July 3, 2025

June Jobs - Solid Report Validates a Patient Fed

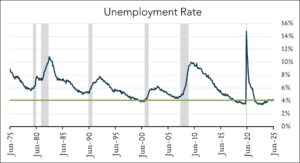

June hiring tops expectations for a fourth straight month; July rate cut off the table. Nonfarm payrolls increased 147K in June (vs. consensus of +106K) and the jobless rate fell to 4.1%, down from 4.2% a month earlier. Price pressures have generally been subdued so far this year and a moderating but generally balanced labor market has given the Federal Reserve flexibility to respond to developments that may arise from evolving federal trade and fiscal policy. The Fed’s next meeting is scheduled for July 30th. While investors are still pricing in 2 cuts this year, they are also pricing in 95% odds that policymakers hold rates steady later this month.

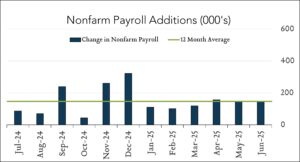

- 147k jobs added in June – above expectations. The U.S. labor market added 147k jobs in June approximating an upwardly revised +144K in May and topping expectations for +106K. June’s outcome places year-to-date results slightly ahead of expectations entering the year. Monthly job gains have averaged 130K in 2025 compared to expectations for 121K per month when the year began and compared to average gains of +150K over the prior 12 months. Job gains trended higher in state and local government and health care while Federal government employment declined by 7K in and is down 69K since January.

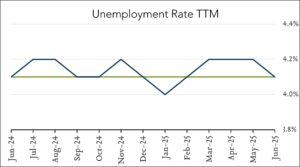

- 4.1% unemployment – down 0.1% compared to May. The U.S. unemployment rate declined 0.1% to 4.1% in June. The unemployment rate has remained in a narrow range of 4.0% to 4.2% since May 2024. The labor force participation rate declined slightly to 62.3% from 62.4% in May. Wage growth decelerated slightly to 3.7% year-over-year (vs. 3.8% in May) and +0.2% month-over-month (vs. 0.4% in May). Collectively, data suggests continued balance between labor supply and labor demand.