September 23, 2022

Back into a Bear Market and to a New Year-to-Date Low

Back into a Bear Market and Near the Year’s Low

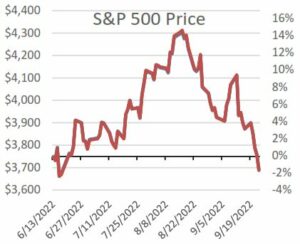

The markets are experiencing another volatile quarter. We are writing today to provide an update on what’s changed since the official start of the bear market back in June. We will also provide some historical context on bear markets and share our thoughts of what to do, and not to do, when the markets are volatile.

What is a bear market again?

The stock market is considered to be in a bear market when the price closes down more than 20% from a recent peak. Since World War II, there have been eleven drawdowns of more than 20%, or roughly one every seven years. This year’s drawdown makes it twelve.

What has changed since June?

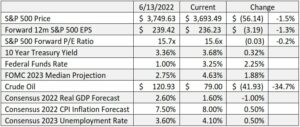

We entered the current bear market about three months ago on June 13th. Over that timeframe, there have been several notable market developments:

- Before its current decline, the S&P 500 rose over 14% from mid-June to mid-August as investors hoped for moderating inflation and a slower path of Federal Reserve rate hikes.

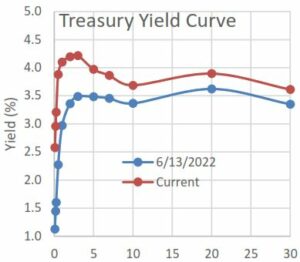

- The Fed has not showed signs of slowing, delivering three consecutive 0.75% rate hikes in June, July, and at their meeting this week in September. The Federal Funds Rate has risen from 1.00% to 3.25% over that timeframe and projections for next year have risen from 2.75% to 4.625%.

- Interest rates across the yield curve have risen, with 2 year treasuries yielding more than 4% and the 10 year treasury touching 3.7% this week.

- Earnings expectations for S&P 500 companies for the next year have not moved much, falling just 1.3% since June.

- Crude Oil prices have fallen dramatically, from $121 a barrel down to $79 today.

- Expectations for GDP growth and employment have weakened while forecasts of near-term inflation have risen.

What can we learn from previous bear markets?

During periods of volatility, it can be easy to feel unnerved. This year’s markets, in particular, have tested investors’ discipline. In times like these, we find it helpful to return to fundamentals, and to look back to history to guide the way forward.

As mentioned previously, there have been eleven prior bear markets since World War II. Looking at the historical stock market experience, we have the following observations:

- Short-term returns have been very volatile. Returns in the one year following the start of a bear market have ranged from -25% in 1973 & 2008 to +65% in 1982 and +62% in 2020.

- Longer-term returns following a bear market look more average-to-slightly good. 7 of the 10 instances for which we have 10 year returns exceeded 10% per year.

This is consistent with our general philosophy that the short-term can be quite unpredictable, but over the long-term a disciplined investment approach is the surest path to preserving and growing wealth.

This analysis also gives us the opportunity to compare today’s fundamentals to prior episodes. In particular, the 2001 bear market stands out for delivering poor investment returns, averaging just 2.9% per year for stocks over the forward 10 years. If we knew in advance that the S&P500 was poised to deliver so little, we would certainly be enticed to allocate away from stocks.

The 2001 experience looks quite different from today’s markets. Stocks were priced to deliver an earnings yield that was more than 1% lower than the prevailing 10 year treasury rate. Today, stocks offer an earnings yield of 5.5% and consensus expectations call for earnings growth of around 8% per year through 2024.

So, what should Greenleaf clients do, and not do, today?

In the short term, lots of things can and will come our way and there are always reasons to sell. However over longer periods of time, we have a much better idea of what to expect and we know that discipline has historically been rewarded.

The rapid double-digit recovery from mid-June to mid-August demonstrates an important concept. We advise clients not to attempt to time volatile markets. Over the long-term, we fundamentally believe that diversification and discipline will provide better outcomes than timing strategies.

As unsettling as a bear market can be, we encourage our clients to stay focused on the longer-term and stay disciplined to the plan you have in place. In the background, we are taking advantage of market opportunities where we see them, rebalancing to manage risk, and harvesting taxable losses where applicable. Despite an ever-changing landscape, our disciplined approach and long-term orientation serve us well as we endeavor to create comprehensive investment solutions that help our clients reach their financial goals. Please contact any member of our team if you have questions.

Source: Bloomberg, L.P.