April 5, 2024

Be-Labored

For some time now, surprising resilience in the U.S. labor market has underpinned a favorable narrative for the economy. Healthy demand for labor has kept American consumers employed and spending. This strength allowed the Fed to deliver the fastest rate-hiking cycle in 30 years to counter inflation. It was also one of the key factors that prevented a recession in 2023.

Entering 2024, the labor market remains strong, but when evaluating a broad set of data there are areas that have softened over the last two years in now-noticeable ways. In this article, we will look beyond monthly payroll numbers and highlight some of the more nuanced considerations regarding the path forward for the labor market. While the current pace of softening is both normal and manageable, accelerated deterioration could pose risks to the economic expansion.

The Strong

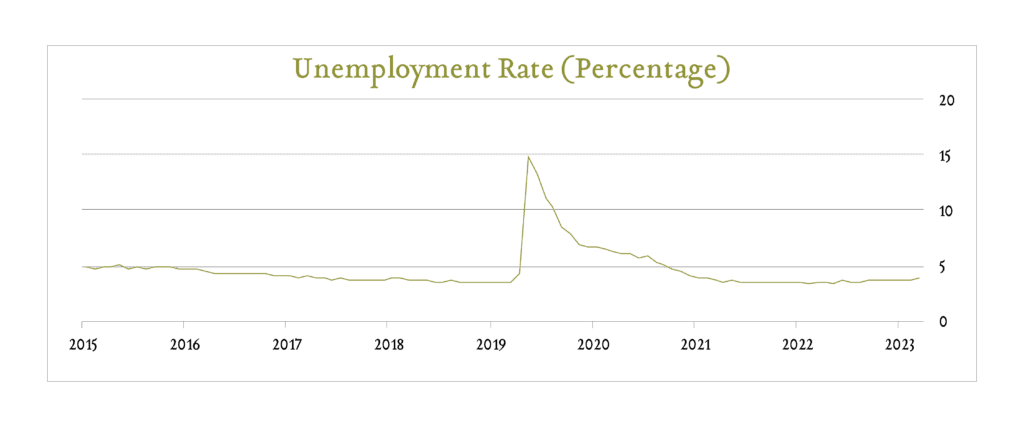

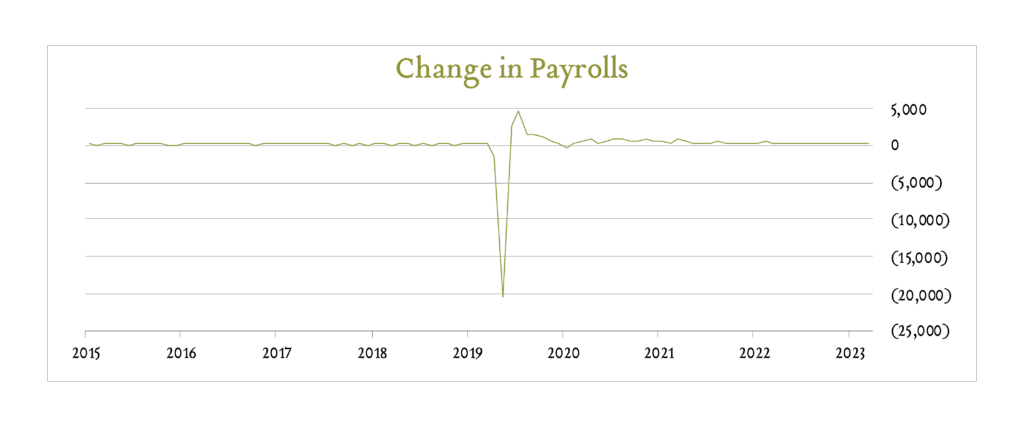

The main data set used to monitor and evaluate the labor market is the monthly Employment Situation Summary from the Bureau of Labor Statistics. The report has consistently painted a positive picture of the state of the US labor market. Over the past year, the economy has added an average of 230K new jobs per month with the most recent three months averaging 265K new jobs. At 3.9%, the unemployment rate has held below 4% for more than two years and remains low by historical standards.

