May 6, 2024

At Any Rate…

Spring has officially sprung. I currently find myself steeped in America’s pastime, shuffling my kids between baseball and softball fields almost daily. Many of our readers may also be following the start of baseball season, particularly the Detroit Tigers’ puzzling start, with one of the best records in the league on the road, and one of the worst at home. The early part of the season gives a glimpse into how the year may unfold, but a lot can change and trends that arise in April often reverse as the year goes along.

This is true both in baseball and for the economy and markets. Projections for 2024 that seemed certain back in December are being revised and asset prices are adjusting accordingly.

One of the most significant adjustments has been to market expectations for Federal Reserve policy in 2024. We will address that topic later in the article, but first we must set the predicate by looking at growth and inflation dynamics so far this year.

Coming into the year, the median economist expected real GDP growth of 1.3% for 2024 in the US. They also expected the unemployment rate to rise to 4.2% and forecasted a 50% chance of a recession in 2024.

As the year has unfolded, the labor market has been stronger-than-expected. The US has added an average of 276k jobs in each of the first three months and the unemployment rate has stayed below 4%. Retail sales started 2024 on a sluggish note but March’s report showed yet-resilient demand in spite of restrictive monetary policy. Household balance sheets appear to be solid, especially in the upper half of the income spectrum where house price appreciation and rising stock prices have buoyed net worth.

These positive surprises have led to upgrades in growth expectations for the year. Today, the median economist expects above-potential real GDP growth of 2.4%. Expectations for a recession in the next twelve months have fallen to a median forecast of 30%. The median economist now expects unemployment to stay below 4% for the duration of the year.

Growth assets like stocks have responded positively to these dynamics. The S&P 500 has delivered around 6% returns for the year-to-date period reflecting solid earnings growth expectations for the near future. Consensus expectations call for 2024 S&P 500 earnings growth of 10.8%, similar to the 11.1% expectation entering the year, and current forecasts for 2025 earnings growth are solid at 13.9%. Forward valuation ratios are similar to where they started the year at 20x forward earnings.

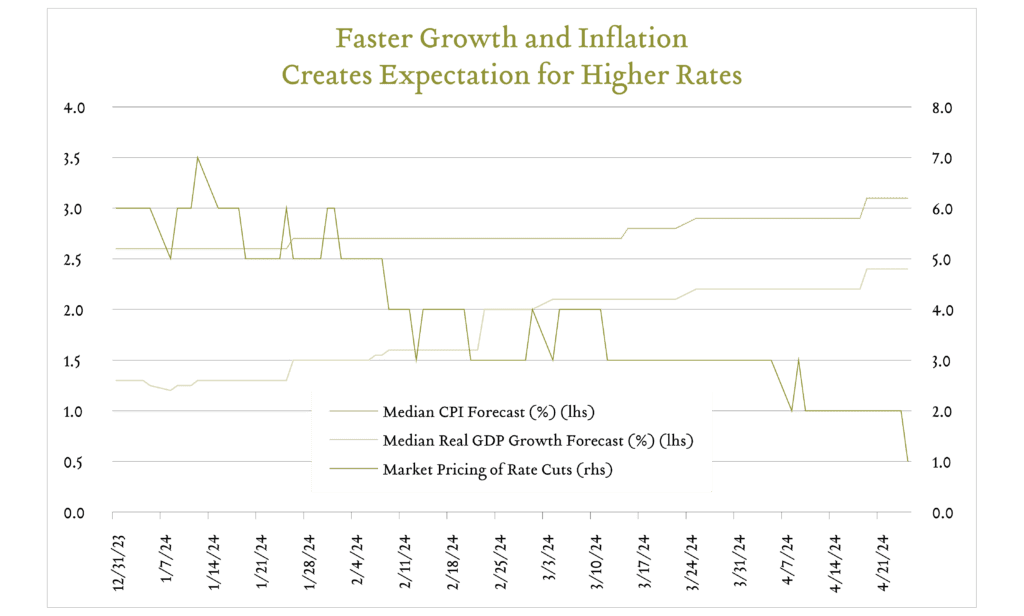

The drawback to greater-than-expected economic activity has been that inflation has been stickier than policymakers at the Fed would prefer. Coming into the year, the median economist expected CPI inflation to decelerate to 2.6% for 2024. Today, the expectation for the year is 3.1%. Each of the first three inflation reports for 2024 have resulted in faster-than-anticipated inflation.

This combination of faster-than-expected growth and stickier-than-expected inflation has generated the most significant adjustment in market expectations so far in 2024: expectations for Fed rate cuts. Coming into the year, the market was pricing in six quarter-point rate cuts in 2024. That would have taken the Fed from its current policy range of 5.25-5.50%, which has been in place since July 2023, down to 3.75-4.00%. Today, nearly all of those rate cut expectations have been repriced and the market currently anticipates only one cut, implying a year-end 2024 policy rate range of 5.00-5.25%.

The Federal Reserve updated its 2024 forecasts as well. At its March 20, 2024 meeting, the FOMC released its first dot plot since December. In December, the median FOMC participant forecast a year-end Fed Funds target range of 4.50-4.75%. In March, that forecast remained steady, 4.50-4.75%, implying that participants still expected to deliver three quarter-point cuts yet this year. Bond investors beg to differ. The market now clearly expects the Fed to use upcoming meetings to communicate that it needs greater confidence that inflation will return to its 2% target before lowering policy rates. The next FOMC meeting is May 1 and we will receive updated economic forecasts at the June 12 meeting.

These changing expectations have impacted longer-term bonds as well. The 10 year treasury rate was 3.88% coming into 2024 and has moved significantly higher to 4.65% as of this writing. Faster growth and inflation can be welcome news to stock investors, but they tend to negatively impact fixed income investments. In the year-to-date period, 1-5 year US bonds have returned around -0.5%, 5-10 year US bonds have returned around -3.5%, and 10+ year US bonds have returned around -7.7%.

Looking beyond 2024, investors are pricing in a higher-for-longer outlook. Futures markets indicate that over the next 10 years, the lowest policy rates will go is around 4.00% in 2027. Options markets show a 25% chance that the next move will not be a cut, but a further increase in the Fed Funds rate.

Our view is that it is likelier-than not that at some point in the next 10 years, policy rates will be below today’s expectations. Expansions do not last forever. In only one out of the last eight Fed policy cycles dating back to 1974 did the Fed respond to a recession with fewer than 2% in interest rate cuts. The market is only pricing in 1.5% in cuts today. We cannot reliably time the next recession, but we can have reasonable confidence it will occur within the next decade. We are positioning portfolios accordingly.

We hope you are enjoying the change in seasons. As always, we look forward to sharing our views as we navigate the balance of 2024, and we encourage investors to lean on discipline and the benefit of a long time horizon during periods of uncertainty. On behalf of the entire team, thank you for allowing us to serve on your behalf.