May 13, 2025

April Inflation - Below Forecast For a Third Month

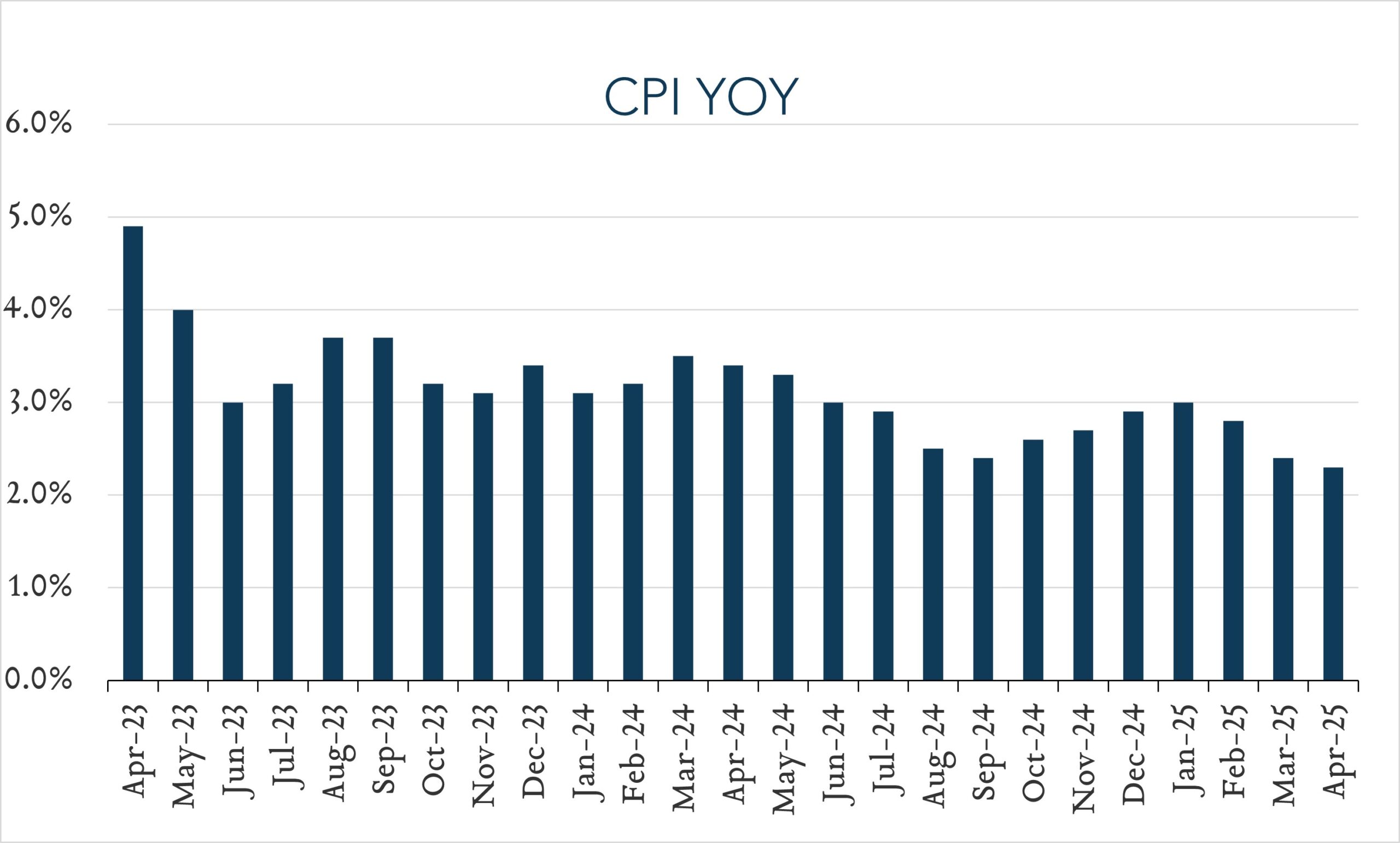

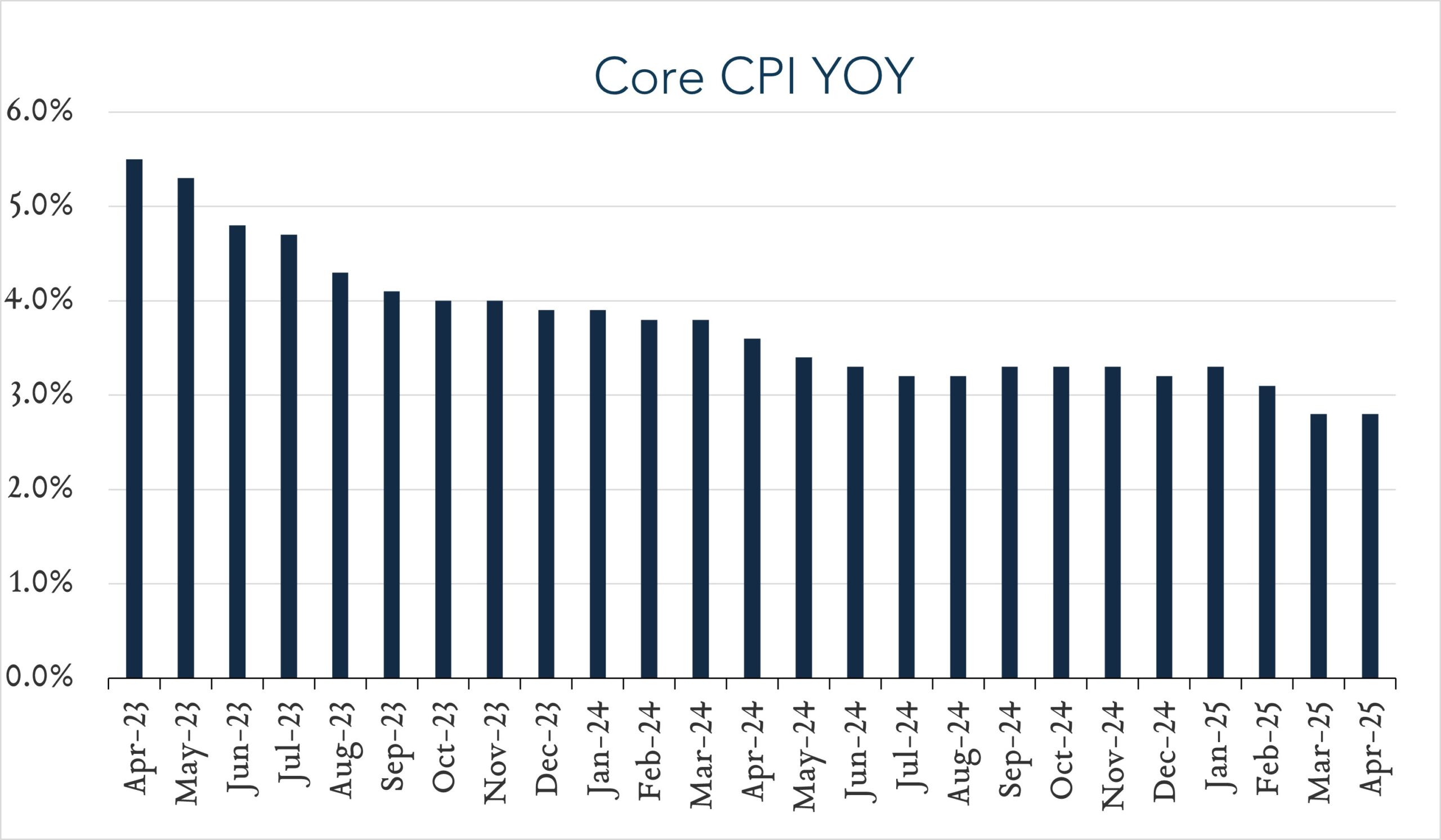

In April, consumer prices as measured by CPI, rose 2.3% compared to a year ago, down from 2.4% in March and below expectations for the same. Core CPI (excludes volatile food and energy prices) rose 2.8%, consistent with the March result and in line with forecasts. Today’s report indicates a continued degree of relief after months of stalling progress on inflation, however, it likely does not fully reflect price increases that may result from ongoing trade policy discussions. Looking forward and based on the current policy path, prices in key sectors are likely to experience a period of transitory inflation amid price increases on a variety of goods from food to clothing to automobiles. For its part, the Federal Reserve remains in wait and see mode until there is more clarity on the Trump administration’s policy agenda and the trajectory of inflation.

