January 7, 2025

2024 Review and 2025 Outlook

Happy New Year! After the second consecutive year of significantly positive surprises for economic growth and for stocks, spirits are brighter as we enter 2025. Economists have largely shelved their recession forecasts, which last year registered 50% odds of a downturn in 2024. The outlook for corporate earnings growth is rosy. Predictions for inflation remain marginally concerning, but overall, the outlook for the coming year is positive.

These expectations appear reasonable and consistent with a “soft landing” for the economy. If achieved, stocks could extend their winning streak, though likely not at the pace of the past two years, and bonds could realize better returns as well. There appears to be room for marginal upside surprises, but the outlook is clouded by the potential for significant economic policy changes, the potential for a misstep by the Fed, and, as always, the possibility of exogenous shocks that we cannot currently foresee.

Market Strength

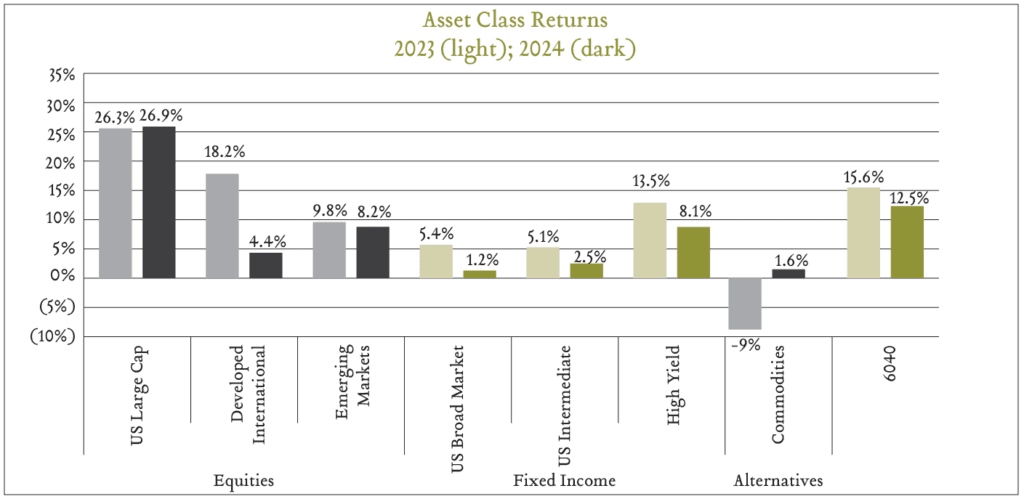

In 2024, global equities gained 19%. Domestic large caps added 26.9%, while developed international and emerging market stocks rose 3.8% and 7.5%, respectively. At the same time, fixed income categories returned 1.2% to 8.1% as interest rate expectations fluctuated. Even a balanced portfolio comprised of 60% stocks and 40% bonds gained 12.5% last year. These outcomes built upon a similarly strong 2023.

Positive Surprises in 2024

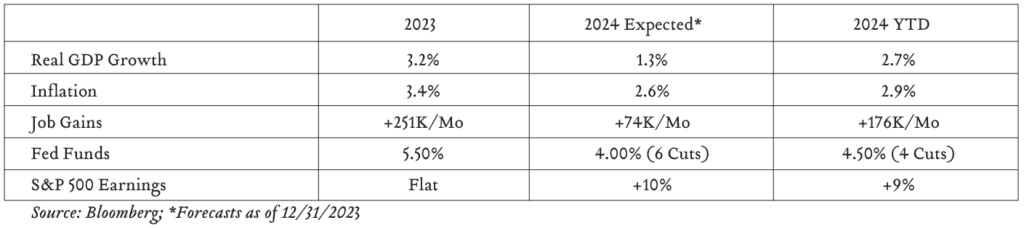

Entering 2024, economists widely anticipated a significant economic slowdown. The probability of recession was placed at 50% and real GDP growth was anticipated to register just 1.3%. Investors anticipated the Fed would need to respond by stimulating the economy with six 0.25% rate cuts, beginning in the first quarter.

The table below outlines the median forecast and the actual results for the year.

Actual outcomes defied these negative predictions. Real GDP growth, while moderating slightly from 2023’s pace of 3.2%, will likely end 2024 around 2.7%, more than double the initial forecasts. Inflation remained firm, particularly in core services. The labor market cooled from a previously overheated supply/demand imbalance but remained resilient throughout the year. Corporate earnings growth essentially matched expectations. These positive surprises led to robust stock market performance for the second consecutive year.

The unexpected strength also changed the course for Fed policy. The FOMC deferred rate cuts until the third quarter and cut rates less than investors expected in 2024. This led the bond market to underperform cash in 2024 but provides a positive starting yield for 2025 and beyond.

