May 5, 2023

April Jobs - Job Gains and Wage Growth Signal Resilience

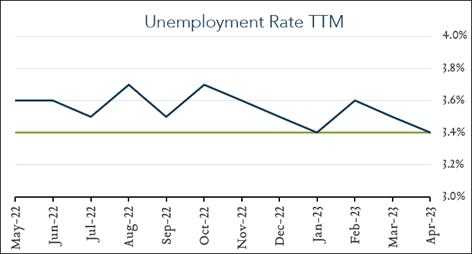

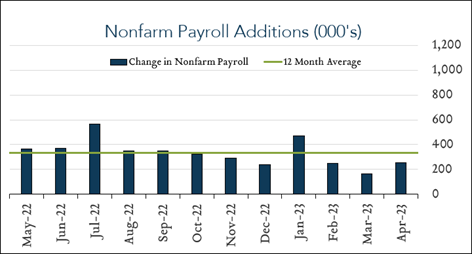

Hiring and wage gains accelerated in April complicating calculus for policymakers. The U.S. labor market added 253K jobs in April after a downwardly revised 165K in March and the unemployment rate fell back to a multi-decade low of 3.4%. Meanwhile, average hourly earnings increased 0.5% month-over-month, up from 0.3% in March. Today’s report highlights a resilient demand for labor despite broader economic headwinds. While there are indications that the labor market is coming more into balance (job postings declining, layoff announcements etc.) it remains extremely tight today. In conjunction with a tenth, and possibly final, Fed rate increase announced Wednesday, policymakers stated that achievement of the FOMC’s 2% inflation target would require a period of below-trend growth and softer labor market conditions, including an easing of wage gains. That was not the read on today’s report.

- 253K jobs added in April – above expectations. The U.S. labor market added 253K jobs in April compared to forecasts ranging from +125K to +270K with a median of +185K. The March outcome (+236K) was revised sharply lower to +165K. Job gains were broad-based with notable additions in professional & business services (+43K), health care (+40K), and leisure & hospitality (+31K). Employment showed little change in other major industries.

- 3.4% unemployment – remains historically low. The U.S. unemployment rate fell slightly to 3.4% from 3.5% a month ago. Forecasts ranged from 3.4% to 3.6% with a median of 3.6%. The labor force participation rate was unchanged at 62.6% – matching the highest level since March 2020. Wage growth rebounded with hourly earnings up 4.4% over the last year (above expectations of +4.2%; up from +4.3% in March) and 0.5% month-over-month (above expectations of +0.3%; up from +0.3% in March).