March 6, 2025

Economic Commentary

February is the shortest month of the year, but it was not short on economic developments, from the first estimates of 2024 GDP to corporate earnings reports to new tariff announcements. Let us close the books on 2024, take a quick look at the early indicators for 2025, and then turn our attention to what President Trump calls the most beautiful word in the English language – tariffs.

2024 Wrap-up and 2025 Developments:

The US economy wrapped up 2024 with real GDP growth of 2.8%, slightly below 2023’s 2.9%. Growth was fueled by gains in consumer spending, investment, government spending, and exports. Initial estimates for Q1 2025 GDP growth are currently projected at 2.2%, up from 1.9% at year end.

The Federal Reserve maintained its target range for the federal funds rate at 4.25-4.50% in January, as expected, signaling a pause in its rate-cutting cycle. Policymakers continue to weigh a strong labor market against slightly above-target inflation. Non-farm payrolls increased by 143,000 in January, following a revised gain of 307,000 in December, reinforcing a steady, if moderating, labor market picture. The January inflation report showed prices edging higher with the Consumer Price Index (CPI) up 3.0% over the past year, driven by higher auto insurance, shelter, and energy costs.

Corporate earnings are generally exceeding expectations for Q4 2024, supporting equity markets despite broader economic uncertainty. To date, around 75% of reporting S&P 500 companies have delivered positive EPS surprises and over 60% have reported positive revenue surprises. Resilient corporate earnings growth coupled with a more measured Fed should provide a constructive backdrop for markets in 2025 absent an unforeseeable shock or policy misstep.

Tariffs Back in Focus:

Trade policy took center stage in February with US tariffs announced on goods imports from China, Mexico, and Canada with varying implementation dates and negotiation windows. Given all the noise surrounding tariffs, a discussion of this policy instrument is warranted. Simply put, tariffs are taxes imposed on imported goods. Historically, nations have used tariffs for a variety of reasons, including revenue generation, to protect domestic industries, and to influence international affairs. The current statuses of incremental US tariffs are as follows:

- China: On February 4th, US imposes an incremental 10% tariff, China responds with additional tariffs on certain US products, export controls, and regulatory scrutiny of US-based companies.

- Mexico: A proposed 25% tariff is suspended until March 4th; Mexico considered, but did not officially release a schedule of retaliatory tariffs on US goods. Negotiations are ongoing and reports indicate Mexico is motivated to avoid new US tariffs.

- Canada: A proposed 25% tariff is suspended until March 4th; Canada announced a tariff package targeting US goods if the tariffs go into effect. Negotiations are ongoing and reports indicate Canada is motivated to avoid new US tariffs.

- Steel and Aluminum: On March 12th, a 25% tariff will replace current tariffs on all steel and aluminum imports.

- Automobiles, Pharmaceuticals, and Semiconductors: President Trump discussed imposing a 25% tariff on imports of automobiles, pharmaceuticals, and semiconductor chips with details expected to be released in April.

- Reciprocal tariffs: Various federal agencies are preparing reports due in April regarding “non-reciprocal trade arrangements” where trading partners impose tariffs, taxes, or other trade barriers that are not currently matched by US tariffs on that counterparty. The intention will be to determine the equivalent of a reciprocal tariff with respect to each trading partner.

Now let us consider some of the potential consequences of tariffs, accepting the ever-changing nature of the current trade landscape. Economists’ consensus are that tariffs generally:

- Increase consumer prices,

- Create a drag on GDP growth,

- Impact FX rates for the domestic currency,

- Lead to higher interest rates,

- Disrupt supply chains and reduce business investment,

- Protect jobs in targeted industries but reduce jobs elsewhere,

- Increase volatility and reduce business confidence, and

- Generate government revenue, but at a cost to economic efficiency.

The economic impact of tariffs is a multifaceted issue with wide-ranging implications. Presidents, of course, have considerations outside of just economics and the current administration has shown a fondness for using tariffs as leverage when pursuing policy initiatives. Ultimately, the overall cost or benefit of tariffs is a question of diplomacy and governance, not simply an economic matter.

