July 9, 2024

All From One or Some From All

Every person coming into retirement has struggled with the shift in mindset from work income to income from retirement assets. While this shift can be taxing, deciding which account(s) to withdraw from and when to withdraw from them can also be taxing. Up until retirement, focus is mostly on saving; meeting with advisors to determine what accounts to use and when to save in those accounts to get to your retirement goals. This can lead to a combination of taxable, tax-deferred, and tax-exempt accounts. Examples of the different accounts are shown below. How many different types of accounts you have can make the decision of what accounts to withdraw from and when to withdraw a little more complicated. The goal, when making withdrawals, is to maximize your income and minimize your taxes throughout retirement.

Investment accounts fall into three main tax categories:

- Taxable accounts – These are standard or non-retirement investment accounts. They are funded with after-tax money. Taxes are paid annually on realized capital gains and on any income that is generated by assets within the account.

- Tax-deferred accounts – Retirement accounts like a traditional IRA, 401(k), 403(b), TSP, SEP, and Simple IRA. They are funded with pre-tax money. Since the money isn’t taxed when contributions are made, taxes are owed when withdrawals are taken. The full amount of the withdrawal is generally taxed as ordinary income.

- Tax-exempt accounts – Retirement accounts like a Roth IRA or Roth 401(k). They are funded with after-tax money. Since the money is taxed before contributions are made, taxes are not owed when withdrawals are taken.

So, when making withdrawals, do you take it all from one or some from all? Maybe some sort of combination of withdrawals? Decisions about which account and how much can have an impact on the amount of taxes you will pay and also the sustainability of assets. An article I read said, “Taking retirement income from your investment portfolio in retirement is like walking through a minefield.” I think that’s a bit dramatic. Maybe more like the difference between walking through Edison and Ford Winter Estates and the Betty Ford Alpine Gardens. Both are spectacular, but the amount and size of the blooms afforded may differ depending on where and when you visit. As long as you stop and smell the roses, you’re doing great!

There are different withdrawal strategies that should be considered when taking income from investments in retirement. Since no single withdrawal strategy is best for everyone, it is worth evaluating the different options. With any strategy, there is a trade-off between tax-deferred growth and future tax liabilities. The following are three different strategies to evaluate.

Traditional or Standard Withdrawal Strategy

This strategy draws down taxable accounts first, then tax-deferred accounts, and finally tax-exempt accounts. This strategy is implemented to maximize the tax-deferred growth.

Proportional or Pro Rata Withdrawal Strategy

This strategy draws proportionally from taxable accounts and tax-deferred accounts first, then from Roth accounts. This rules-based strategy is easy to implement and may help to manage current and future tax brackets. It works best and can make sense as a simple approach with larger tax-deferred accounts and smaller taxable accounts.

Personalized or Tailored Withdrawal Strategy

This dynamic strategy takes withdrawals in a way that can help to control the income tax bracket you are in. There are different ways to take withdrawals and different reasons to do so. A personalized strategy that is being used more often is taking withdrawals from tax-deferred accounts, before Required Minimum Distributions (RMDs) begin; up to the amount where any additional distribution would push income into a higher tax bracket. Other reasons for tailoring a withdrawal strategy include having highly appreciated assets or larger, one-off, expenses that would push income into a higher tax bracket in any given year.

If all the investment accounts are in the same category, then all withdrawals are taxed the same way. If you have more than one type, then a withdraw strategy should be determined and discussed on an annual basis with your advisors. Just like anything with taxes, withdrawal strategies have several exceptions to consider.

The traditional strategy allows for current taxes to be lower in the beginning years of retirement, postponing as much tax as possible. Once the taxable accounts are depleted and money is then withdrawn from the tax-deferred accounts, some of the income taken will likely fall into a higher income tax bracket. Also, since the tax-deferred accounts were undisturbed and allowed to continue to grow, there is a chance the RMD will be more than is needed for income in any given year and therefore paying more than is needed in taxes. Analysis shows that leveling out taxes and staying in lower income tax brackets throughout retirement can potentially help with lowering overall taxes and improving portfolio sustainability.

