January 18, 2023

December Retail Sales - Below Forecast

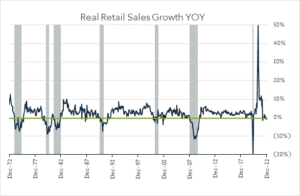

U.S. retail sales fell by more than forecast in December (-1.1% MoM vs. -0.9% expected) with a real year-over-year decline of 0.5%. While real year-over-year retail sales declines can be a leading indicator of a recession, softness is also an indication that Fed efforts to reduce consumer demand, and in turn inflation, is having an impact.

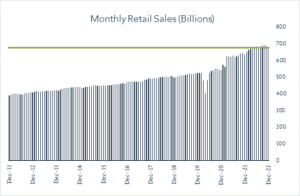

- Real (inflation adjusted) retail sales declined 0.5% year-over-year. In December, retail sales grew 6.0% compared to a year ago netting -0.5% real growth after adjusting for 6.5% inflation. Higher spending in online retail (+13.7%), restaurants (+12.1%) and grocery stores (+6.9%) accounted for a large portion of the nominal increase though all other categories (ten of thirteen) posted declines after adjusting for inflation.

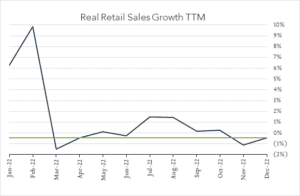

- Real (inflation adjusted ) retail sales fell 1.0% month-over-month. In December, retail sales levels contracted by 1.1% compared to November (consensus -0.9%) netting -1.0% in real terms. Ten of thirteen categories fell last month, including gasoline stations (-4.6%), furniture stores (-2.5%), and auto/parts dealers (-1.2%). Brick & mortar retail, online retail, and electronics/appliance sales all declined 1.1%.