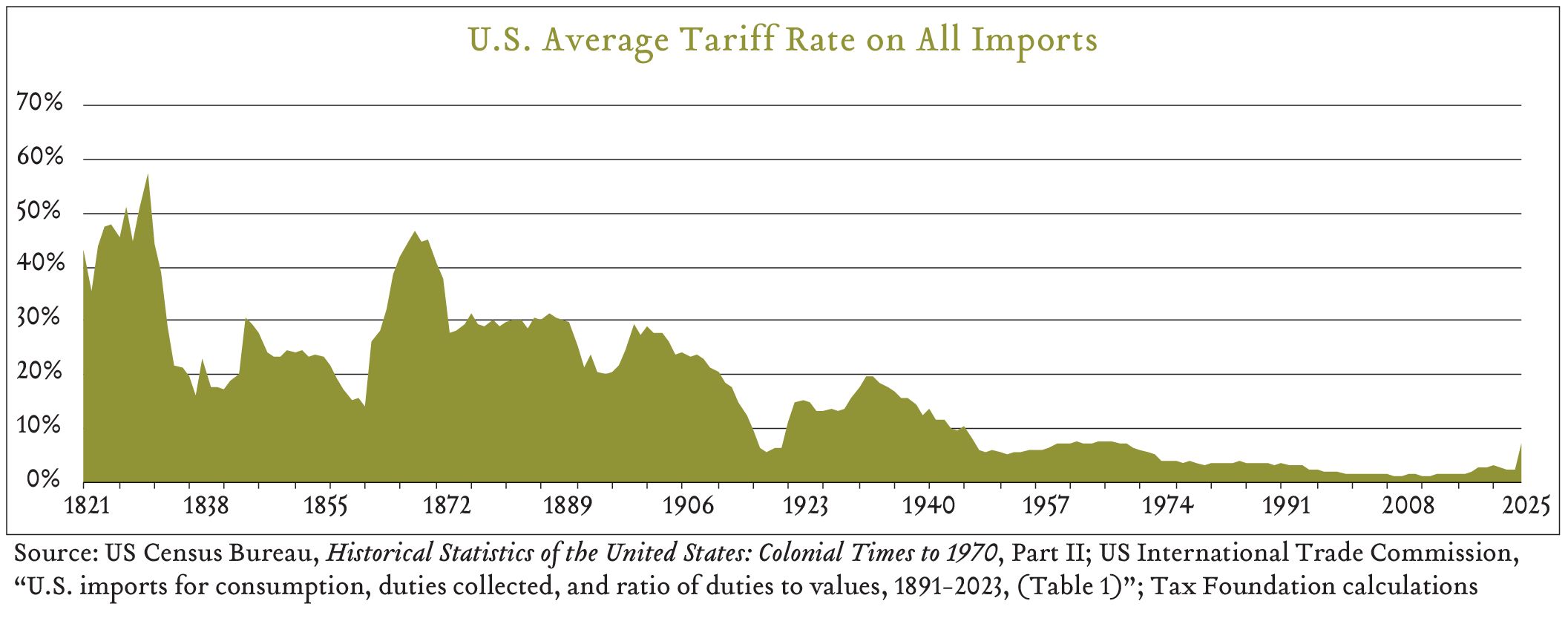

The Tax Foundation estimates that the proposed tariffs against China, Canada, and Mexico, if implemented, could triple the average import tariff rate to 7%, a level not observed since 1969. Zooming out further, however, makes 7% seem rather small in a historical context.

Historically, markets have shown resilience during periods of both high and low tariff regimes. While it is unclear what the future tariff rates may be, Greenleaf Trust continues to advise clients on the merits of maintaining a long-term investment perspective and avoiding reactive portfolio adjustments based on short-term market fluctuations or headline risk. Our dedicated team remains vigilant in monitoring these developments. On behalf of the entire team, thank you for allowing us to serve on your behalf.