January 4, 2024

2023 Review and 2024 Outlook

Happy New Year! While 2023 did not lack for drama, it was also a positive year for the economy and markets. After a painful 2022, last year was a welcome period of recovery that exceeded expectations. Think about it: inflation decelerated, the labor market held up, consumers continued to spend, we didn’t have a recession, and market performance was strong.

That’s a whole lot better than most were anticipating at the start of the year and downright remarkable considering some of the risks that emerged throughout the year. In this article, we will look back on the events that shaped 2023 and provide some context for what 2024 may offer.

Market Strength

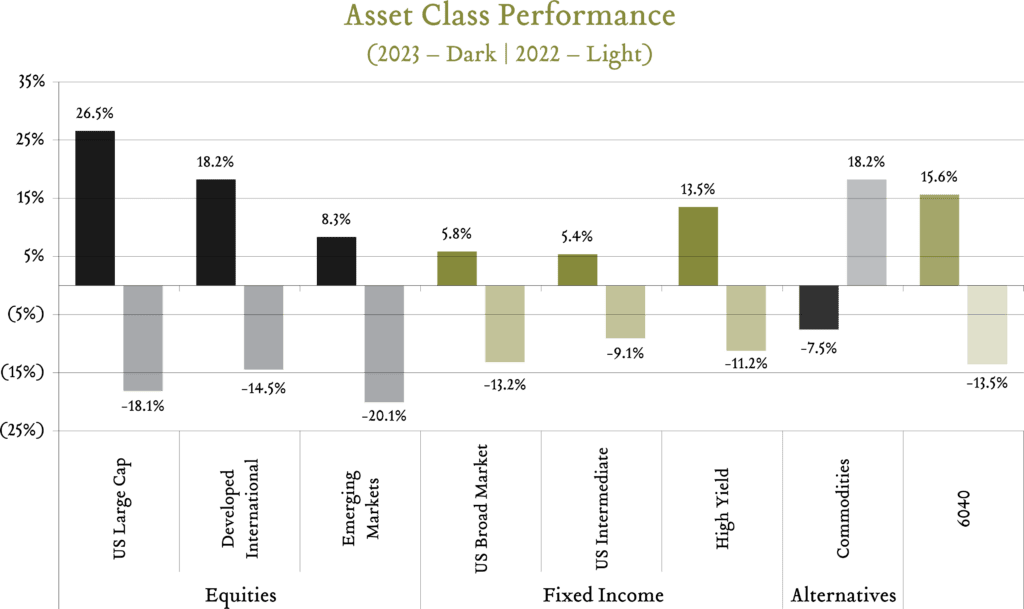

In 2023, global equities gained 22.9%. Domestic large caps added 26.5%, while developed international and emerging market stocks rose 18.2% and 8.3%, respectively. At the same time, fixed income categories returned 5.4% to 13.5% as interest rate expectations moderated. Even a balanced portfolio composed of 60% stocks and 40% bonds gained nearly 16% last year. All of these outcomes were in stark contrast to 2022.

Risky Business

In 2022, economists dramatically ratcheted up their expectations for a recession in 2023, assigning a 65% probability by the time the year began. Forecasters were considering a range of risks including intensifying geopolitical tensions, a potential US debt default, and tightening monetary policy among others. As 2023 unfolded, several other challenges and risks emerged including regional bank failures in the first half of the year, rising oil and gas prices, the UAW strike, resuming student loan payments, and the possibility of a government shutdown in the second half of the year. Unlike in 2022, when it seemed like every risk was breaking bad, the economic threats that arose in 2023 seemed to break favorably one by one. As a result, the gloomy initial predictions were proven wrong, and the US economy not only avoided a recession but achieved healthy real GDP growth in the range of 2.4-2.7%.

Inflation Remediation

In December 2022, consumer prices, as measured by the Consumer Price Index (CPI), were rising at an annual rate of 6.5%. This was a notable improvement from the peak pace of 9.1% six months earlier, but still much faster than the Fed (not to mention the American consumer) was comfortable with. Amid rapidly tightening monetary policy, inflation decelerated further throughout 2023 to 3.1% by November. Looking to 2024, forecasts indicate that inflation will inch closer to but not achieve the Fed’s 2% target, as the lagged effects of today’s restrictive policy impact the economy and labor market.

Gainfully Employed

Labor market resiliency was another surprise in 2023. Considering odds on expectations for a recession, one might have also expected a sharp rise in unemployment. The labor market did indeed moderate in 2023, but instead of laying off workers, employers took an initial step of reducing open positions – bringing the labor market closer to equilibrium. In 2023, US employers added an average of 232K jobs per month, moderating from the 2022 average of 399K per month. The overall unemployment rate occupied a narrow, and historically low, range of 3.4% to 3.9%, finishing the year at 3.7%. The ratio of job openings to unemployed workers declined to 1.5:1 from a peak of 2:1. In 2024, unemployment is expected to trend modestly higher as economic growth decelerates from 2023 levels.

Monetary Policy

Inflation decelerated significantly, and the labor market has softened without falling off of a cliff. While the monetary policymaking environment remains tenuous, these developments have been positive for the Fed. After raising interest rates by 4.25% in 2022, from 0.00%-0.25% to 4.25%-4.50%, policymakers continued to tighten in 2023, albeit at a more moderate pace. The FOMC implemented four additional rate hikes last year to bring policy rates to a peak range 5.25%-5.50% at the July meeting before pausing.

