March 14, 2023

February Inflation - Overall In Line; Fed in The Hot Seat

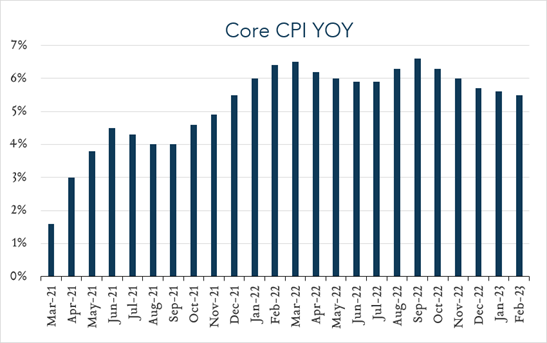

February inflation data showed overall annualized price increases slowing for an eighth straight month – matching analysts’ expectations. That said, shelter costs, which represent nearly one third of the overall CPI basket and tend to impact the index with a lag, have yet to decelerate and Core CPI (excludes food and energy) increased more than expected compared to January. Today’s outcomes reaffirm the exceptionally challenging policy-making environment the Fed is in right now. The economy has proven more resilient than hoped amid the fastest rate-hiking cycle on record. Looking forward, the Fed must determine how best to prioritize conflicting interests including inflation that remains too high and financial instability risks revealed by regional bank failures over the last week. Shortly before the failures, Fed Chair Powell opened the door for a re-acceleration of rate increases in congressional testimony. In light of the stress evident in the financial system, markets are now pricing in a potential pause in rate hikes following next week’s FOMC meeting.

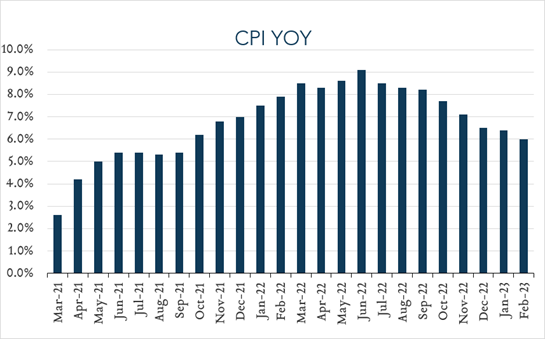

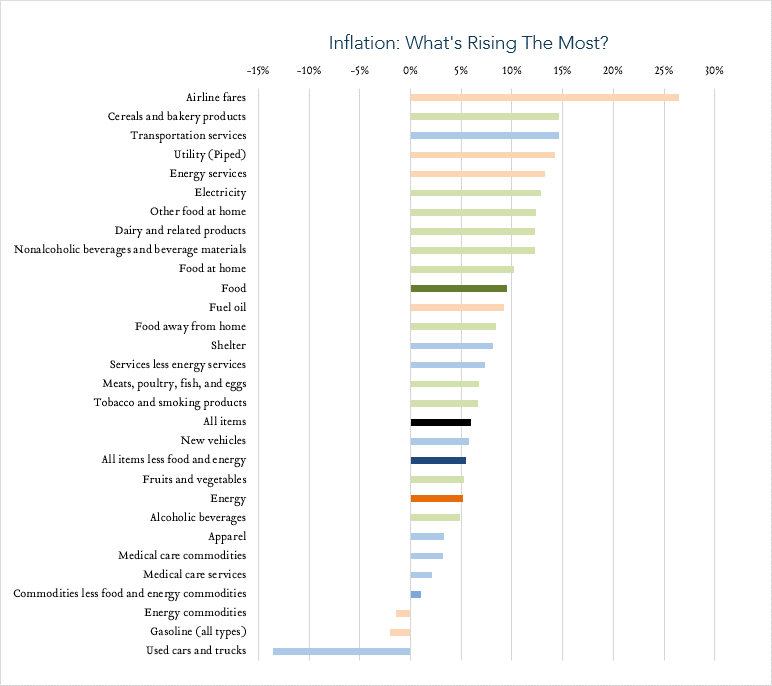

- Consumer prices (CPI) increased 6.0% year-over-year. In February, the consumer price index (CPI) increased 6.0%, decelerating from 6.4% in January. Expectations ranged from 5.8% to 6.3% with a median of 6.0%. Food (+9.5%), shelter (+8.1%) and transportation services (+14.6%) were key contributors to the overall increase. We continue to keep a close eye on shelter costs, which represent nearly one third of the consumer price index and tend to impact the index with a lag. Used cars and trucks was the only category to post a year-over-year decline, down 13.6%. Core CPI (excludes food and energy) increased 5.5% year-over-year, in line with expectations.

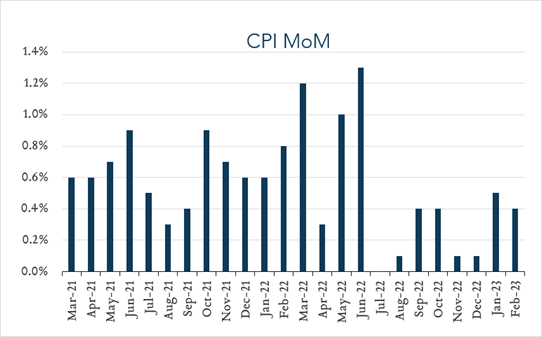

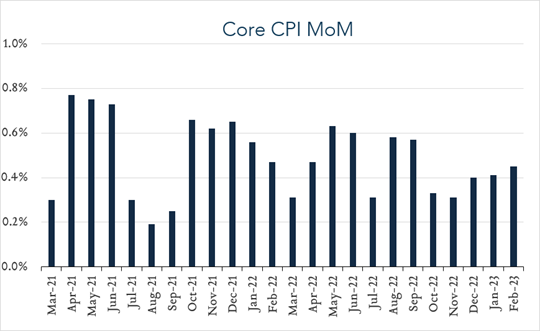

- Consumer prices (CPI) increased 0.4% month-over-month. In February, consumer prices rose 0.4% compared to January. Expectations ranged from +0.2% to +0.5% with a median of +0.4%. Shelter costs increased 0.8% for the month. Used car and truck prices fell another 2.8% in the month. Core CPI (excludes food and energy) increased 0.5% compared to January, compared to expectations of 0.4%.