July 7, 2025

2025 Mid-Year Update

The first half of 2025 was a volatile period characterized by economic and geopolitical uncertainty. However, if you closed your eyes on the first of January and reopened them on the first of July, you would probably be pretty pleased with your portfolio. Expectations for 2025 have shifted, but not to the extent one might imagine. Meanwhile, a moderating but solid labor market and stalled progress on inflation have created a challenging environment for Fed policymakers. Looking ahead to the second half of the year, trade and monetary policy decisions are likely to remain centerstage.

A Bumpy Ride

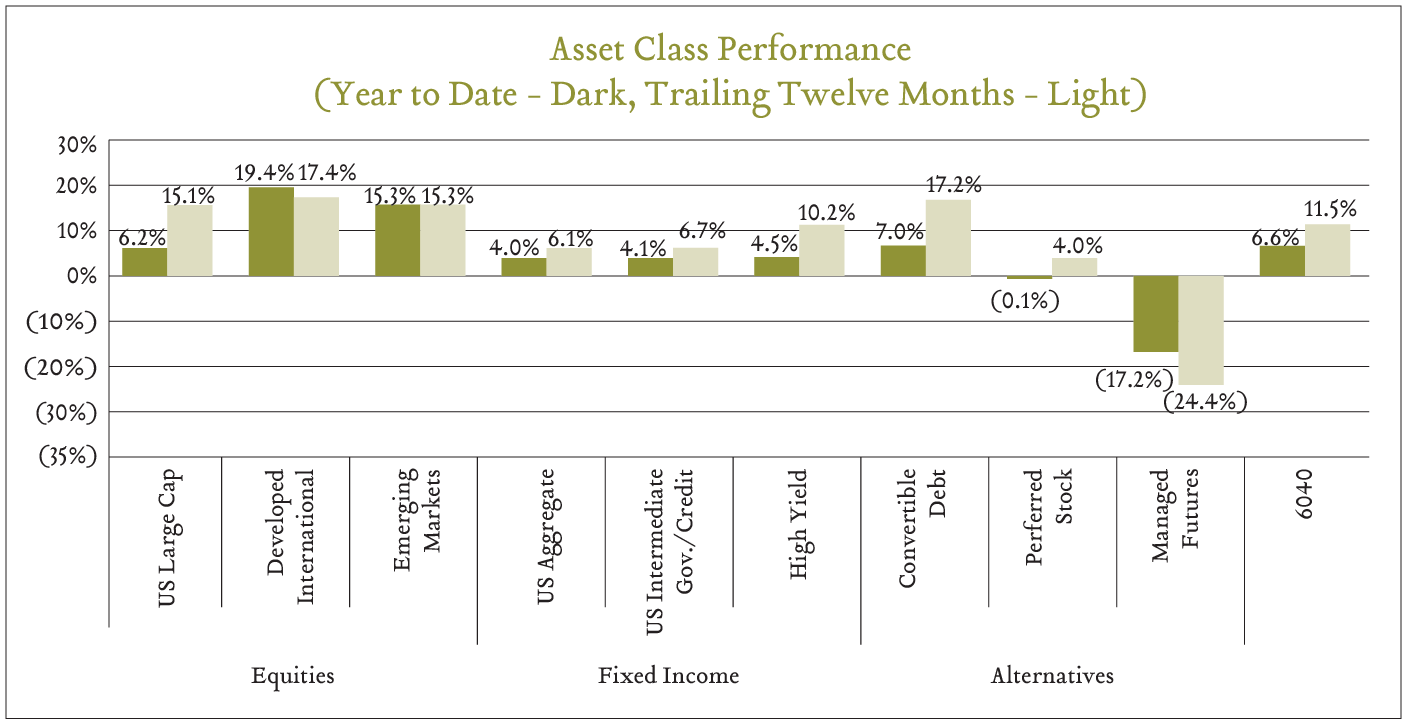

Year-to-date, global equities are up more than 10%. Domestic large caps are up 6.2%, while developed international and emerging market stocks have fared better generating returns of 19.4% and 15.3%, respectively. These results came in spite of a near-20% drawdown for the S&P 500 between February 19th and April 8th. At the same time, core bonds are up 4.1% as the 10-year Treasury yield has fallen to 4.23% compared to 4.57% starting the year. Even a balanced portfolio comprised of 60% stocks and 40% bonds is up 6.6% in the first six months of the year. Markets have proven resilient in the face of uncertainty.

Labor Market Resilience

Despite tariff uncertainty and a less-than-stable economic outlook, companies have continued hiring at a pace that roughly matches expectations coming into the year. Monthly job gains through May have averaged 124K in 2025 compared to expectations for 121K per month when the year began and compared to average gains of +150K over the prior 12 months. More importantly, the ratio of job openings per unemployed worker now stands at 1:1, down from a peak of 2:1, indicating that the labor market is in a place of balance. Over the last twelve months, the unemployment rate has been rangebound between 4.0% and 4.2% – quite low by historical standards.

Inflation: Coming or Going?

Despite a gradually cooling labor market and growing concerns about tariffs driving up the costs of goods, inflation, as measured by yearly changes in the Consumer Price Index (CPI), has continued to trend downward. In May, consumer prices rose 2.4% compared to a year ago, indicating that companies have found ways to limit how much of the tariff-related expenses are being passed through to consumers. Entering the year, forecasters anticipated inflation would be 2.5% in 2025. Again, expectations and reality are surprisingly close to one another. Looking forward, we see risk to the upside depending on how trade policy evolves.

