August 1, 2025

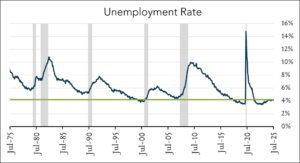

July Jobs - Weak Print and Prior Months Revised Sharply Lower

US job growth cooled sharply over the last three months. Nonfarm payrolls increased by just 73K in July (vs. consensus of +104K) and the jobless rate rose to 4.2% from 4.1% a month earlier. Previously reported figures for May and June were cut by approximately 260K combined suggesting the labor market is more than just ‘moderating.’ Earlier this week, Fed officials kept interest rates unchanged in a split decision noting ongoing inflationary risks related to tariff policy and a labor market that remained solid. Following today’s report, investors solidified expectations for two quarter point cuts later this year and raised 2026 expectations to five cuts from four to five cuts previously. The next FOMC meeting is slated for September and Policymakers will have the benefit of another employment report and a few more inflation reports prior to determining the path forward.

- 73k jobs added in July – lower than forecast. The U.S. labor market added just 73k jobs in July falling short of expectations. In addition, job gains for May and June were revised significantly lower cutting reported YTD payroll additions by 260K combined. The updated figures place year-to-date results well below expectations entering the year. Job gains have averaged 85K per month in 2025 compared to expectations for 121K per month when the year began and compared to average gains of +128K over the prior 12 months. Job gains trended higher in health care (+55K) and social assistance (+18K) while Federal government employment declined by 12K in and is down 84K since January. Employment showed little change in other major industries.

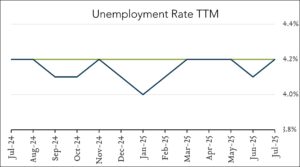

- 4.2% unemployment – up 0.1% month over month. The U.S. unemployment rate rose 0.1% to 4.2% in July matching expectations. The unemployment rate has remained in a narrow range of 4.0% to 4.2% since May 2024. The labor force participation rate declined slightly to 62.2% from 62.3% in June. Wage growth accelerated slightly to 3.9% year-over-year (vs. 3.8% in June and 3.8% forecast) and +0.3% month-over-month (vs. 0.2% in June and 0.3% forecast).