January 16, 2025

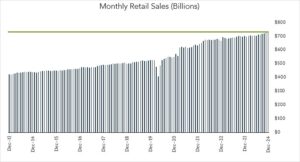

December Retail Sales - Broad Advance Caps Solid Holiday Season

U.S. retail sales broadly advanced in December indicating a healthy end to the holiday shopping season. Entering 2025, the labor market and consumers appear to be on solid footing.

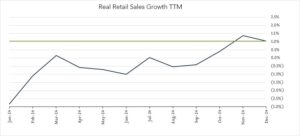

- Real (inflation adjusted) retail sales advanced 1.0% year-over-year. In December, retail sales grew 3.9% nominally netting growth of 1.0% after adjusting for 2.9% inflation. Higher spending at online retailers (+6%) and motor vehicles (+8.4%) was partially offset by lower spending at department stores (-1.8%). Eight of thirteen categories advanced in real terms.

- Real (inflation adjusted) retail sales were flat month-over-month. In December, nominal retail sales levels increased 0.4% compared to November (consensus +0.6%) resulting in no growth after adjusting for 0.4% inflation. Higher spending at misc. store retailers (+4.3%) and at sporting goods, hobby, musical instrument & bookstores (+2.6%) contributed to the strength whereas building material & garden eq. & supplies dealers (-2%) offset the gains. Seven of thirteen categories increased in real terms.