September 11, 2024

August Inflation - Modest Underlying Acceleration Favors 0.25% Fed Cut Next Week

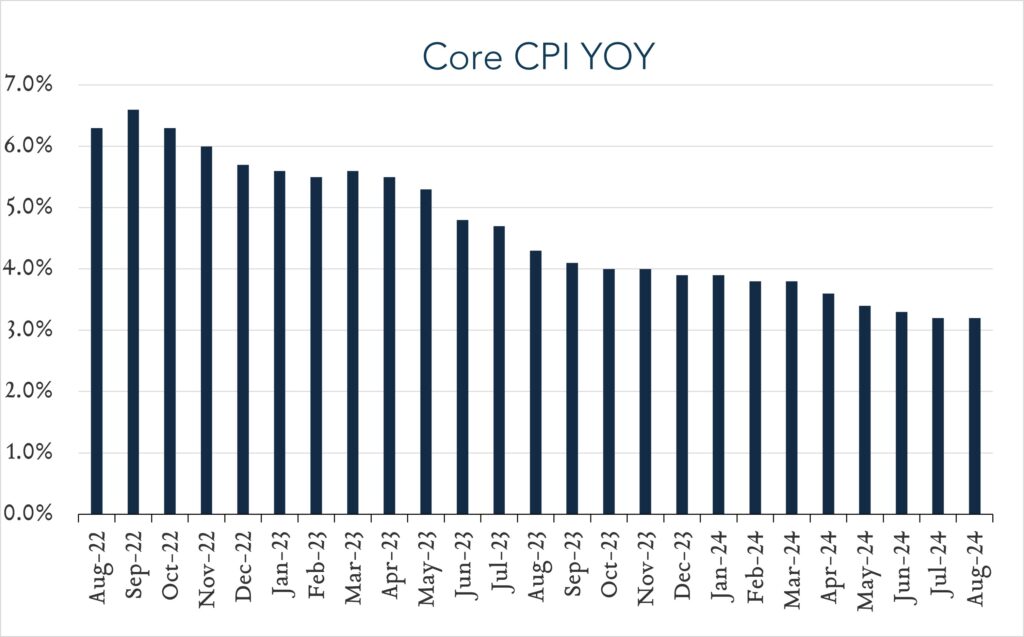

In August, consumer prices as measured by CPI, rose just 2.5% compared to a year ago, decelerating 0.4% compared to July and in line with expectations. However, so-called “core” CPI (excludes volatile food and energy prices) unexpectedly accelerated month-over-month as shelter costs moved higher. While the uptick in Core CPI will raise some eyebrows, policymakers have made it clear that their focus has shifted from inflation reduction to the health of the labor market, which is more likely to drive policy decisions in the months ahead. The FOMC has been widely expected to cut interest rates after its meeting concluding September 18, though the size of the cut (0.25% or 0.50%) has been a topic of debate. While today’s report will not deter policymakers from cutting rates next week, it does shift the calculus in favor of a single 0.25% reduction.

