September 5, 2025

August Jobs - Another Soft Month Solidifies Rate Cut Expectations

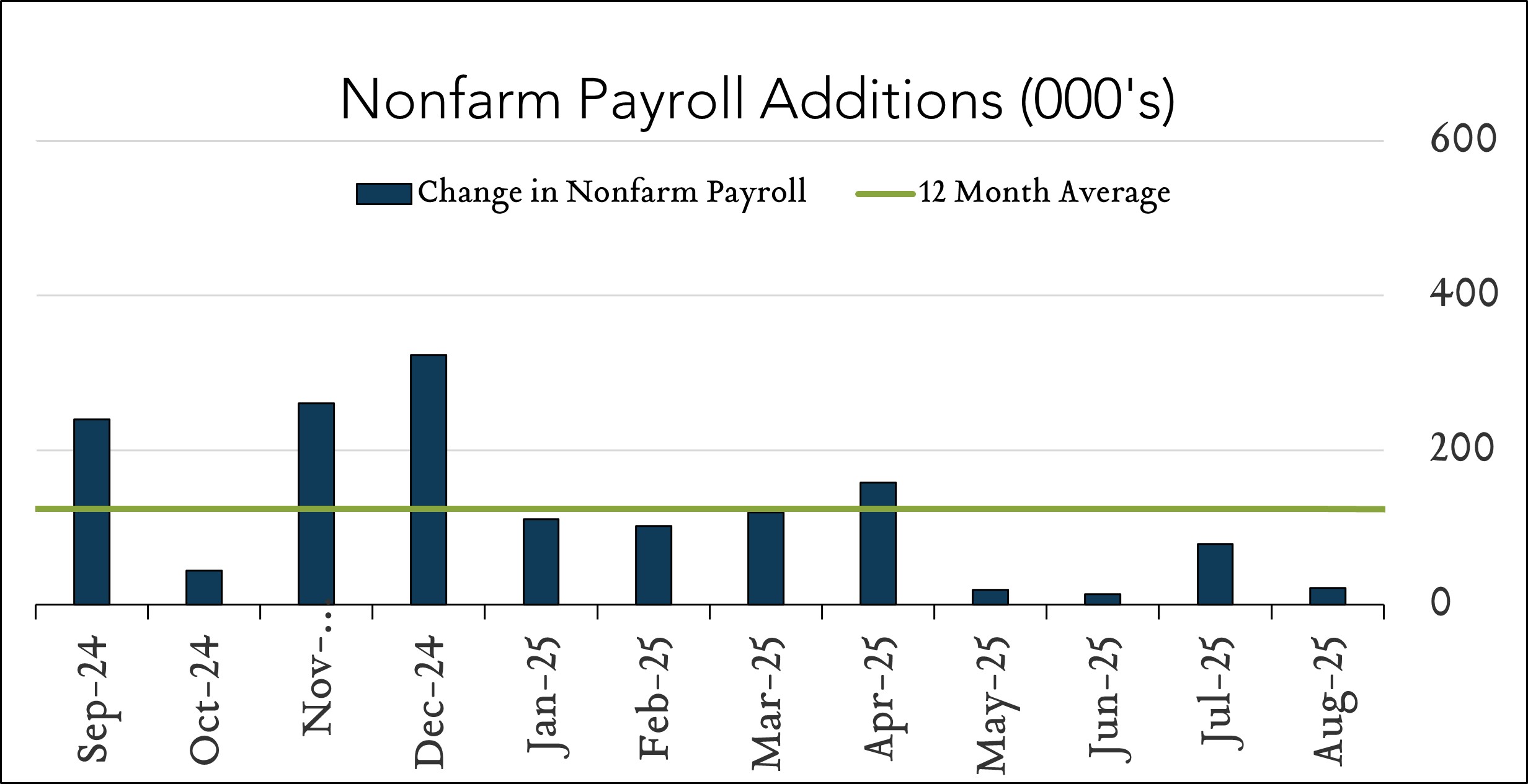

US job growth cooled sharply over the last three months. Nonfarm payrolls increased by just 22K in August (vs. consensus of +75K) and the jobless rate rose to 4.3% from 4.2% a month earlier – fanning concerns of ongoing labor market deterioration following July’s unexpected weakness. Job gains have moderated materially, averaging just 27K per month since May. Traders continued to price in a 0.25% interest rate cut later this month, which Fed Chair Jerome Powell signaled at the central bank’s annual symposium in Jackson Hole, WY. Policymakers will also have the benefit of an additional CPI report prior to finalizing their decision. Investors have also solidified bets that Fed policymakers will implement three 0.25% cuts this year – up from two to three previously.

