May 16, 2023

April Retail Sales - YoY Deceleration Continues

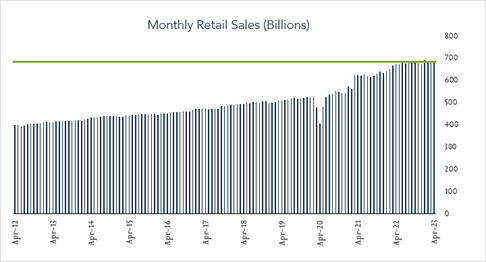

U.S. retail sales increased less than expected month-over-month and decelerated further on a year-over-year basis. In real terms, retail spending was unchanged compared to March and down 3.3% year-over-year. Monthly data helps to highlight current trends, however we focus more closely on year-over-year results as a recession indicator. Real (inflation adjusted) declines in retail spending can indicate increased recession risk as the consumer represents the lion’s share of the U.S. economy. Over the last six months, we have seen real five instances of year-over-year declines averaging -1.6%. Today’s result (-3.3% YoY) marks further deceleration from a March reading of -2.6% adding to evidence that momentum is slowing in household spending and the broader economy as inflation persists and monetary policy continues to tighten.

- Real (inflation adjusted) retail sales down 3.3% year-over-year. In April, retail sales grew 1.6% nominally and declined 3.3% after adjusting for 4.9% inflation. Today’s result marked further deceleration from a real decline of 2.6% in March. Higher spending on restaurants (+12.4%), health and personal care stores (+8.1%), and non-store retailers (+8.0%) was partially offset by lower spending at gas stations (-9.9%) and electronics/appliance stores (-3.9%). Nine out of thirteen categories declined in real terms.

- Real (inflation adjusted) retail sales unchanged month-over-month. In April, retail sales levels increased 0.4% compared to March (consensus +0.8%) netting no change in real terms. Growth at miscellaneous store retailers (+2.4%) and nonstore retailers (+1.2%) was offset by declines at sporting goods stores (-3.3%) and gas stations (-0.8%). Seven of thirteen categories declined in real terms last month.