December 17, 2024

November Retail Sales - Cars & Clicks Underpin Strength

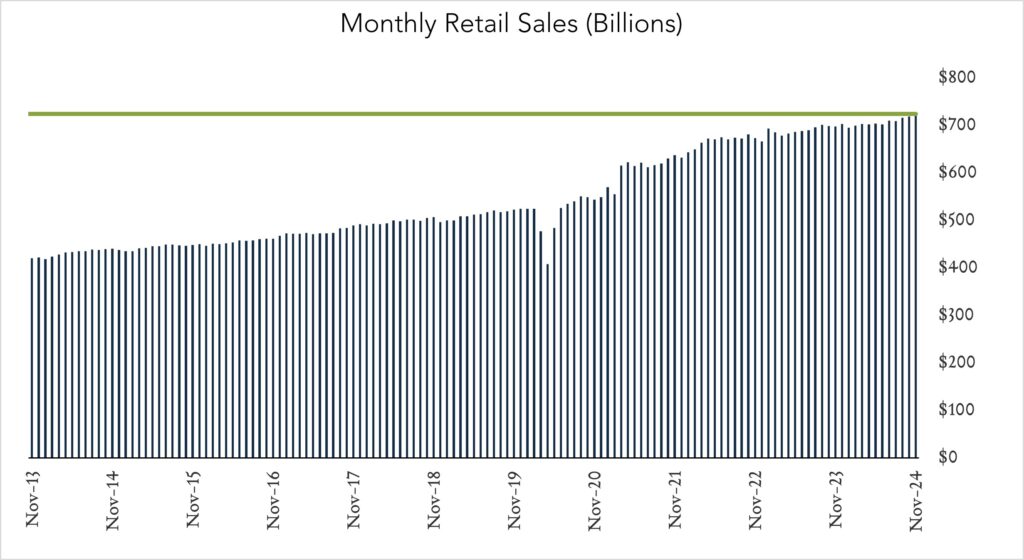

U.S. retail sales accelerated and rose more than expected in November. Strong auto sales and a jump in e-commerce owing to healthy Black Friday and Cyber Monday receipts suggests consumers remain resilient during the crucial holiday shopping season. Retail spending, unadjusted for inflation, rose 0.7% topping expectations for 0.6%. Today’s report indicates yet-resilient household demand even as hiring and wage growth have shown some signs of moderating. Investors are widely anticipating another 0.25% cut tomorrow (12/18), though it seems likely policymakers will reign in projections for cuts in 2025.

- Real (inflation adjusted) retail sales advanced 1.1% year-over-year. In November, retail sales grew 3.8% nominally netting growth of 1.1% after adjusting for 2.7% inflation. Higher spending at online retailers (+9.8%) and motor vehicles (+6.5%) was partially offset by lower spending at gas stations (-3.9%). Four of thirteen categories advanced in real terms.

- Real (inflation adjusted) retail sales expanded 0.4% month-over-month. In November, nominal retail sales levels increased 0.7% compared to October (consensus +0.6%) netting 0.4% growth after adjusting for 0.3% inflation. Higher spending on motor vehicles (+2.6%) and online retail (+1.8%) contributed to strength. Four of thirteen categories increased in real terms.