A Conflicted Fed

The developments of 2025 have put the Federal Reserve in an unenvious position. On the one hand, the Fed faces a political regime that wants to see rates lowered to spur economic growth and lower debt servicing costs. On the other hand, inflation remains slightly above the Fed’s 2% target and the net impact of fiscal and trade policy changes is expected to be inflationary.

The Fed is charged with maintaining a very delicate balance with a very blunt set of tools. The goal of restrictive monetary policy is to gradually slow economic activity to bring inflation back to targeted levels without slowing it enough to impair the labor market or risk sending the economy into a recession. Entering the year, market participants priced in one-to-two quarter point rate cuts in 2025. Through the first half of the year, there have been no cuts, however, the markets continue to price in two cuts to take place in the second half of 2025. Again, despite numerous unforeseen market events, the reality on the ground six months into the year is generally in line with expectations at the beginning of the year. With the effects of tariffs and increased costs associated with geopolitical unrest not yet fully realized, the Fed is likely going to stay on the sidelines until they have more clarity on the trajectory of the labor market and inflation.

Growth Missteps and Tepid Earnings Expectations

To begin the year, corporate earnings and real growth were expected to remain strong – both have received haircuts. Corporate earnings growth for 2025 was expected to come in at 14.1%, a high bar in any market environment. Through the first half of the year expectations have been reigned in, with the market now pricing in earnings growth of just shy of 10% – reflecting base effects of stronger-than-expected earnings in 2024 and modest revisions to 2025 expectations. Similarly, real growth expectations, as measured by inflation-adjusted GDP, has gone from 2.1% to start the year to 1.4% today. Trade policy uncertainty drove a negative GDP print in the first quarter as corporations pulled forward imports in anticipation of higher tariffs. Looking to the second half, tariff negotiations, the situation in the Middle East, and the final version of the federal budget bill are likely to shape the outlook

Looking Forward – Capital Market Assumptions

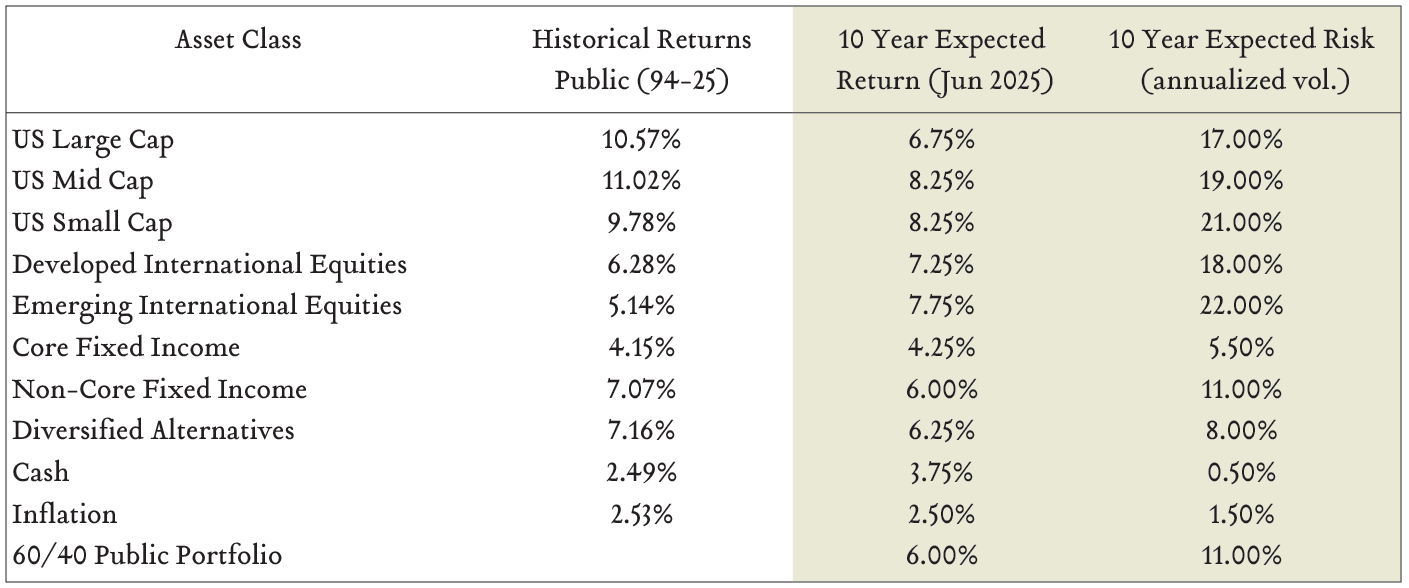

As for the market experience going forward, we share our updated capital market assumptions below. These forecasts represent our expectations for average annualized returns for each asset class over the next ten years. Over the next decade, there will be years when returns exceed our expectations and years when returns trail our expectations. We believe short-term market-timing strategies are unlikely to improve long-term outcomes.

We continue to recommend most of our clients hold a full weight to global equities in accordance with their individualized risk profile and we remain marginally more constructive on U.S. small- and mid-cap equities. Concurrently, in this volatile environment, we are utilizing diversifying strategies (alternative assets) that can access return drivers uncorrelated with traditional stock and bond markets.

Despite an ever-changing landscape, our disciplined approach and long-term orientation serve us well as we endeavor to create comprehensive investment solutions that help our clients reach their financial goals. On behalf of the entire team, thank you for allowing us to serve on your behalf and good luck in the second half of the year.