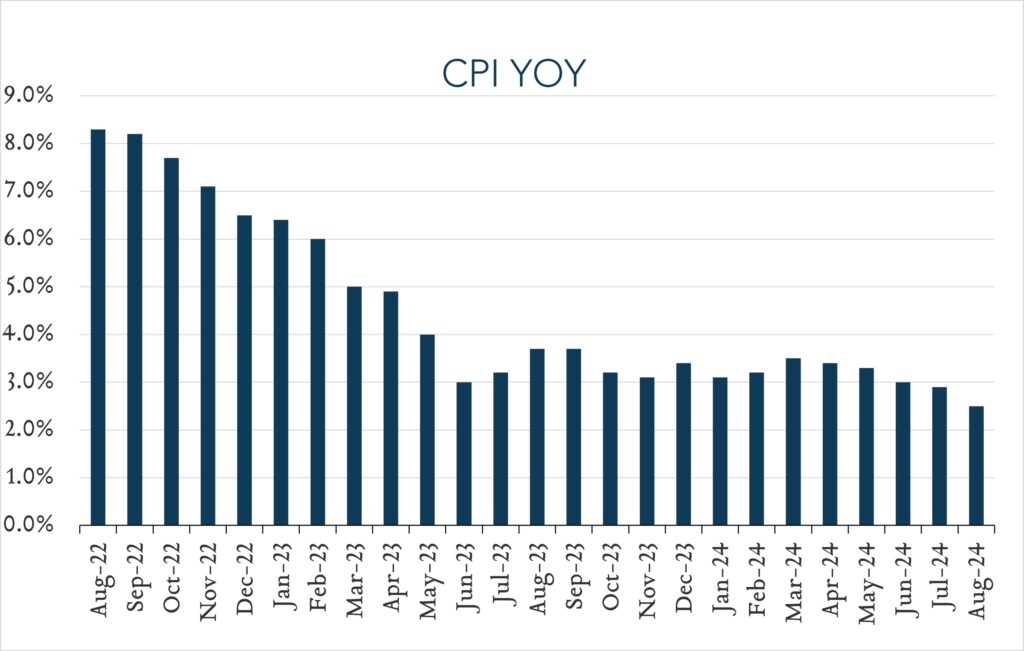

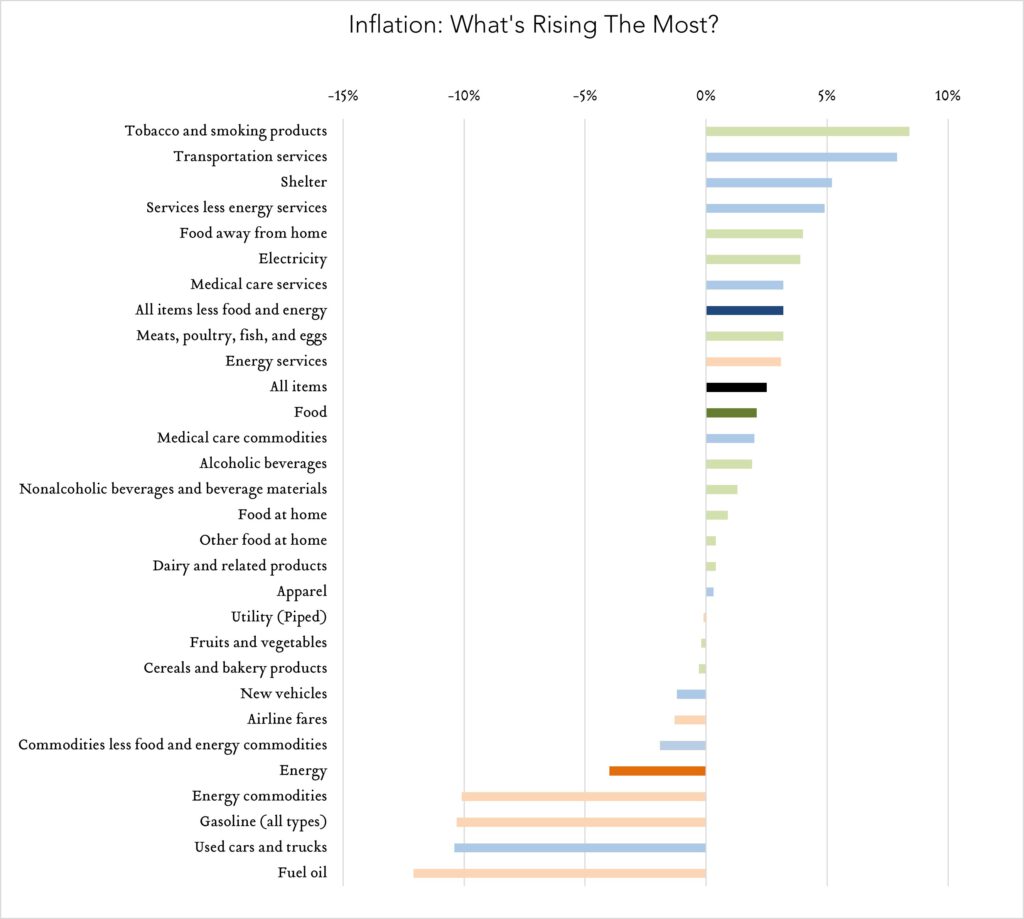

- Consumer prices (CPI) increased 2.5% year-over-year. In August, the consumer price index (CPI) increased 2.5%, down from 2.9% in July and in line with expectations. Transportation services (+7.9%) and shelter (+5.2%) were key contributors to the overall increase, more than offsetting declines for used vehicles (-10.4%). We continue to keep a close eye on shelter costs, which represent nearly one third of the consumer price index and tend to impact the index with a lag. At +5.2% year-over-year, shelter costs accelerated 0.1% from July but are down from a peak of 8.2% in March 2023. Core CPI (excludes food and energy) increased 3.2% year-over-year, unchanged from July and in line with expectations.

