January 5, 2023

2022 Review and 2023 Outlook

Happy New Year! As we enter 2023, we celebrate our 25th year sitting on the same side of the desk as our clients. Our first quarter century has included bull markets and bear markets, a global pandemic, geopolitical conflicts, contested elections, asset bubbles and just about every type of challenge that might arise for investors.

Arguably, 2022 was one of the more challenging of the past 25 years. We experienced high inflation that extended throughout the economy and induced monetary policy surprises as central banks tightened in response. Russia’s invasion of Ukraine shocked commodity prices exacerbating inflationary pressures and accelerating monetary policy changes. As the year progressed, tighter policy caused activity in the housing market to slow dramatically and the combination of these factors significantly increased the likelihood of a recession. Relative to when the year began, all of these developments came as surprises.

Inflation

Entering 2022, market participants were pricing in CPI (consumer price index) inflation expectations of about 3.5–4.0%. CPI inflation swaps were priced at 3.7% while TIPS (Treasury Inflation Protected Securities) break-evens were priced at 3.5%. Economists at the Federal Reserve were projecting Core PCE (Personal Consumption Expenditures) inflation of 2.5–3.0% and the median economist on Bloomberg projected core PCE of 3.3% for 2022. Even though we experienced elevated inflation in 2021 market participants were projecting a relatively quick reversal, with the economy reverting to Fed targets in 2023.

So, what did everyone miss? One of the big inflationary surprises came in February, when Russia invaded Ukraine sparking turmoil in global commodity markets. Hindsight is 20/20, so if you are in the camp that says, “It was obvious Russia was going to invade and I knew inflation would be a continuing problem,” I would push back on the assertion. Markets were clearly not anticipating an invasion, and in order to trade around the event you would have needed to: 1) Forecast, out-of-consensus, that Russia would undertake the first armed invasion of a sovereign nation in Europe since WWII; 2) Ignore the emerging consensus expectation that Russia would be satisfied reclaiming limited territory in Eastern Ukraine, with intelligence reports suggesting the conflict would be over in May with a negotiated cease fire; and 3) Foresee European and US sanction responses, and the foreign divestment that would cause a decline in Russian GDP of roughly 3%.

Looking to 2023, the TIPS market is currently pricing in a one-year expectation of just 1.9% for headline CPI. Meanwhile, inflation swaps are priced a little higher at 2.4%, and the median Bloomberg economist is forecasting 4.3%. If those numbers sound low, consider that many of the drivers of inflation seem to have reversed, in some cases into outright deflation. Commodity prices are down significantly from peak levels, with energy commodities around 35% lower than their mid-year highs and ex-energy commodities around 15% lower. The Supply Chain Pressure Index is still disrupted, but has normalized significantly throughout the year. The Mannheim used vehicle index is down 16% from its peak. The Case-Shiller Home Price Index is down 2% from highs. And, the Money Supply is no longer growing. In fact, 2022 saw the slowest money supply growth since we’ve been keeping M2 records beginning in 1959.

There are clearly a lot of disinflationary, or even deflationary dynamics rippling through the economy and while we expect inflation to slow significantly in 2023, we acknowledge that there may still be upside surprises to market expectations. China’s pivot from a zero-COVID policy could lead to greater inflation through increased demand for commodities, while a surge in cases could disrupt production. In addition, there remains a large imbalance in the US labor market, where significant demand relative to the supply of available workers is fueling wage growth, which in turn supports consumer demand. This imbalance is one of the key reasons the Federal Reserve has continued on a monetary policy tightening agenda at a pace that far exceeded expectations starting the year.

Monetary Policy

For the markets, there is no question that tighter monetary policy did the most damage in 2022. Over the course of the year policymakers increased the Federal Funds rate, from a range of 0.00%-0.25% starting the year to a range of 4.25%-4.50% today. If we go back and read Chair Powell’s December 2021 commentary, he was concerned about the potential impact of rising COVID-19 case counts as Omicron had just been named a variant of concern on November 26. The December 2021 Fed projections showed a median projection of 0.75%-1.00%, implying we would get a total of 75 basis points of Fed tightening in 2022. Of course, what actually transpired was 75 basis points of tightening at multiple meetings this past year!

