May 15, 2024

April Inflation - Indications of Cooling?

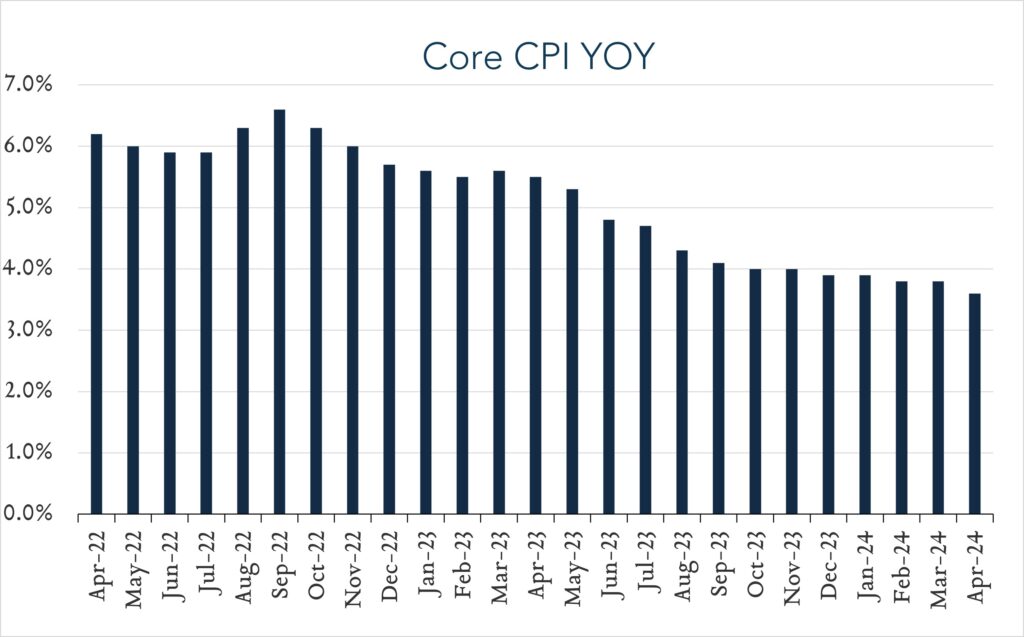

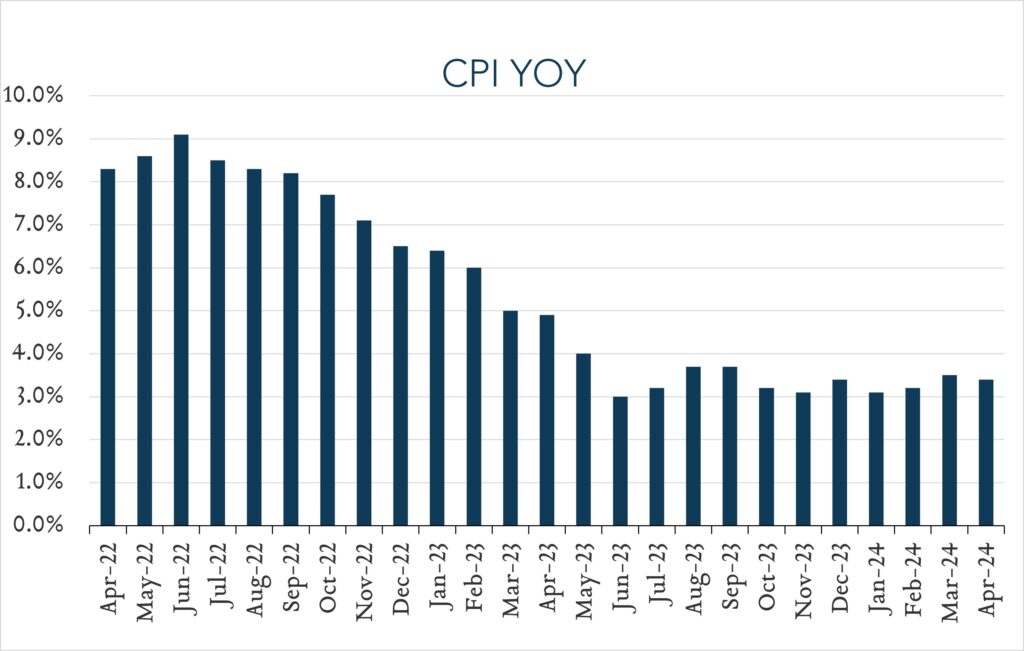

Year-over-year, inflation rose 3.4% in April, down 0.1% compared to march and in line with expectations. Month-over-month, prices increased +0.3%, down from 0.4% in March and 0.1% below expectations. Importantly, Core CPI (excludes food and energy) decelerated for the first time in six months, a possible indication that persistent price pressures are gradually subsiding. While Fed projections (provided in March) call for three 0.25% rate cuts this year, commentary out of the most recent FOMC meeting indicated the prospect for cuts would be based on incoming data that either supports higher confidence that inflation is decelerating or highlights unexpected weakness in the economy. Today’s report, coupled with softer April jobs data and flattening retail spending likely tilts the calculus in favor of more accommodation from the Fed. Following the report, investors repriced expectations to reflect two cuts in 2024, up from one to two cuts previously.