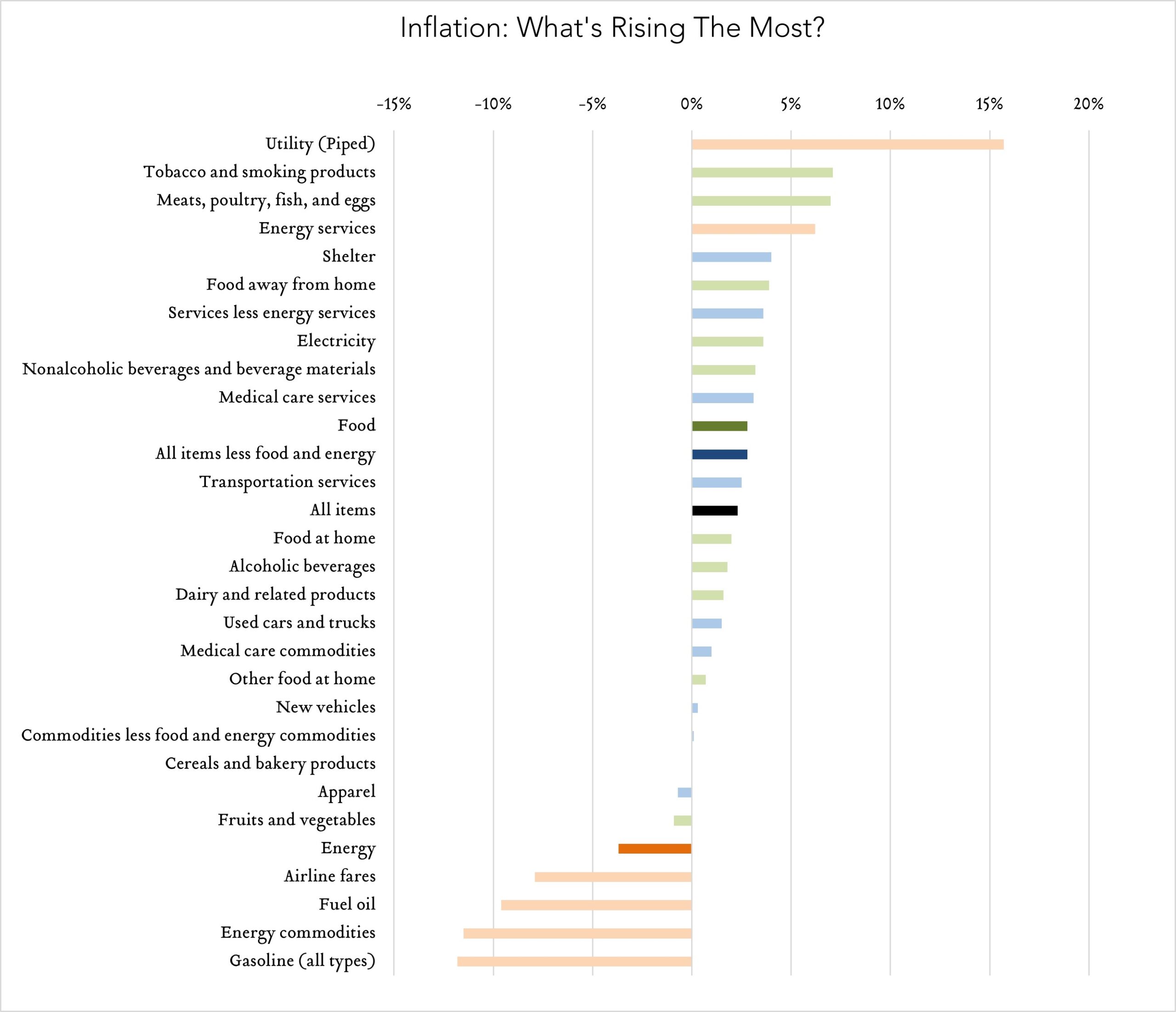

- Consumer prices (CPI) increased 2.3% year-over-year. In April, the consumer price index (CPI) increased 2.3% – below expectations for 2.4% and down from 2.4% in March. The cost of food (+2.8%) and shelter (+4.0%) were key contributors to the overall increase, more than offsetting declines in gasoline (-11.8%). We continue to keep a close eye on shelter costs, which represent nearly one third of the consumer price index and tend to impact the index with a lag. At +4.0% year-over-year, shelter inflation was unchanged from March 2025, but down from a peak of 8.2% in March 2023. Core CPI (excludes food and energy) increased 2.8% year-over-year, unchanged from March and in line with expectations. This is the lowest reading since March 2021.