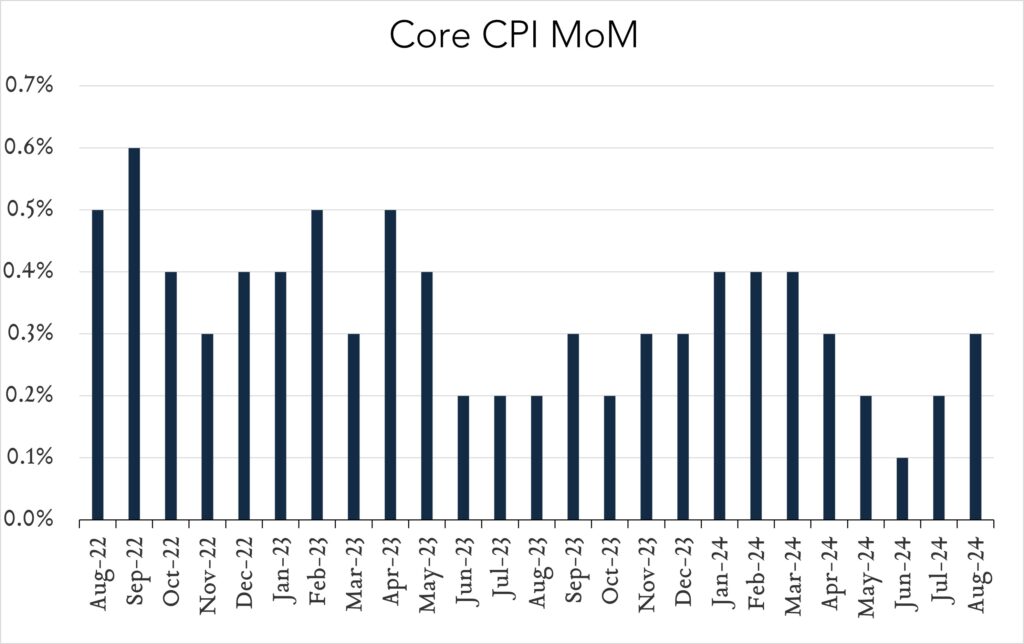

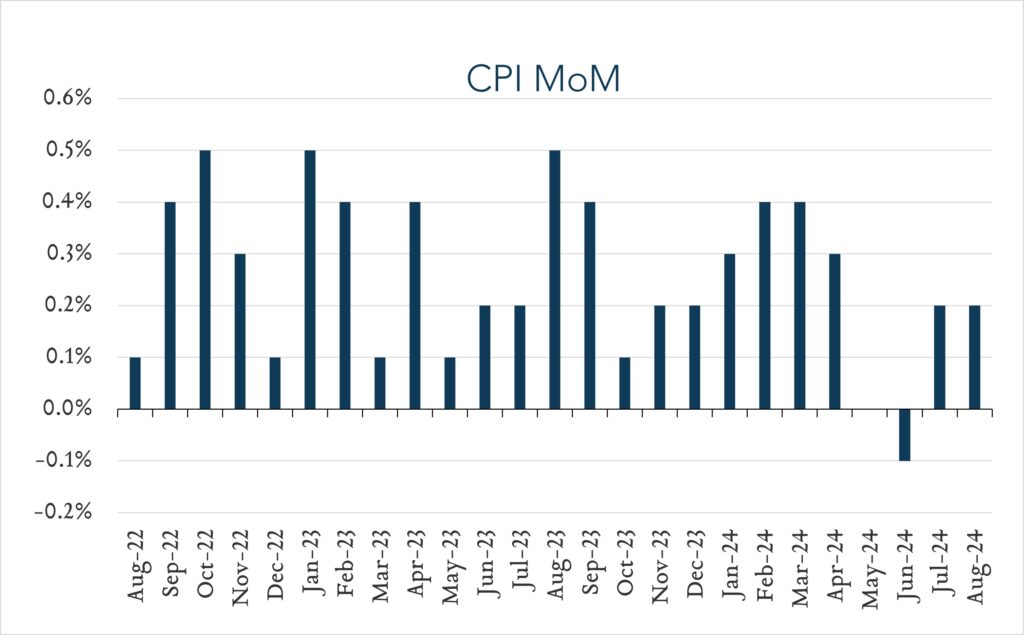

- Consumer prices (CPI) increased 0.2% month-over-month. In August, consumer prices rose 0.2% compared to July. Expectations ranged from +0.0% to +0.3% with a median of +0.2%. Shelter costs increased 0.5% (up from 0.4% in July and 0.2% in June), while used vehicle prices fell 1.0%. Core CPI (excludes food and energy) increased 0.3% month-over-month, up from 0.2% in July and above expectations for the same.