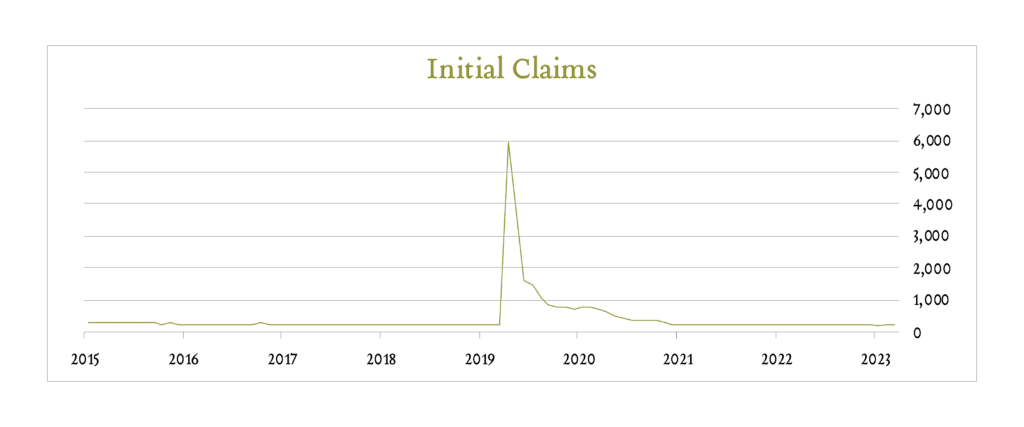

Looking across our dashboard, we see other indications that the labor market remains on solid footing. For instance, after reaching unprecedented highs at the onset of the pandemic, initial jobless claims have settled into a normal range averaging just over 200K per week since 2022. Year-to-date in 2024, weekly initial jobless claims have averaged just 208K. Initial jobless claims are released weekly and provide a higher frequency look into the strength of the labor market. So far, they show no indication of a soft labor market.

The Moderating

While these core metrics indicate strength, we find initial indications of a softening labor market in data from the monthly Job Openings and Labor Turnover Survey (JOLTS) from the Bureau of Labor Statistics. I want to communicate carefully here; I am not suggesting that the labor market is soft, just that softer is the direction of the trend. If you’re traveling down the highway at 100 miles per hour and ease your foot off of the gas pedal such that you decelerate to 99 miles per hour, you’re going slow(er) but you’re not going slow.

