mostly stable today, rising a bit during the press conference back to pre-statement levels.

The dollar is slightly weaker. Gold is up. Oil is down.

| Prev. Close | Open | 2pm | 2:45pm | % change Prev Close | % change Open | % change 2pm-2:45pm | ||

| S&P 500 | $ 4,119.58 | $ 4,122.25 | $ 4,131.32 | $ 4,137.31 | 0.43% | 0.37% | 0.14% | |

| Dow Jones Industrial Average | $ 33,684.53 | $ 33,726.64 | $ 33,725.96 | $ 33,708.32 | 0.07% | -0.05% | -0.05% | |

| Nasdaq | $ 12,080.51 | $ 12,097.04 | $ 12,141.82 | $ 12,176.80 | 0.80% | 0.66% | 0.29% | |

| 10 Year Treasury Rate (%) | 3.42% | 3.43% | 3.38% | 3.40% | -0.02% | -0.03% | 0.02% | |

| US Dollar | $ 101.96 | $ 101.87 | $ 101.22 | $ 101.42 | -0.53% | -0.44% | 0.20% | |

| Gold | $ 2,016.68 | $ 2,016.67 | $ 2,029.49 | $ 2,029.10 | 0.62% | 0.62% | -0.02% | |

| Oil | $ 71.66 | $ 71.56 | $ 68.95 | $ 68.62 | -4.24% | -4.11% | -0.48% |

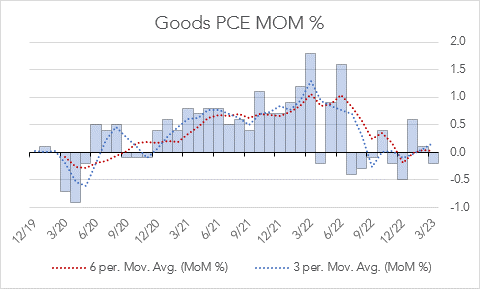

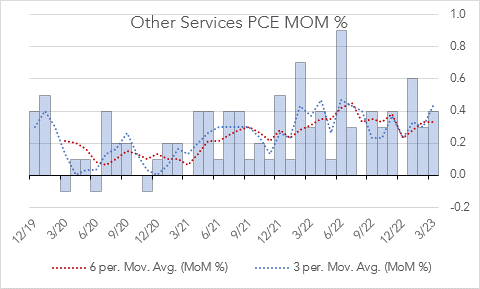

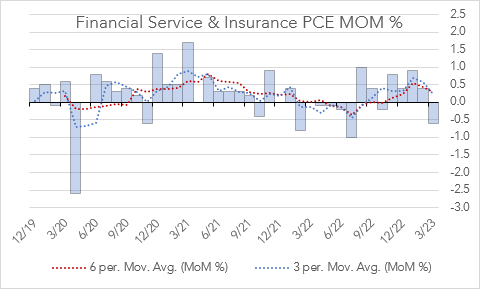

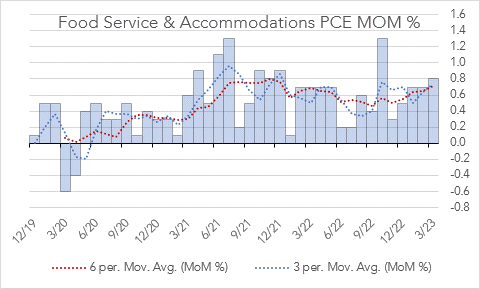

Detail on inflation trends in the Core PCE basket:

| Core PCE Category | Trend | 12m Rate | 3m Annualized Rate |

| Goods | Stable | 1.6 | 2.0 |

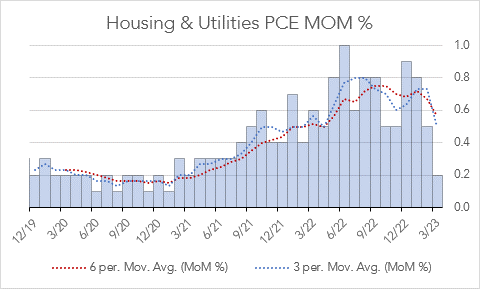

| Housing and Utilities | Decelerating | 8.3 | 6.2 |

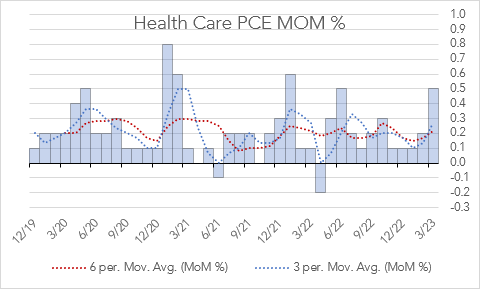

| Health Care | Stable | 2.5 | 3.2 |

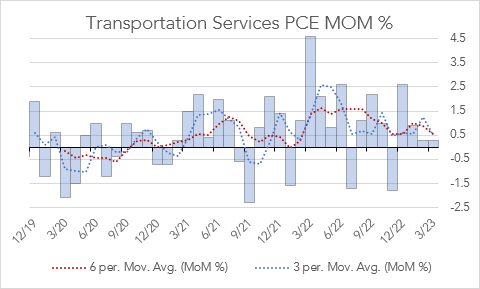

| Transportation Services | Decelerating | 10.7 | 6.2 |

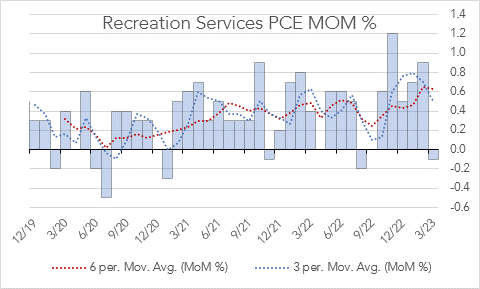

| Recreation Services | Stable | 5.5 | 6.2 |

| Food Service and Accommodations | Accelerating | 7.6 | 9.2 |

| Financial Services and Insurance | Stable | 1.7 | 2.8 |

| Other Services | Stable | 4.4 | 5.3 |