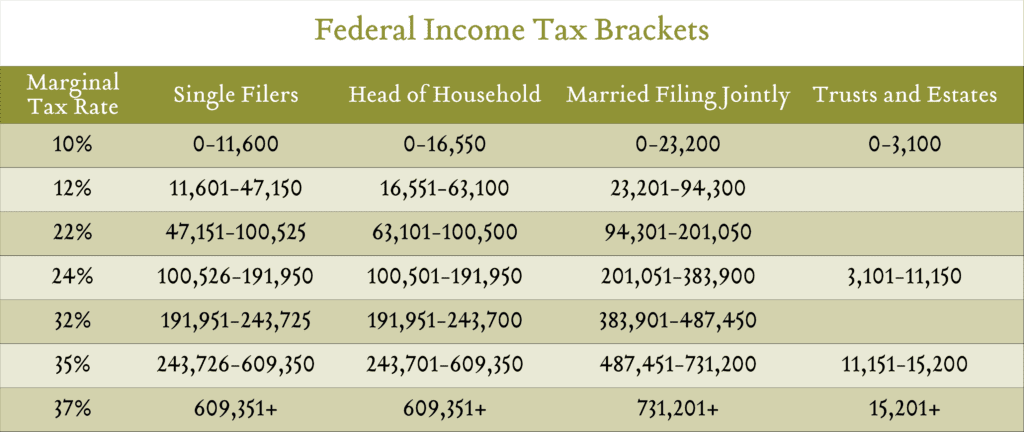

If withdrawals for retirement income are made from tax-deferred accounts as well as taxable accounts, until RMDs begin, the first thing to consider is what tax bracket to stay in makes the most sense. The level of income depends on different circumstances, which is part of any withdrawal strategy analysis. If the 12% bracket is considered, then joint filers can receive income up to $94,300 and individuals up to $47,150.

One reason this strategy is being utilized more is because the SECURE 2.0 Act raised the age account owners need to begin taking RMDs to 73. This provides a greater opportunity to spread out taxes and reduce future RMDs by reducing account balances. Withdrawing funds in a low tax bracket until RMDs begin allows you to take less income in higher brackets later in life. Withdrawing funds within slightly higher tax brackets can also prove beneficial. Withdrawals from tax-deferred accounts can be used as income or converted into Roth IRAs. Roth conversions allow you to move money out of a traditional IRA and into a Roth IRA. Taxes are owed on the amount converted but then they grow tax-free. This can be especially useful in a year where income is unusually low, perhaps in a year when larger charitable donations are made, i.e., funding a donor advised fund.

Another strategy that can be paired with this is a Social Security optimization strategy. There are many reasons for taking Social Security benefits earlier or later, but delaying benefits until age 70 could allow for the reduction of tax-deferred accounts even more and allow Social Security benefits to increase. Another reason to try to keep RMDs lower is the Medicare income-related monthly adjustment amount (IRMAA). Medicare Part B and Part D premiums are based on modified adjusted gross income (MAGI) from two years ago. For instance, the Part B monthly premium adjustment for 2024, which is added to the base Part B premium of $174.70, goes from $69.90 per month to $174.70 at the 2022 MAGI of $129,000.01 for individuals and $258,000.01 for joint filers. So, the total Part B premium for 2024 would go from $244.60 ($174.70 + $69.90) to $349.40 ($174.70 + $174.70) per insured individual.

Yet another reason for using a tailored strategy includes having highly appreciated assets in taxable accounts. If you are planning on leaving money to others after you pass, you might consider not selling them for income but rather taking income from tax-deferred or tax-free accounts. The assets receive a step up on the cost basis meaning the cost gets a reset to the value at your passing and the capital gains taxes that the inheritor would have had to pay from selling go away. This can be substantial, depending on how much assets have appreciated.

So, we have considered a few withdrawal strategies for those who pay substantial taxes in retirement. In general, after satisfying any RMDs, you should withdraw funds from taxable accounts before retirement accounts. However, before RMDs begin, you should consider withdrawing sufficient funds from tax-deferred accounts to fully use lower tax brackets.

The “best” strategy for withdrawing funds from tax-deferred and tax-exempt depends upon uncertain factors such as lifespan, future health, the account owner’s and beneficiary’s future tax rates, and whether any funds will be left to a charity. Nevertheless, knowledge of the key factors should help us develop an informed and appropriate withdrawal strategy. The client centric team at Greenleaf Trust is ready to run any analysis or answer any questions you may have.