March 10, 2023

February Jobs - Payrolls Beat but Unemployment on the Rise and Wages Cooling

Job report details hint at slowing inflation. U.S. employers again added more jobs than expected in February, but markets appear more focused on a rising participation and unemployment and perhaps more importantly lower-than-expected wage gains – potential indications of moderating inflation. The immediate market response seemed to indicate renewed expectations for a 0.25% Fed rate hike later this month rather than the 0.50% increase Chair Powell put on the table earlier this week. In Congressional testimony, Powell noted that accelerating rate increases would be based on the totality of the data, which includes today’s jobs report as well as next week’s CPI (inflation) report due out Tuesday (3/14). Policymakers will also need to consider recent signs of stress on the financial system in light of its aggressive tightening regimen as evidenced by Silicon Valley Bank this week.

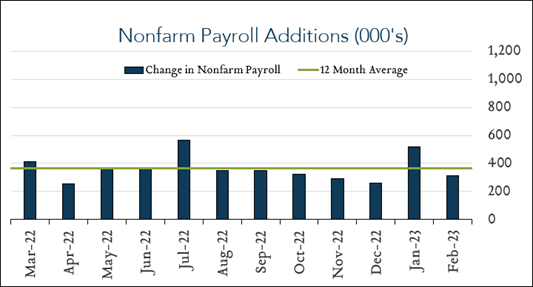

- 311K jobs added in February – topping expectations again. The U.S. labor market added 311K jobs in February compared to forecasts ranging from +80K to +325K with a median of +225K. Meanwhile, January’s unexpectedly robust payroll gains (+517K) were revised only slightly lower to +504K. Notable job gains were seen once again in leisure & hospitality (+105K), retail trade (+50K), and government (+46K). Employment declined in information (-25K) and transportation & warehousing (-22K).

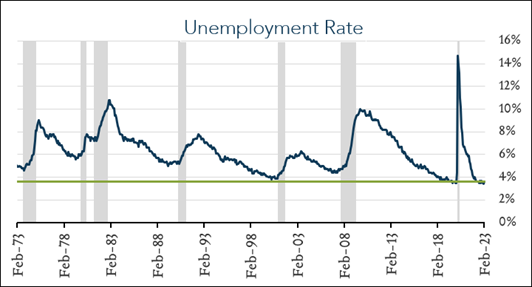

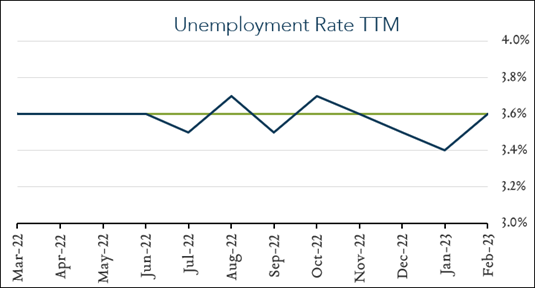

- 3.6% unemployment – up from 3.4% in January. The U.S. unemployment rate rose to 3.6% from 3.4% a month ago. Forecasts ranged from 3.3% to 3.5% with a median of 3.4%. The labor force participation rate increased slightly to 62.5% – the highest since March 2020, continuing a steady climb over the last three months. Hourly earnings increased 4.6% over the last year (below expectations of +4.7%) and just 0.2% month-over-month(below expectations of +0.3%, and closing in on Fed targets).