- 22k jobs added in August – lower than forecast again. The U.S. labor market added just 22k jobs in July falling short of expectations for +75K. August figures place year-to-date results well below expectations entering the year. Job gains have averaged 75K per month in 2025 compared to expectations for +121K per month when the year began and compared to average monthly gains of +167K in 2024. Job gains trended higher in health care (+31K) and social assistance (+16K) while Federal government employment declined by 15K and is down 97K since January. Employment showed little change in other major industries.

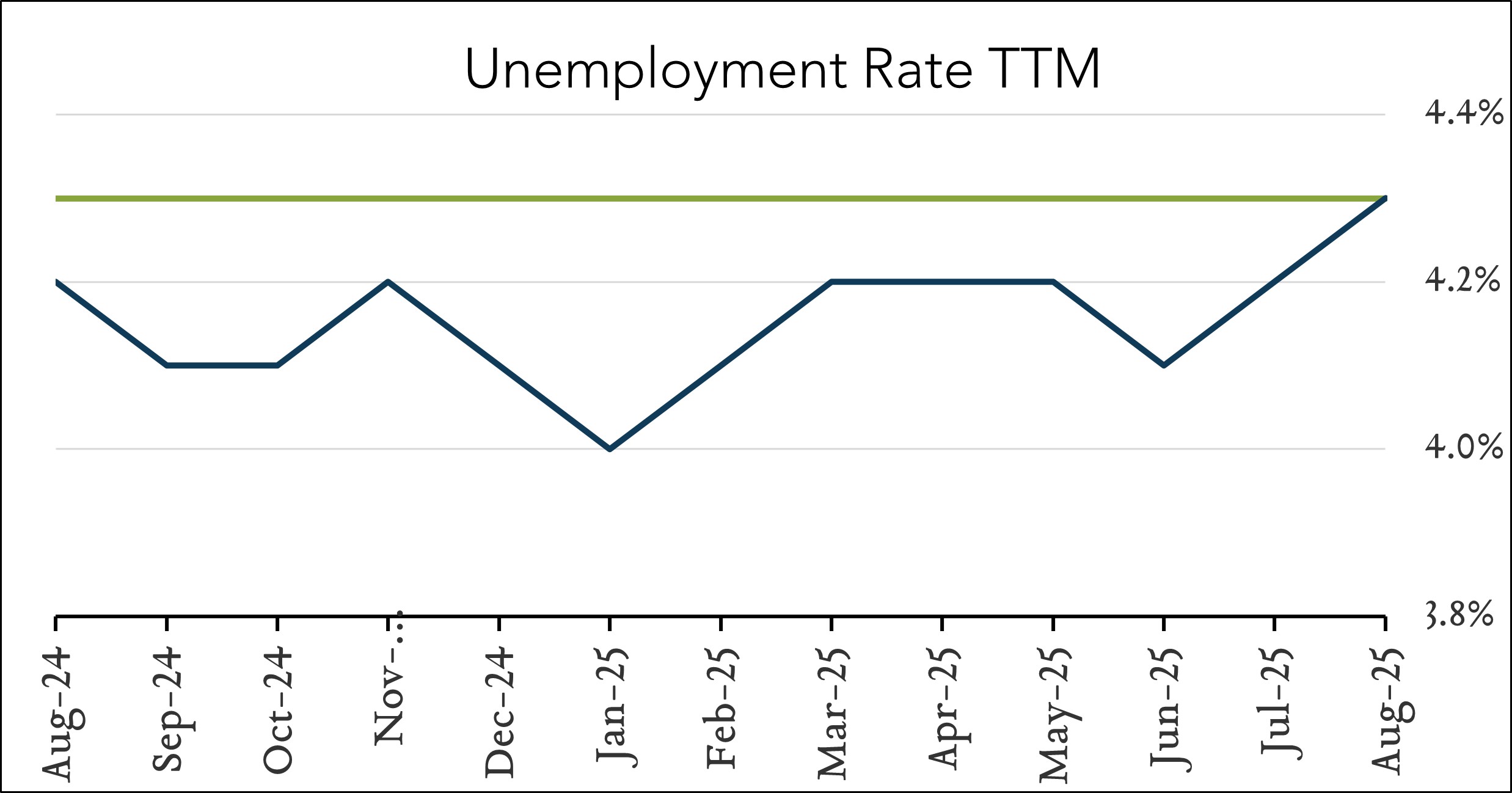

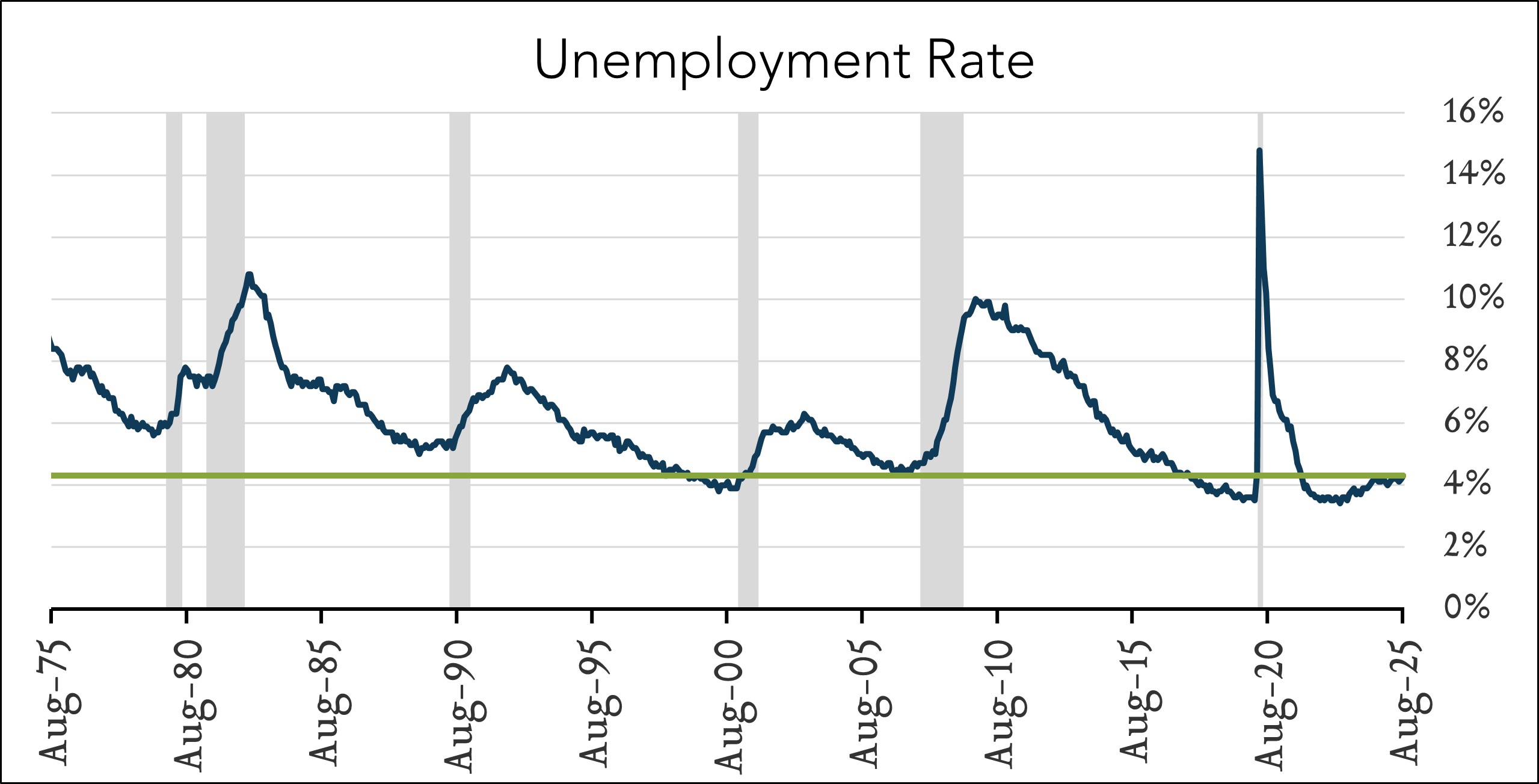

- 4.3% unemployment – up 0.1% month over month. The U.S. unemployment rate rose 0.1% to 4.3% in August matching expectations. While still historically low, today’s reading marks the highest level of unemployment since October 2021. The unemployment rate had previously remained in a narrow range of 4.0% to 4.2% since May 2024. The labor force participation rate rose slightly to 62.3% from 62.2% in July. Wage growth decelerated slightly to 3.7% year-over-year (vs. 3.9% in July and 3.8% forecast) and was unchanged at +0.3% month-over-month.