January 10, 2025

December Jobs - Hot Print: Payrolls Pop; Unemployment Down

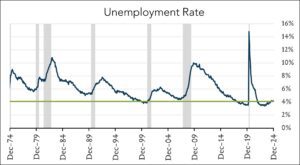

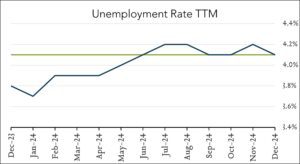

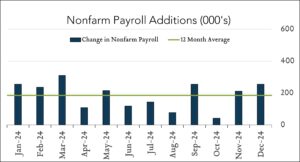

December job gains advanced by the most since March and the unemployment rate unexpectedly fell, capping another year of resilience for the labor market. Nonfarm payrolls increased 256K in December following a (revised) gain of +212K in November. The unemployment rate retreated 0.1% to 4.1%. Today’s report confirms that 2024 was another strong year for the labor market despite higher borrowing costs, lingering inflation, and political uncertainty. Last year’s 100 bps of Fed rate cuts were implemented to support a cooling labor market, but policymakers are likely to shift focus back to inflation which means holding rates steady for the time being. Following today’s report, investors pared back rate cut expectations for the year ahead pricing in just one 0.25% cut in the back half of 2025. This is a ‘good news is bad news’ report. The good news is the labor market (and therefore consumers and the economy) appears to be on solid footing entering 2025, the bad news is that further accommodation from the Fed is less likely and borrowing costs will remain higher for longer.

- 256K jobs added in December – well above expectations. The U.S. labor market added 256K jobs in December compared to expectations for +165K. November job gains were revised marginally lower to +212K from +227K originally reported. In 2024, monthly payroll gains averaged 186K – strong, but below the 2023 average of 250K per month.

- 4.1% unemployment – down from 4.2% in November. The U.S. unemployment rate ticked 0.1% lower in December to 4.1% – up from 3.7% to start the year. The labor force participation rate was steady at 62.5%. Wage growth decelerated to +3.9% from +4.0% year-over-year and decelerated to +0.3% from +0.4% month-over-month.