January 11, 2024

December Inflation - Uptick Complicates Rate Cut Timing

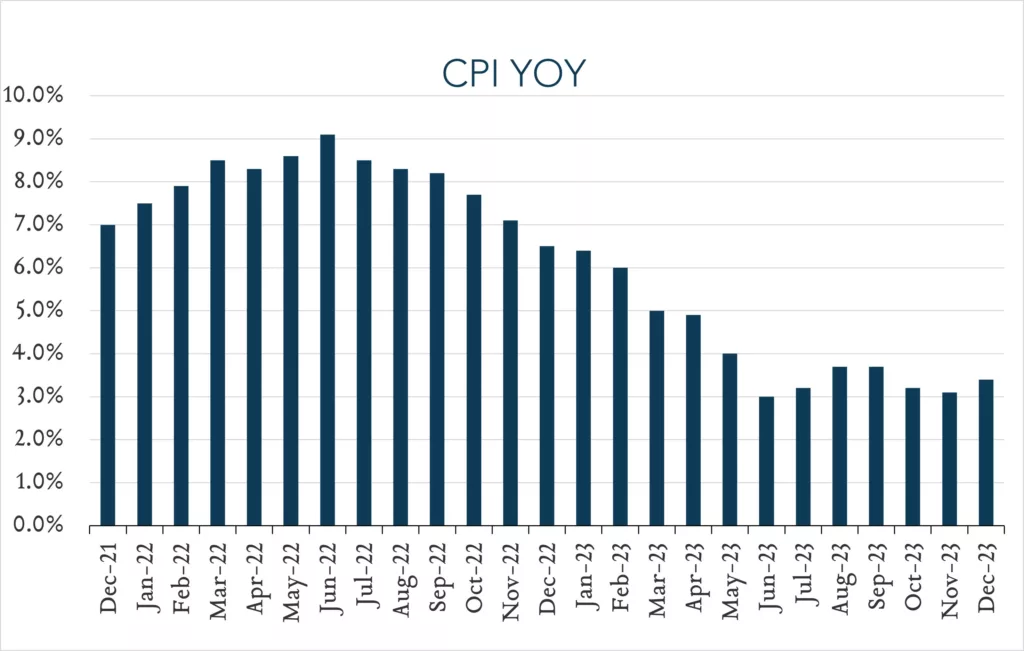

Year-over-year, inflation accelerated to 3.4% in December – the highest reading since September. Month-over-month, inflation accelerated to +0.3% from +0.1% in November. While inflation has declined substantially from a 40-year high of 9.1% reached last year today’s report highlights the choppy nature of bringing inflation back down to the Fed’s 2.0% target as a still-strong labor market continues to drive consumer spending and the broader economy. Today’s reading is likely to challenge investor bets on Fed rate cuts beginning as early as March. Fed projections provided in December indicated expectations for three rate cuts in 2024, while markets have been pricing in six.

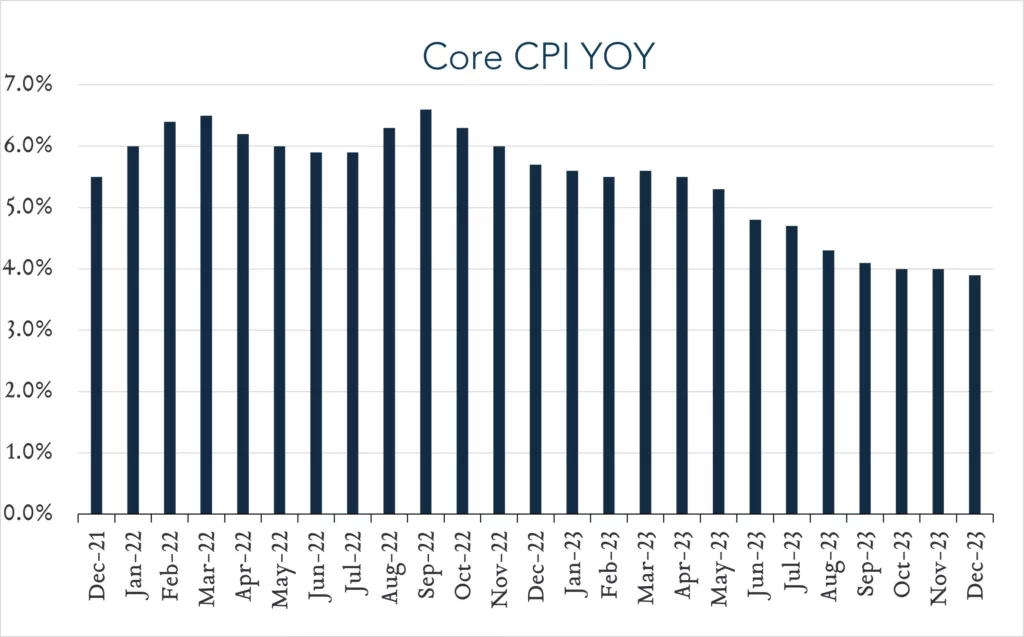

- Consumer prices (CPI) increased 3.4% year-over-year. In December, the consumer price index (CPI) increased 3.4%, accelerating from 3.1% in November and above expectations of 3.2%. Transportation services (+9.7%) and shelter costs (+6.2%) were key contributors to the overall increase, more than offsetting declines in energy (-2.0%) and used vehicles (-1.3%). We continue to keep a close eye on shelter costs, which represent nearly one third of the consumer price index and tend to impact the index with a lag. At +6.2% year-over-year, shelter costs decelerated from +6.5% in November and a peak of 8.2% in March 2023. Core CPI (excludes food and energy) increased 3.9% year-over-year, down from 4.0% in November, but above expectations of 3.8%.

