February 11, 2025

Estate Planning Opportunities Abound

With the receipt of our national charter and our continued Delaware limited purpose trust company charter, we now have additional tools for bringing our clients the best planning opportunities. Many states have adopted “uniform acts” which create greater consistency between state laws. However, each state retains unique differences in both substance and whether the laws in that state have been tested by the courts. In helping our clients, we are always looking to make the best decision balancing both the substance of the law and the protections of the law.

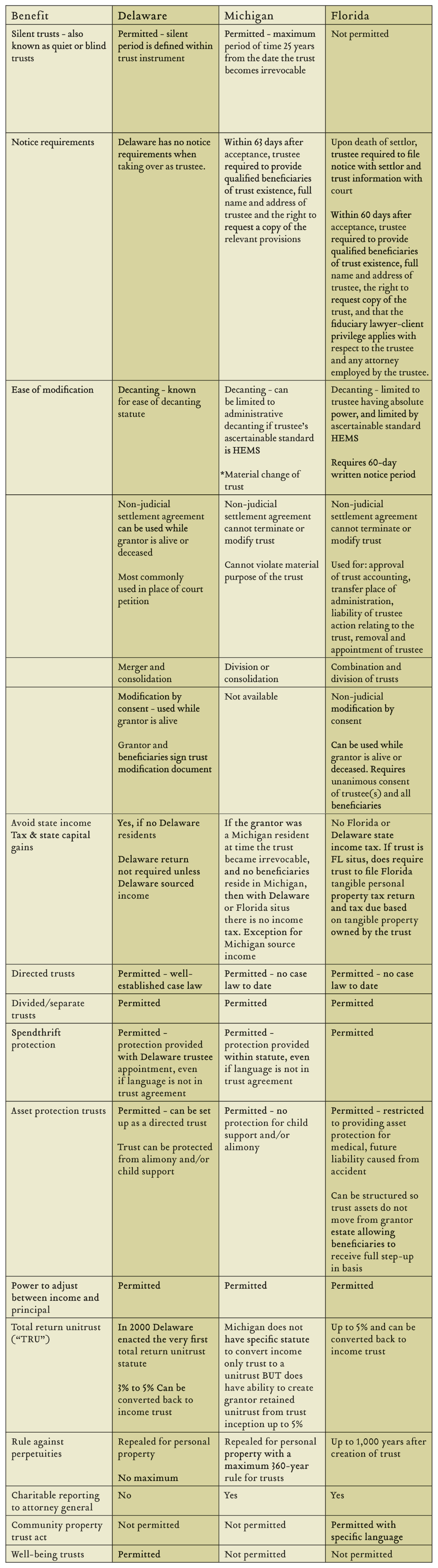

In the chart below, we compare key trust laws in Delaware, Michigan and Florida. A few key highlights are:

Silent Trusts

A silent trust permits the trust to be kept secret from the beneficiary for a period of time. During the silent period, information regarding the trust is provided to a designated representative. This permits a grantor to set aside trust assets for younger beneficiaries or beneficiaries with lifestyle concerns, such as spending habits or addictions, for a period of time. Delaware and Michigan have enacted silent trust statutes, but Florida has not.

Trust Modifications

A revocable trust can always be modified by the grantor. It is sometimes necessary to modify an irrevocable trust because of a change in circumstances. Irrevocable trusts can be modified in a variety of ways. A trust can be “decanted” to another trust containing different or additional provisions. The beneficiaries may be able to agree to a judicial or non-judicial settlement agreement to address changes, a modification by consent, or a merger or consolidation of trusts. The law varies greatly between the states and should be reviewed to determine the best course of action based on specific circumstances.

Directed/Divided or Separate Trusts

The states use different language to say the same thing. A directed trust is a type of trust that gives other participants in the trust more control over how the trust is carried out. This allows the trust creator to separate the trustee’s responsibilities and assign them to other trustees, directors or advisors. For example, different individuals may be appointed to make decisions regarding investments, distributions or management of specific assets. All three states permit these types of trusts. Delaware has the advantage of being first with well-established case law.

Community Property Trusts

Florida enacted the Florida Community Property Trust Act which is a joint trust between spouses and which has very specific requirements. Couples may choose to add specific property to the trust. It works best where couples have highly-appreciated property, real estate or stocks, which would likely be sold upon the first spouse’s death and which would benefit from a step-up in basis. Michigan and Delaware have not enacted a similar statute.

Well-Being Trusts

In 2024, Delaware was the first state to enact a beneficiary well-being trust statute. The primary purpose of the beneficiary well-being trust is to provide wealth management training and services for the beneficiaries’ mental health and well-being and to educate beneficiaries about their family history and legacy, family values and dynamics, family governance, and philanthropy. With reference to this statute in the trust instrument, a trustee can provide or pay for beneficiary needs that are normally at trustee discretion under support. Michigan and Florida have not enacted a similar statute.

With our expanded charter and our expertise in Delaware, Michigan and Florida trust laws, your team at Greenleaf Trust looks forward to providing you with the best solutions for your families’ needs.