The impact to the bond markets was direct and significant. Yields rose significantly on every sector of the fixed income markets, with many sectors now yielding more than 4% more than when we started the year. Longer-duration bonds experienced record drawdowns, with investors in 30 year treasuries experiencing a drawdown of 50%. The volatility of interest rates and of interest rate options remains extremely high and creates opportunities in fixed income markets, especially in mortgages and municipal bonds where spreads on callable bonds are quite elevated relative to history.

Of course higher rates do not just impact the bond markets. Equity valuations are based, to a significant extent, on the rates earned by safer assets like bonds and cash. As bonds and cash offer higher returns, equity valuations fall to reflect that higher hurdle rate. In 2022 that meant, despite growing earnings, stocks fell significantly as the forward P/E ratio on US stocks went from 21.7x to 17.0x, a 22% reduction. Looking ahead, equity valuations could stabilize as it appears the Fed may be closer to the end of its hiking path than the beginning.

Looking to 2023, investors are pricing in an expectation that the Fed will hike rates 50 basis points, to 4.75%-5.00% before cutting. Meanwhile, the Fed has communicated an expectation that it will hike 75 basis points to 5.00-5.25% by year-end. That means the bond market is pricing roughly 25 basis points lower than the Fed. We think it is clear that this pricing reflects investors’ belief that there is an elevated probability of recession in 2023, and that the Fed would respond to a recession by cutting rates.

Housing

The pandemic caused a meaningful increase in demand for housing as Americans migrated away from large city centers and household formation spiked higher as adult children moved out and more renters left roommates behind. These dynamics, coupled with decades-low mortgage rates, caused house prices to rise more than 15% in the first half of the year. Rate increases from the Fed quickly drove 30-year mortgage rates from around 3% starting the year to a peak of more than 7% in November – a level not seen in over 20 years. Using round numbers, a would-be home buyer shopping for a $500K home, based on what her budget allowed for the monthly mortgage payment, very quickly found herself shopping for a $250K home at the same monthly cost.

The financing price shock brought a very active market to a screeching halt as sentiment among both buyers and sellers plummeted deep into pessimistic territory. Existing home sales fell from a pace of nearly 6.5M per month in January to approximately 4.0M per month in November, and median home prices declined more than 8% from peak levels.

Importantly, the housing market has tentacles with wide-reaching implications for the broader economy. New housing starts have fallen by more than 20% from peak levels in early 2022 and Fannie Mae forecasts further declines in 2023. In terms of the economy, this means significant layoffs among home builders, home sellers, and mortgage lenders are a certainty, while suppliers of building and construction materials and connected retailers are at risk as well.

Anticipating the Next Recession

Entering the year, consensus expectations were for no recession in 2022, which appears to have been the case. Over the course of the year, however, forecasters dramatically ratcheted up their expectations for a recession in 2023. If we do experience a recession this year, it would represent a significantly shorter business cycle than the post-WWII average of 5 years, 4 months, but the recovery has also occurred at a significantly faster pace.

Usually recessions come as surprises, but today everyone seems to agree that we are poised to have one in 2023. We have to wonder how damaging a recession might be if it is well-anticipated. In particular, when global equities are already discounted by nearly 20% and the Fed is able, if not willing, to offer relief by loosening policy from current levels.

Historically speaking, even when recessions catch investors off guard, investment outcomes have probably been better than you might imagine. We studied the 15 recessions that occurred over the last 100 years. On average, disciplined investors would have captured 8.5% annualized returns from stocks in the typical three-year period beginning 12 months prior to recession and ended 12 months after a recession. Further, the usual recessionary playbook of underweighting stocks, overweighting long duration bonds, and staying out of commodities may not work, given the unusual dynamics at play in this cycle. We think the more reliable course for generating investment returns is not to try to time recessions and make dramatic changes that are out-of-line with your long-term investment goals, but rather to focus on the longer-term.