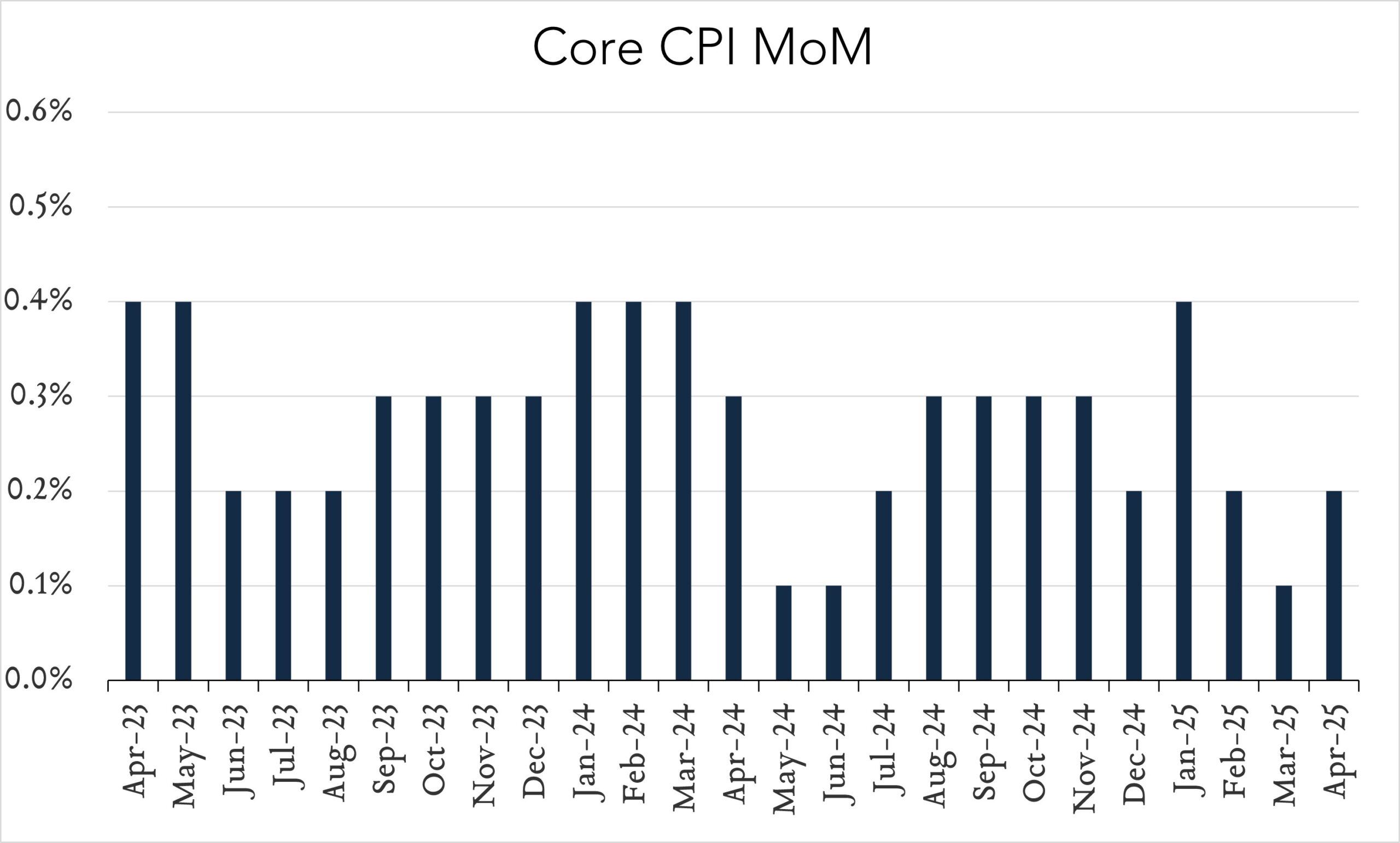

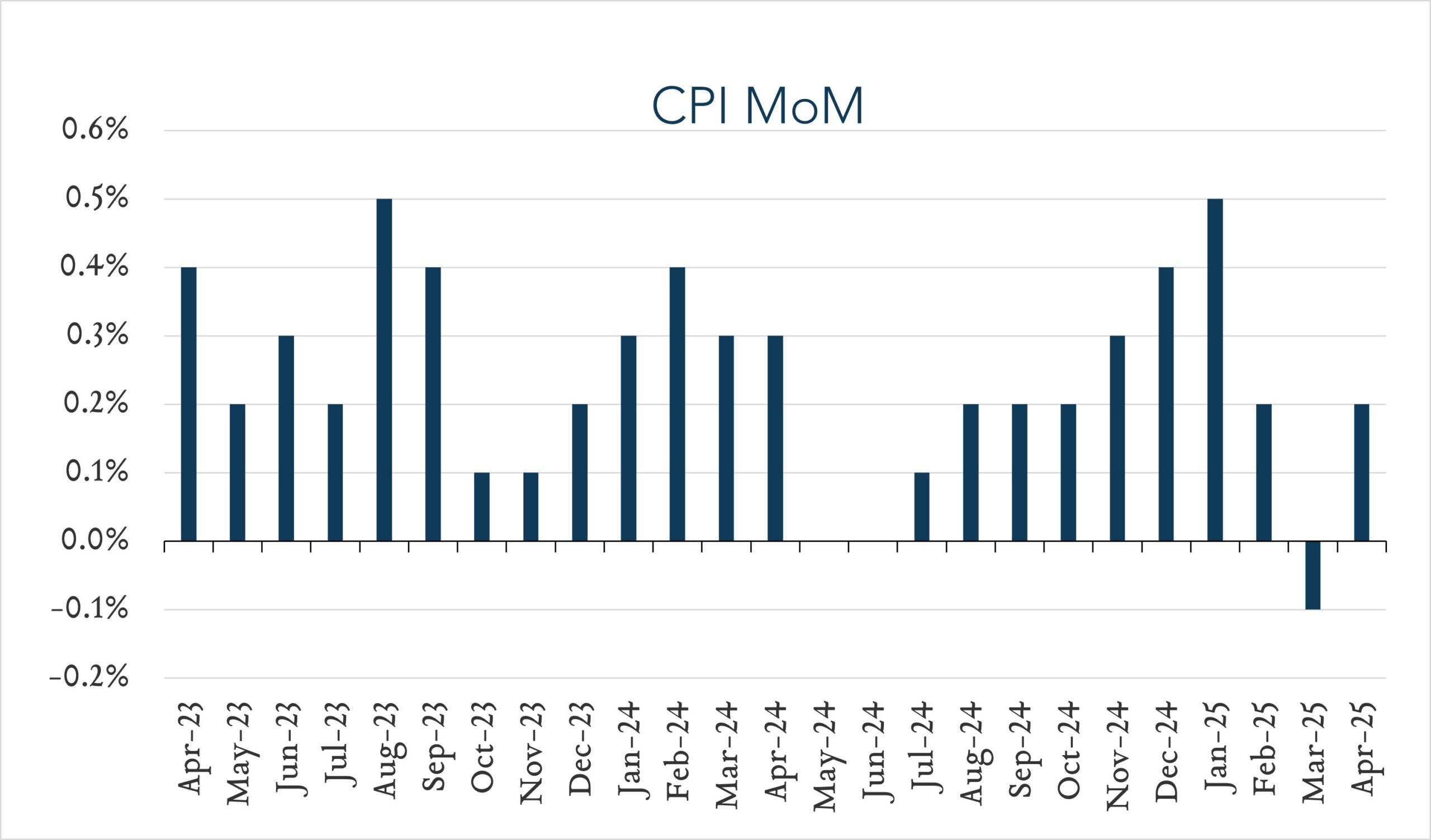

- Consumer prices (CPI) rose 0.2% month-over-month. In April, consumer prices rose 0.2% month-over-month up from -0.1% in March but below expectations for +0.3%. Core CPI (excludes food and energy) also increased 0.2% month-over-month, up from 0.2% in March but below expectations for +0.3%.