April 4, 2018

On Tariffs and Trade Policies

The first quarter of 2018 was exciting if nothing else. Stock market strength in January was followed by a correction in February sparked by inflation concerns and monetary policy uncertainties. Stocks rebounded into March until tariff announcements from the White House and speculation over a possible trade war pushed markets lower again. Evolving U.S. trade policy begets uncertainty and could have far-reaching implications for the global economy. We believe the probability of an all-out trade war remains low at this time, but offer some perspective on recent announcements and their potential implications.

In recent weeks the Trump administration announced tariffs on steel (25%) and aluminum (10%) imported from around the globe with temporary exemptions granted to a handful of trading partners including Canada and Mexico. The administration also announced plans for a 25% tariff on up to $50B of imported Chinese goods. In response, China’s commerce ministry has proposed reciprocal tariffs on $3B of imports from the U.S. Based on their magnitude and scope, these measures represent more aggressive trade posturing and a departure from international norms established in recent decades.

Governments typically impose tariffs to raise revenue or to protect domestic industries and jobs from foreign competition. The Trump administration is citing national security as the grounds for the tariffs imposed on industrial metals – protecting domestic steel and aluminum industries because our defense capabilities depend on their health. Tariffs can also be used as an extension of foreign policy as a means of exerting economic leverage. In this vein, the Chinese tariffs were levied in response to a seven-month investigation into intellectual property (IP) theft – a longstanding point of contention in US-China relations. Here, tariff proceeds (approximately $12.5B) are viewed by the administration as compensation for the alleged IP violations.

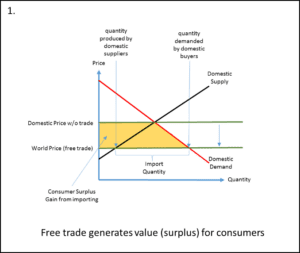

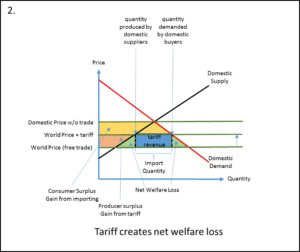

From an economic perspective, tariffs make imported goods more expensive, and therefore less attractive to consumers. In turn, demand for domestically-produced substitutes should increase. Higher prices translate to lower sales volume for foreign producers or lower profitability if they can absorb the added cost of the tariff. This interference with what would otherwise be considered free trade results in an economic inefficiency known as “net welfare loss” or “deadweight loss”. Benefits to domestic producers (more volume, higher prices) and the government (tariff revenue) do not offset the reduction to consumer surplus otherwise supported by free trade.

While their use can be tactical and targeted with specific intentions, tariffs can also cause a range of negative side-effects. For example, tariffs can:

- Reduce competition making domestic industries less efficient

- Increase prices and degrade purchasing power for domestic consumers

- Create tension (even at home) by favoring certain industries and/or regions over others

Perhaps most importantly, global tensions and retaliatory responses from trading partners can quickly escalate into a counterproductive policy exchange or trade war. Taken to an extreme, higher prices and reduced demand for goods and services can erode global GDP growth, perhaps contributing to a global economic recession and/or market downturn. Speculation about this type of escalation is likely the reason investors responded so strongly to recent announcements from the Trump administration.

As observers of the economy and markets, we prefer the economic efficiency of free trade, though we acknowledge the rationales provided for these specific tariffs. The economic impact of the announced tariffs should be modest as many of our important trade partners are exempted, and the initial scope is small relative to our overall trading relationship with China. We think the likelihood of escalation into a full-fledged trade war remains low, though the risk of such an outcome is elevated amidst an evolving stance on trade policy and dynamic relationships with global trading partners.