Looking Forward – Capital Market Assumptions

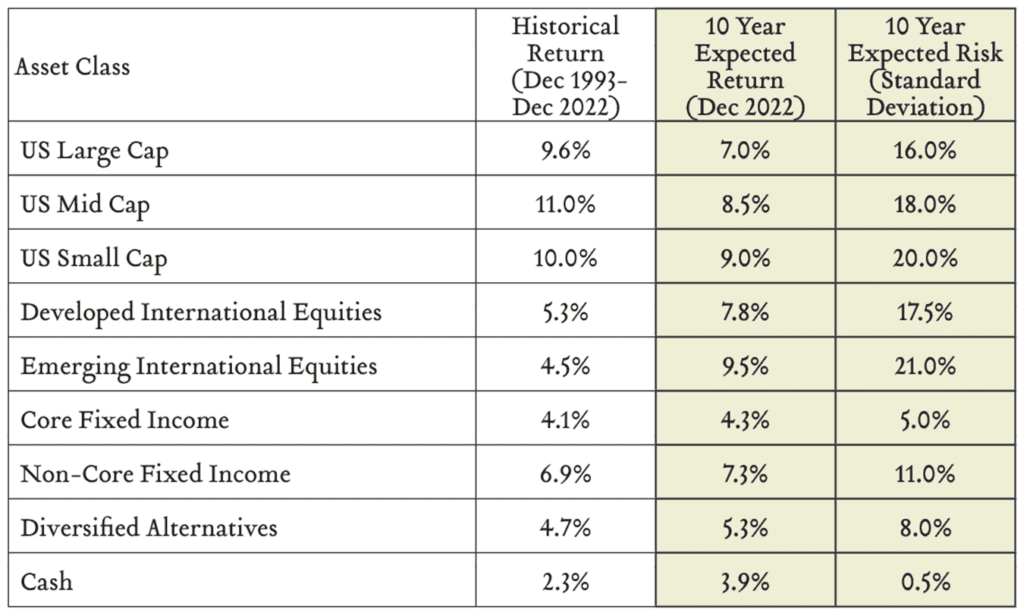

In the longer-term, the outlook for investment returns has improved significantly. We share our updated capital market assumptions below. These forecasts represent the midpoint of our expectations for average annualized returns for each asset class over the next ten years. Over the next decade, there will be years where returns exceed our expectations and years where returns trail our expectations. We believe short-term market-timing strategies are unlikely to improve long-term outcomes.

When it comes to equities, one of the most important determinants of future returns is starting valuations. Higher starting valuations predict lower forward returns and lower starting valuations predict higher forward returns. Consistent with the re-basing of valuations in 2022, our long-term forecast for US large cap equities stands at 7.0% per year, up from 4.75% at the end of 2021 and 4.0% at the end of 2020. So while short-term risks might be elevated, longer-term, we are finally back to more normal levels of prospective returns. That’s true also with bonds.

With bonds, starting yields have historically been a good predictor of future returns. Low starting yields predict low returns and higher starting yields predict higher returns. Consistent with the substantial rise in yields experienced in 2022, our long-term forecast for core bonds stands at 4.3% per year, up from 2.2% at the end of 2021 and 1.0% at the end of 2020.

Across the board, the ability to generate return looks much better today than it has in many years. Even a balanced portfolio constructed with 60% global equities and 40% fixed income is now poised to return 6.2% annually over the next ten years, up from expectations of 4.2% in 2021 and just 3.2% at the end of 2020.

Despite an ever-changing landscape, our disciplined approach and long-term orientation serve us well as we endeavor to create comprehensive investment solutions that help our clients reach their financial goals. Investment decisions are made in alignment with our documented investment philosophy and always with the intention of serving our clients’ best interests. Happy New Year and thank you from everyone on the investment research team for allowing us to serve on your behalf.