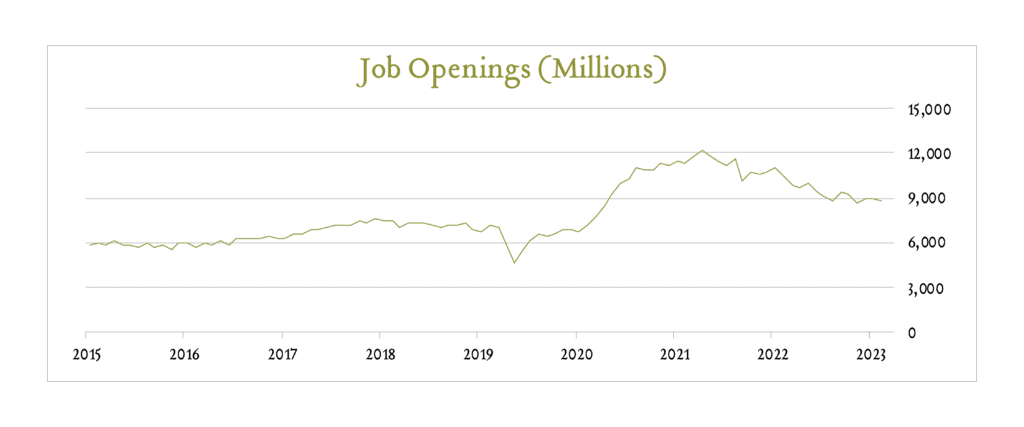

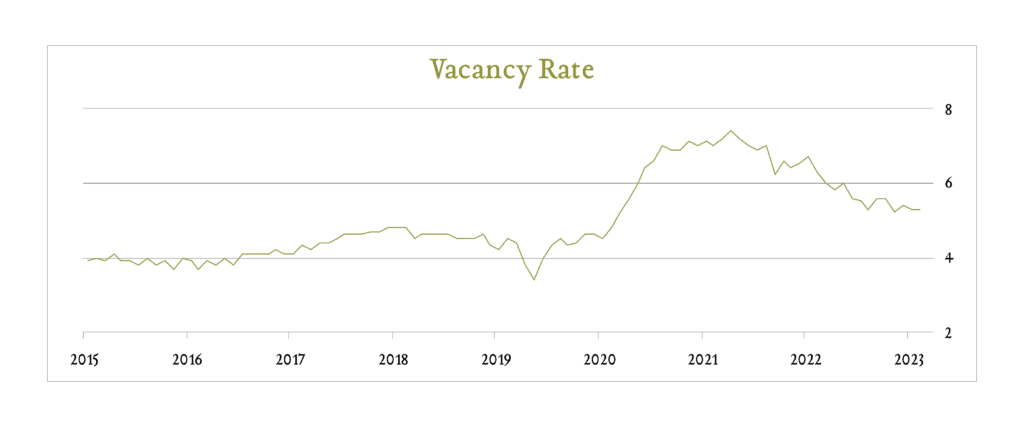

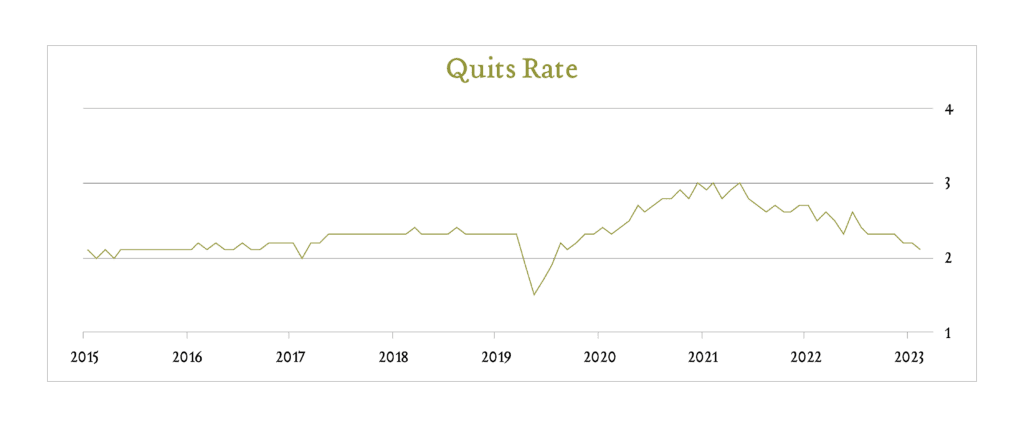

Job openings, vacancy rates, and the quits rate all point to moderating demand for labor, which means we’re seeing the balance between supply and demand move closer to equilibrium. Based on these metrics, demand for labor peaked around the end of 2021 and has been slowly moderating for the last two years.

Job openings (vacancies) is a concept that tracks the number of newly created or unoccupied positions in the economy where an employer is taking specific actions to fill these positions. Total job openings peaked at 12.2 million in March 2022 and declined to 8.8 million entering 2024. For perspective, job openings averaged 7.2 million in the year preceding the pandemic.

The vacancy rate (open jobs divided by total jobs) normalizes for changes to the total number of jobs in the economy – filled and open – and offers context for the absolute figures detailed above. Entering 2024, open jobs accounted for 5.4% of total jobs, down from a peak of 7.4% in March 2022, but still elevated compared to a pre-pandemic average of 4.5%.

Lastly, the quits rate tracks voluntary job separations initiated by the employee as a percentage of employed persons – said simpler: the percentage of workers who quit their job. The quits rate tends to rise when demand for labor is higher because job opportunities are more plentiful and workers feel more confident in their ability to secure a position. After peaking at 3.0% in late 2021 and early 2022, the quits rate stands at 2.1% entering 2024 – a level consistent with pre-pandemic norms.