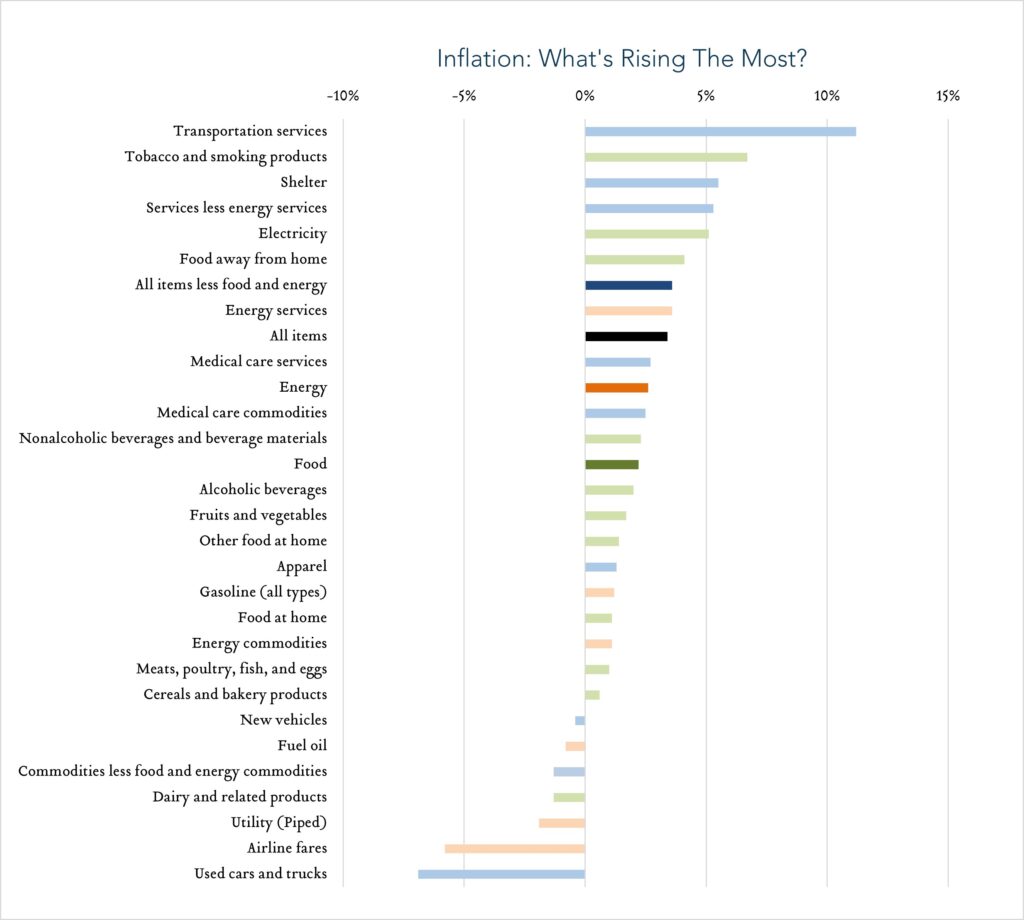

- Consumer prices (CPI) increased 3.4% year-over-year. In April, the consumer price index (CPI) increased 3.4%, down from 3.5% in March and in line with expectations. Transportation services (+11.2%) and shelter (+5.5%) were key contributors to the overall increase, more than offsetting declines for used vehicles (-6.9%) and slower growth for food (+2.2%) and energy (+2.6%). We continue to keep a close eye on shelter costs, which represent nearly one third of the consumer price index and tend to impact the index with a lag. At +5.5% year-over-year, shelter costs decelerated 0.2% from March and are down from a peak of 8.2% in March 2023. Core CPI (excludes food and energy) increased 3.6% year-over-year, decelerating from 3.8% in March.