Reasonable Expectations for 2025

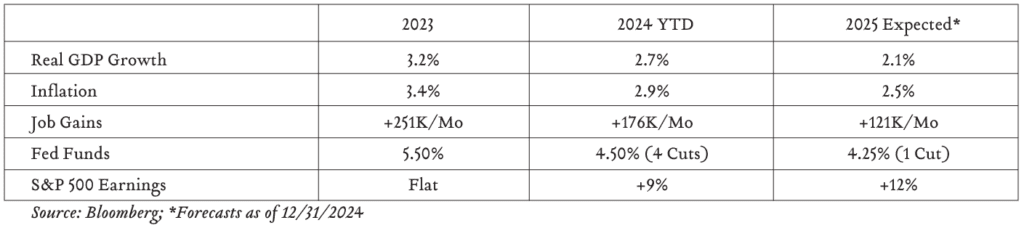

Looking to 2025, expectations are brighter than they were coming into 2024, but still reflect a gradual slowdown. These higher expectations also create a higher hurdle to clear to realize the types of gains experienced in stocks over the past two years. However, the outlook calls for a year that is both solid in absolute terms and better than the initial expectations for 2024.

Of course, the year ahead is likely to be influenced by the policy agenda of the Trump administration. Republican control of the Senate and the House of Representatives should make it easier to implement tax policies and other initiatives proposed by President Trump on the campaign trail. It is important to remember that there is often a wide gap between campaign proposals and actual policies. Directionally, tariffs could result in higher inflation and slower growth relative to forecasts, while tax cuts could lead to higher deficit spending. Additionally, it remains to be seen if deregulation in the domestic energy sector will drive energy prices (and inflation) lower.

It isn’t practicable to account for every known and unknown driver of the economy over the next twelve months. Again, we think base case expectations consistent with a soft-landing scenario are reasonable. And, if the year unfolds as written (or close to it) we would expect another positive year for stocks and compelling yields for bonds. Currently, the things that keep us up at night are the things we can’t anticipate or prepare for including ever-present geopolitical risks, exogenous shocks or a misstep by the Fed.

Looking Forward – Capital Market Assumptions

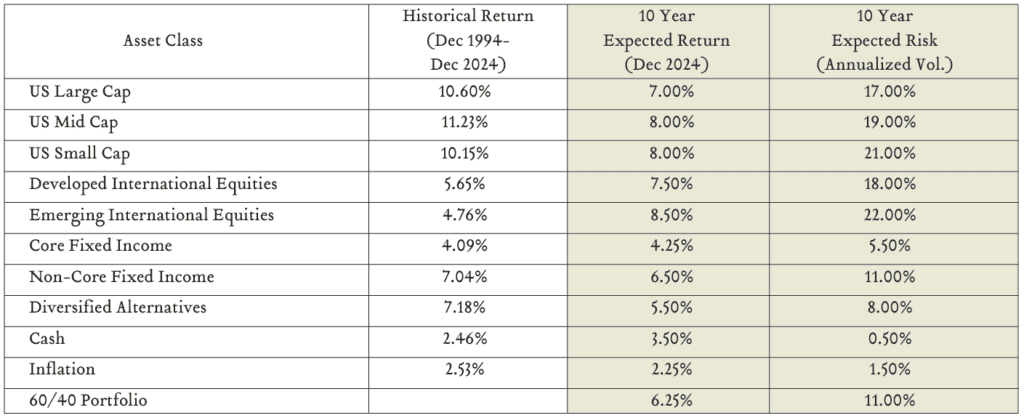

While the short-term can be unpredictable, the outlook for investment returns remains compelling over the long-term. We share our updated capital market assumptions below. These forecasts represent the midpoint of our expectations for average annualized returns for each asset class over the next ten years.

Our long-term forecast for U.S. large cap equities stands at 7.0% per year and our long-term forecast for core bonds stands at 4.75% per year. Further, we expect a balanced portfolio constructed with 60% global equities and 40% fixed income to return about 6.25% annually over the next ten years.

Over the next decade, there will be years when returns exceed our expectations and years when returns trail our expectations. We believe short-term market-timing strategies are unlikely to improve long-term outcomes.

Despite an ever-changing landscape, our disciplined approach and long-term orientation serve us well as we endeavor to create comprehensive investment solutions that help our clients reach their financial goals. Investment decisions are made in alignment with our documented investment philosophy and always with the intention of serving our clients’ best interests. Happy New Year and thank you from everyone on the Investment Research team for allowing us to serve on your behalf.