The Weak

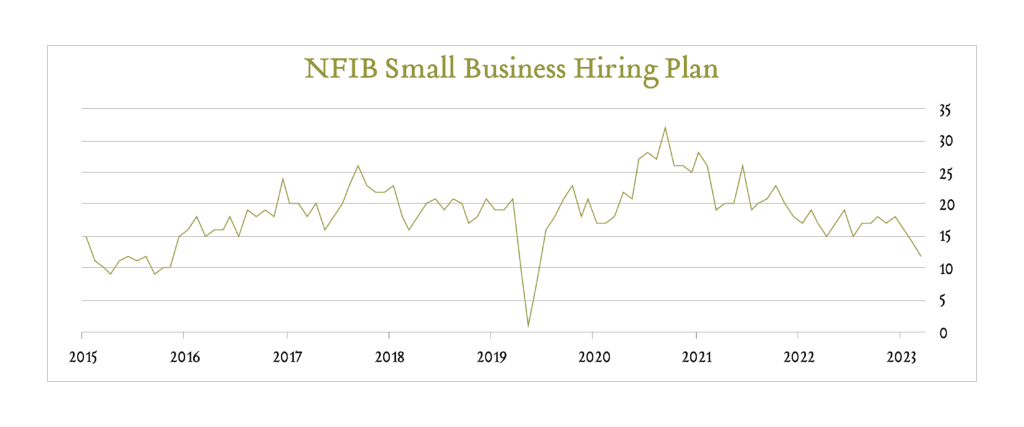

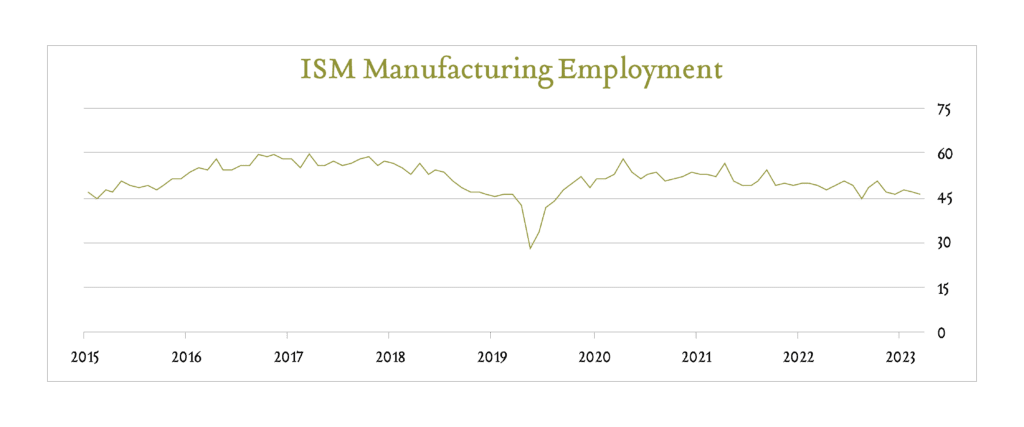

We’ve covered several data points that suggest the labor market remains on solid footing despite initial indications of moderation. These metrics are helpful in assessing the state of the labor market today and how it compares to history but, unfortunately, they’re all backward looking in nature. In order to evaluate forward expectations for the labor market, we turn to soft data. Unlike hard data, which consists of numbers, soft data involves capturing sentiments, attitudes, and expectations through surveys of individuals who might offer valuable insights on the matter.

The National Federation of Independent Businesses (NFIB) tracks the percentage of small businesses that plan to create new jobs in the next three months. As of February, only 12% of approximately 800 small businesses surveyed responded affirmatively. That figure is down from a peak of 32% in August 2021 and well below the 2019 average level of 19%.