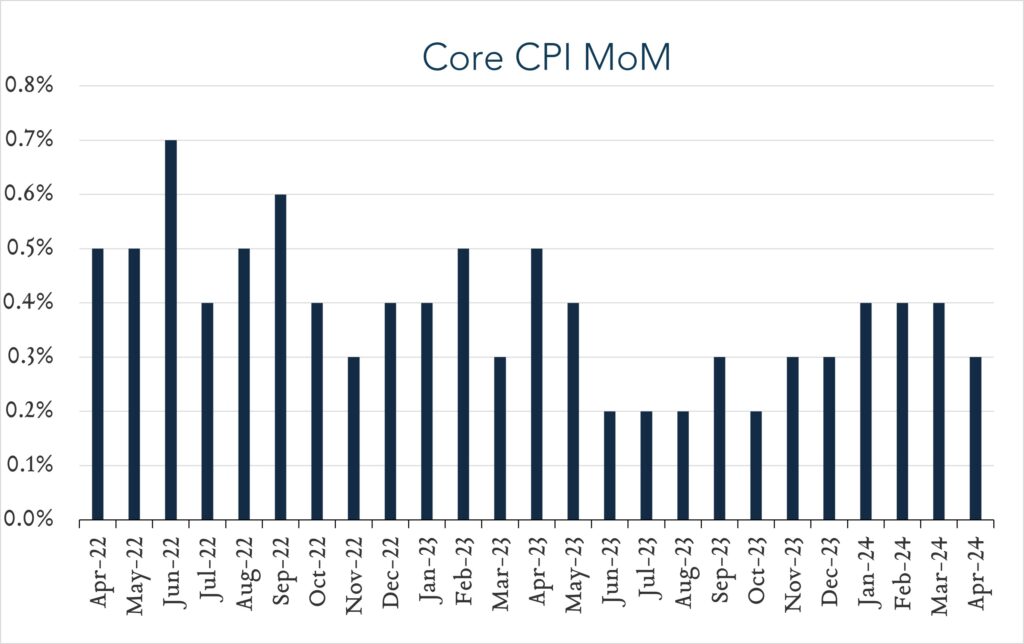

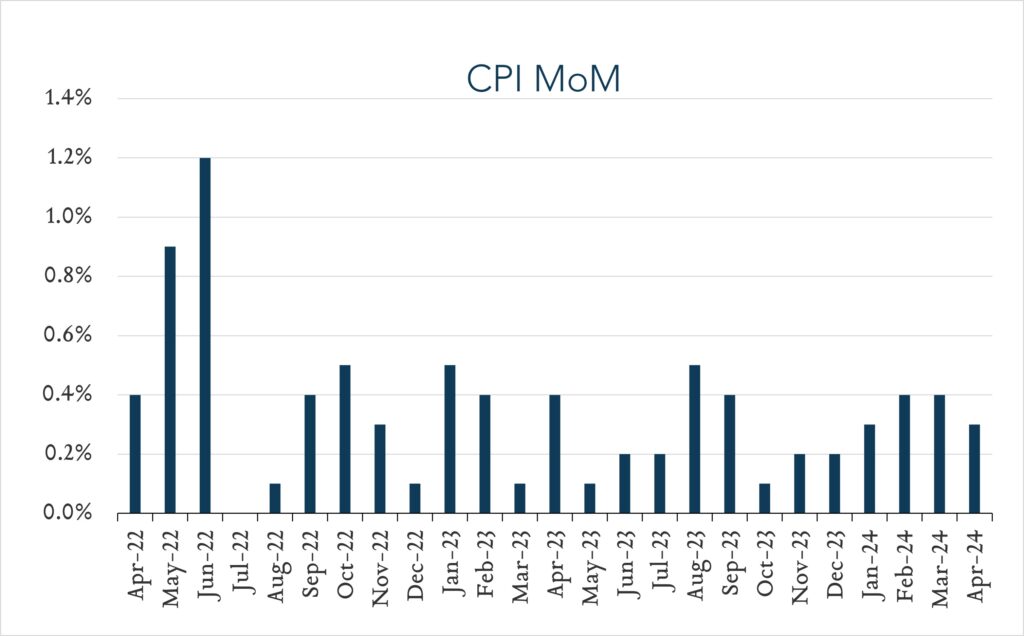

- Consumer prices (CPI) increased 0.3% month-over-month. In April, consumer prices increased 0.3%, down from 0.4% in March. Expectations ranged from +0.3% to +0.5% with a median of +0.4%. Shelter costs increased 0.4% for the month while energy prices rose 1.1% – both consistent with the prior month. Core CPI (excludes food and energy) also increased 0.3% month-over-month, down from 0.4% in March and in line with expectations.