As of September, Fed officials anticipated one more hike in 2023 with cuts in 2024 bringing the policy range down to 5.25%-5.50% by year end. However, policymakers updated their forecasts at the December meeting, acknowledging that current policy rates were likely at or near peak levels, with cuts in 2024 bringing the range down to 4.50%-4.75% by year end. Financial markets rejoiced over the prospect for an accommodative shift in the year ahead, though economic data will continue to drive FOMC decision-making.

Flip a Coin

As of this writing, economists assign a 50% probability of a US recession in 2024. This implies that the likelihood of a recession in 2023 was judged to be higher than the odds of one emerging in 2024 and, as we’ve seen, that prediction did not materialize last year. Nevertheless, these odds remain historically elevated. Supposing these odds accurately capture the likelihood of a recession, several factors could influence the outcome.

First and foremost is the consumer. Today, consumers are gainfully employed and spending money on cars, online retail, and restaurants at rates that exceed the pre-COVID-19 trend. Household debt service ratios remain low and while credit card delinquencies have risen among younger borrowers, they remain below historical levels of concern. Consumer strength is tied to wages and the labor market, so anything that could cause a rapid deterioration therein poses a risk.

Monitoring the housing market will also be important, as it has proven unexpectedly resilient despite mortgage rates doubling in the last two years. The commercial real estate sector could also face challenges, particularly in the office segment.

Additionally, we will be looking for evidence of any deterioration in corporate earnings. While an earnings decline is a common recessionary dynamic, current forecasts call for double digit earnings growth in the year ahead.

While risks are elevated, we continue to believe the prospect of a recession-free 2024 is in the cards absent a significant misstep by the Fed or other exogenous economic shock. Even if we do experience a recession in 2024, clients are strongly encouraged not to make dramatic portfolio changes that are out of line with long-term investment objectives.

Election Year

I would be remiss not to mention the presidential election as part of the 2024 narrative. As a human being, I have political views, but in my role as Greenleaf’s Chief Investment Officer, I do not. Historically, presidential elections have had very little impact on the markets, which are predominantly driven by fundamentals such as corporate earnings, interest rates and other economic factors.

Further, making rash investment decisions based on campaign promises and policy proposals is not advisable. Even the leader of the free world is subject to checks and balances and the broader legislative process requiring congressional support and compromise, typically mitigating any dramatic effect of political changes on the market. The 2024 election will be dubbed “the most important” of our lifetime, just as its predecessors were. My advice is to vote with your ballot and not with your portfolio.

Looking Forward – Capital Market Assumptions

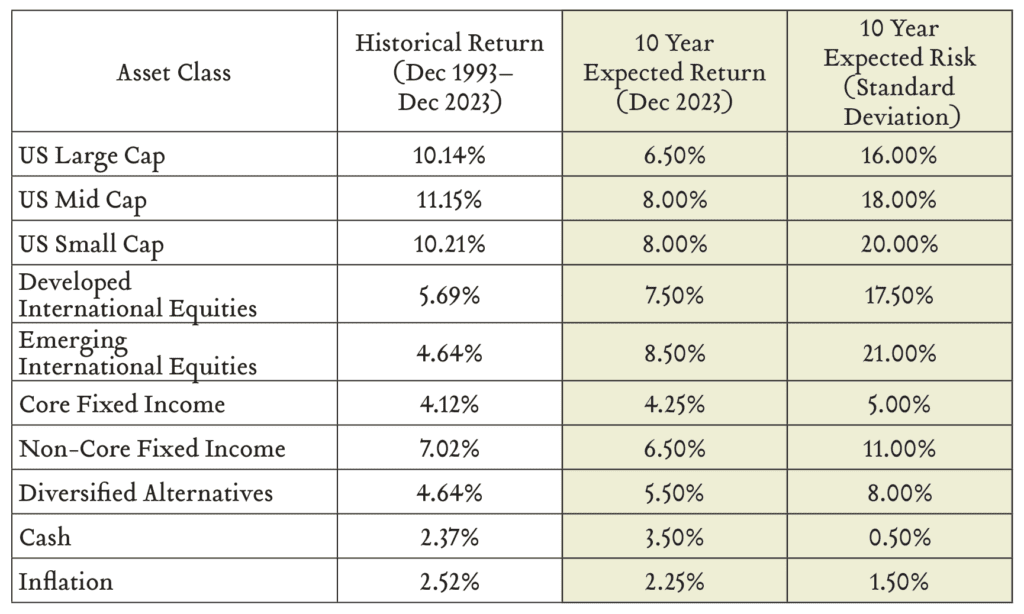

Over the long-term, the outlook for investment returns remains compelling. We share our updated capital market assumptions below. These forecasts represent the midpoint of our expectations for average annualized returns for each asset class over the next ten years.

Our long-term forecast for US large cap equities stands at 6.5% per year and our long-term forecast for core bonds stands at 4.25% per year. Further, we expect a balanced portfolio constructed with 60% global equities and 40% fixed income to return about 6.0% annually over the next ten years.

Over the next decade, there will be years where returns exceed our expectations and years where returns trail our expectations. We believe short-term market-timing strategies are unlikely to improve long-term outcomes.

Despite an ever-changing landscape, our disciplined approach and long-term orientation serve us well as we endeavor to create comprehensive investment solutions that help our clients reach their financial goals. Investment decisions are made in alignment with our documented investment philosophy and always with the intention of serving our clients’ best interests. Happy New Year and thank you from everyone on the investment research team for allowing us to serve on your behalf.