September 11, 2025

August CPI - Rising As Expected; Fed on Track to Cut

In August, consumer prices as measured by CPI, rose 2.9% compared to a year ago, up from +2.7% in July, but in line with expectations . Core CPI (“underlying inflation”; excludes volatile food and energy prices) rose 3.1%, unchanged from July and in line with expectations. Against a backdrop of tariff concerns and trade policy uncertainty, today’s report was largely in line with expectations, showcasing gradually rising inflation. These results are unlikely to derail a Fed rate cut next week after weak jobs reports for July and August called the health of the labor market into question. Investors reaffirmed bets on a single 0.25% cut next week and dialed up bets for three full cuts this year.

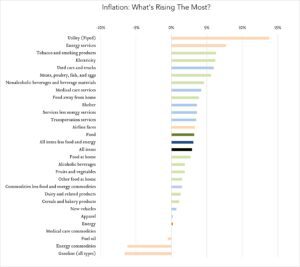

- Consumer prices (CPI) increased 2.9% year-over-year. In August, the consumer price index (CPI) increased 2.9%, up from 2.7% in July and in line with expectations. The cost of used vehicles (+6.0%), shelter (+3.6%) and food (+3.2%) were key contributors to the overall increase, more than offsetting a decline in gasoline (-6.6%). Shelter costs, which represent nearly one third of the consumer price index and tend to impact the index with a lag, continued an elongated path of deceleration. At +3.6% year-over-year, shelter inflation decelerated modestly from 3.7% in July 2025 and is down from a peak of 8.2% in March 2023. Core CPI (excludes food and energy) increased 3.1% year-over-year, unchanged from July and in line with expectations.

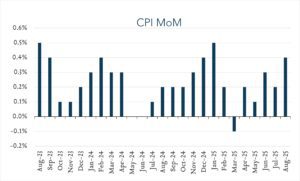

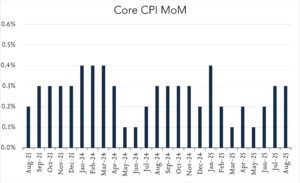

- Consumer prices (CPI) rose 0.4% month-over-month. In August, consumer prices rose 0.4% month-over-month up from +0.2% in July and above expectations for +0.3%. Core CPI (excludes food and energy) increased 0.3% month-over-month, unchanged from July and in line with expectations.