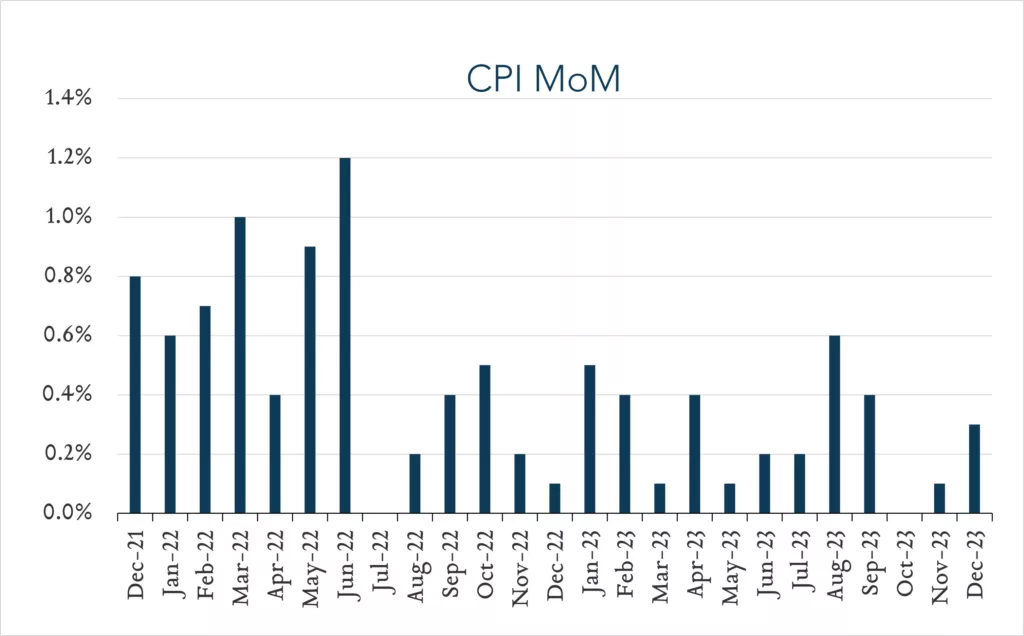

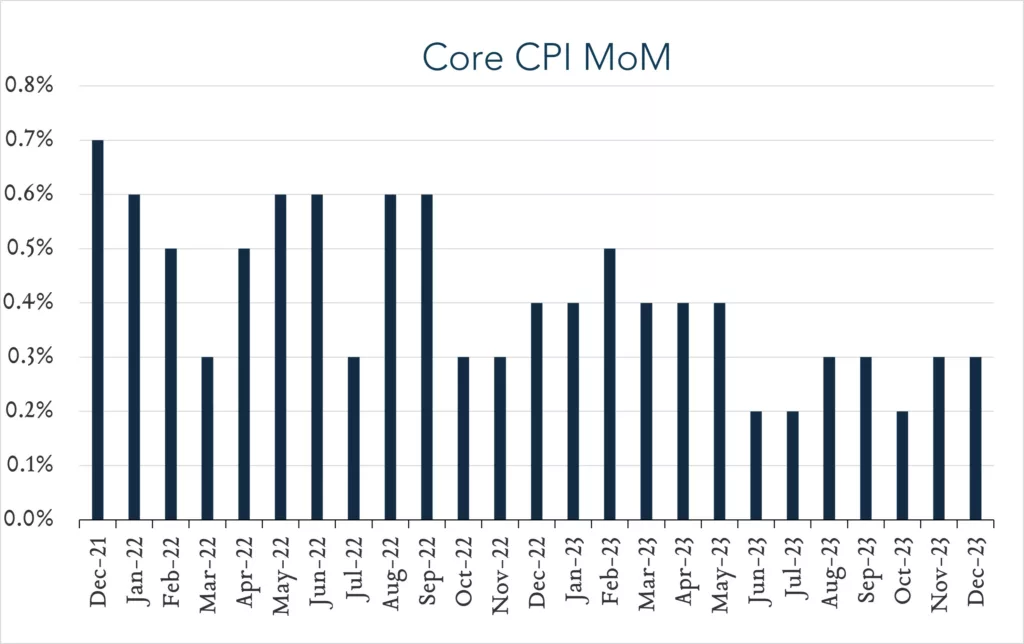

- Consumer prices (CPI) increased 0.3% month-over-month. In December, consumer price levels increased 0.3% accelerating from +0.1% a month earlier. Expectations ranged from +0.1% to +0.4% with a median of +0.2%. Energy prices rose 0.4%, and shelter costs increased 0.5% for the month. Core CPI (excludes food and energy) also increased 0.3% month-over-month, unchanged from November but above expectations of +0.2%.