May 15, 2025

April Retail Sales - Spending Pull Forward Continues

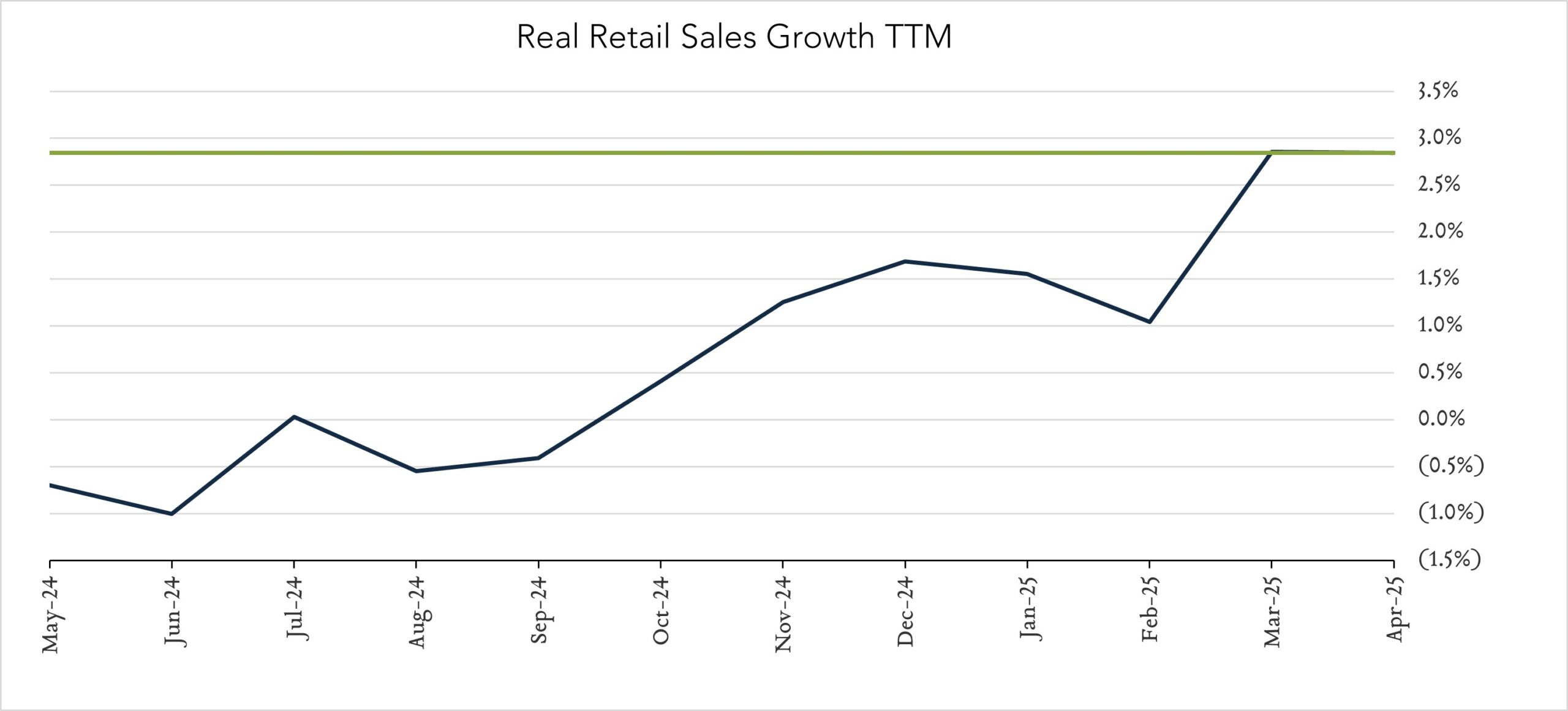

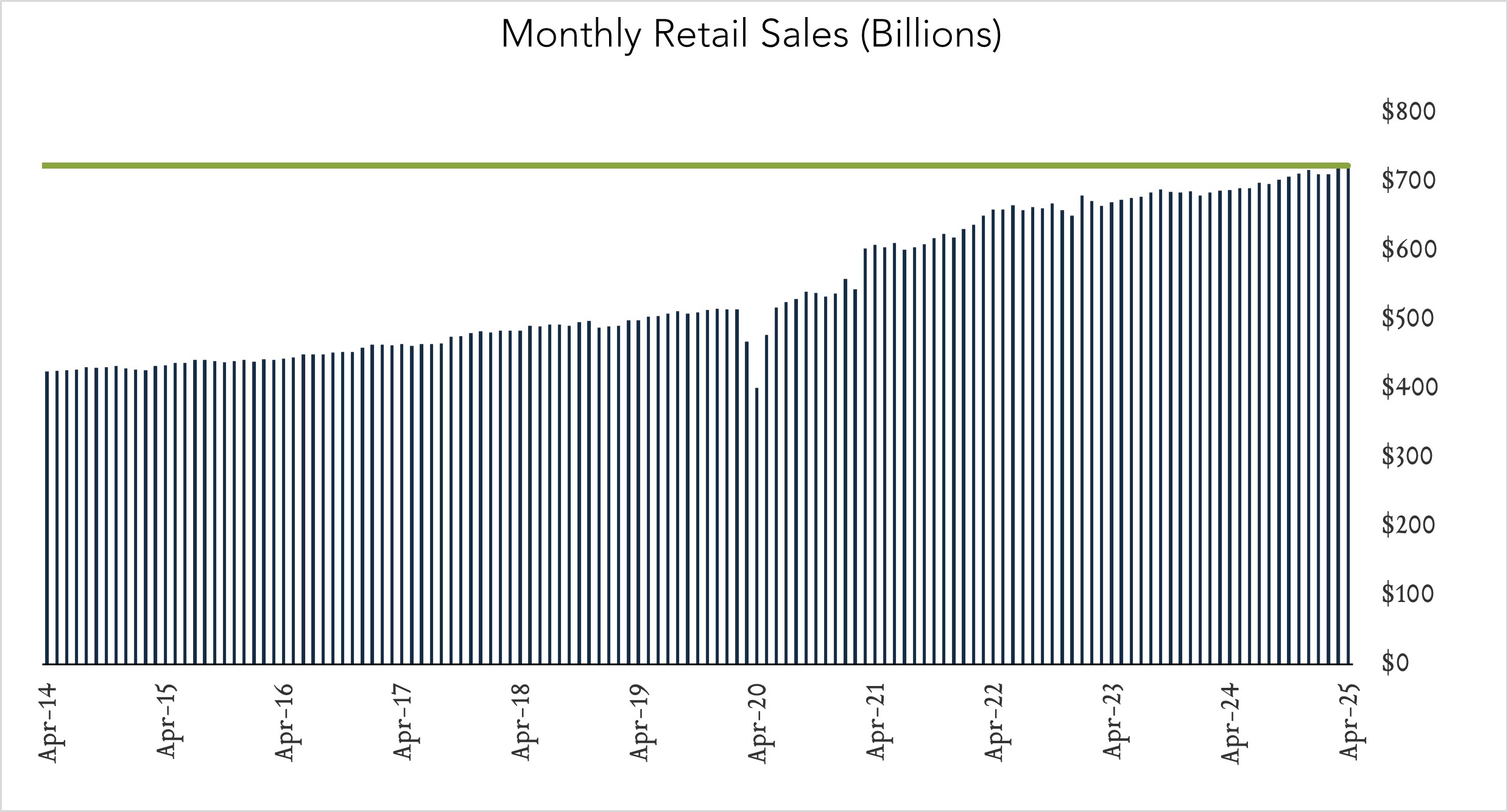

In nominal terms, U.S. retail sales advanced 0.1% month-over-month and 5.2% year-over-year. Adjusting for inflation, spending retreated 0.1% month-over-month but increased 2.9% year-over-year. Following two months of moderating outlays to start the year, April numbers suggest consumers continued the March trend of elevated spending on cars and other high-ticket items in an effort to lock in prices amid ongoing tariff uncertainty. While recent trade policy headlines have been favorable, the eventual breadth and severity of tariffs remains highly uncertain and has weighed heavily on consumer and business sentiment in recent weeks. Elevated spending in March and April could be followed by more subdued spending regardless of how the tariff narrative evolves.

- Real (inflation adjusted) retail sales advanced 2.8% year-over-year. In April, retail sales grew 5.2% nominally netting growth of 2.9% after adjusting for 2.3% inflation. Higher spending on motor vehicles (+9.4%) as well as restaurant dining (+7.8%) and online retail (+7.5%) was partially offset by a declines at the pump (-6.8%). Eight of thirteen categories advanced in real terms.

- Real (inflation adjusted) retail sales declined 0.1% month-over-month. In April, nominal retail sales levels grew 0.1% compared to March, topping forecasts for 0.0% growth but netting a 0.1% decline after adjusting for 0.2% inflation in the month. Higher spending on restaurant dining (+1.2%) and online retail (+0.2%) was partially offset by declines at the pump (-0.5%). Spending on motor vehicles remained elevated but declined 0.1% compared to March. Four of thirteen categories advanced in real terms.