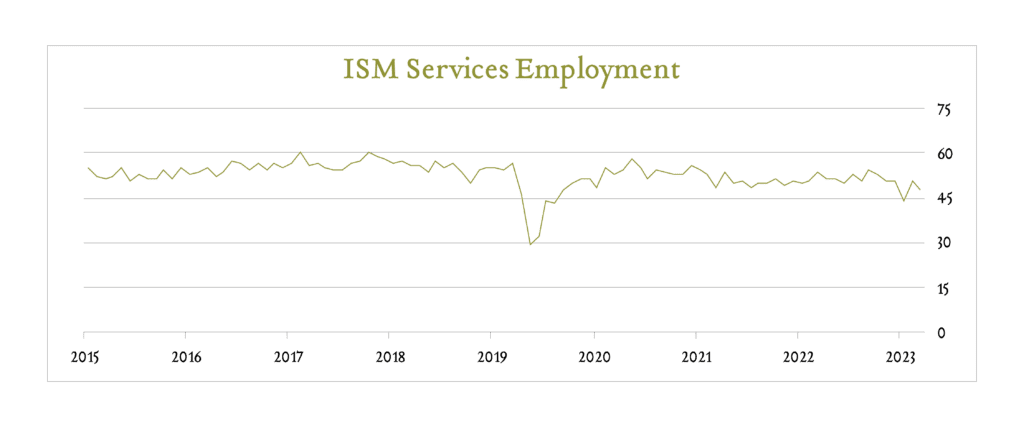

Similarly, the Institute of Supply Management (ISM) tracks whether executives at manufacturing and services-based companies expect to employ more or fewer workers in the current month compared to the previous month. Readings above 50% represent expectations for net expansion in employment and readings below 50% represent expectations for net contraction in employment. February readings indicated contraction in both manufacturing (45.9) and services (48.0) companies. These figures stand in stark contrast to the overwhelming expectations for expansion seen in 2021 and prior to the onset of the pandemic.

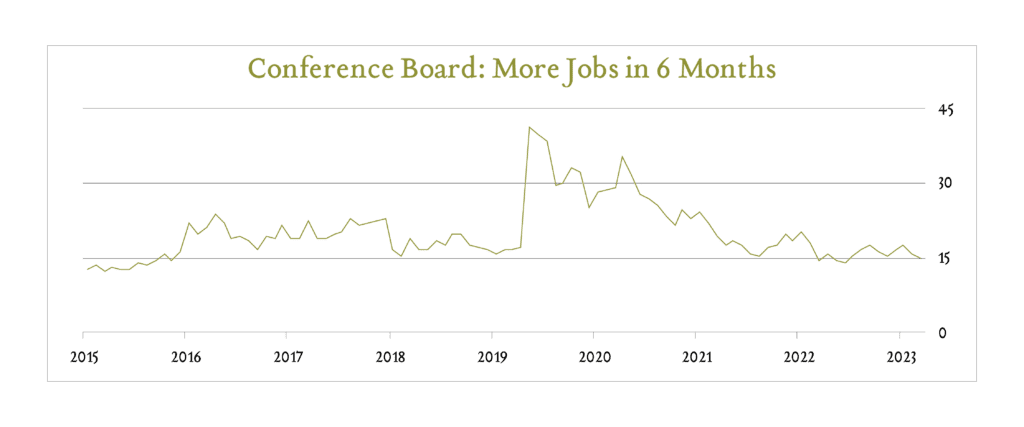

Through household surveys, the Conference Board monitors the percentage of respondents that think there will be more jobs six months into the future than there are today. Apparently, households are perpetually pessimistic as the average reading over the last 20 years suggests only 17% of households typically expect demand for labor to increase. In April 2020, with unemployment at 14.8%, 41.8% of households thought the labor market would improve in the months ahead. Today, only about 15% feel that way.

Conclusion

A healthy labor market is foundational to a healthy economy. Today, the US labor market is indeed healthy but is also slowly moderating, and several leading indicators suggest that continued moderation is the likeliest path forward.

This is not necessarily cause for alarm. Tight labor markets can lead to rapid wage growth which can create undesirable inflation. The labor market was likely too tight in late 2021 and early 2022, which exacerbated inflation, and prompted policymakers to respond by ratcheting up interest rates. The labor market needed to soften to a level consistent with Fed objectives with regard to inflation and it indeed appears to be softening. However, there’s a concern that more rapid deterioration could occur if monetary policy stays too tight for too long.

Policymakers are aware of the tradeoffs inherent in their decisions. In March, against a backdrop of moderating demand for labor and inflation well off of peak levels, Fed officials kept their policy rate steady and reiterated plans to implement three 0.25% interest rate cuts in 2024. Ideally, a well-timed move towards modest accommodation will help to protect against the possibility of accelerating deterioration of labor market conditions without impairing the progress that has been made in containing inflation. For now, labor market moderation appears to be occurring at a manageable pace, but we will continue to monitor indications of a turning point over the rest of the year.

Sources: Bureau of Labor Statistics, Department of Labor, National Federation of Independent Businesses, Institute for Supply Management, Conference Board.