December 6, 2024

November Jobs - Rebound After October Strikes/Storms

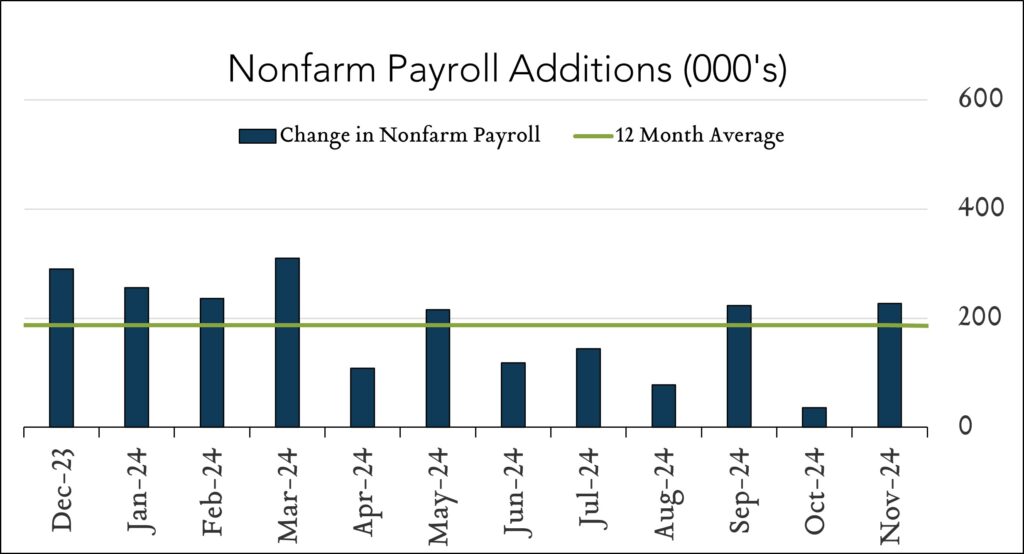

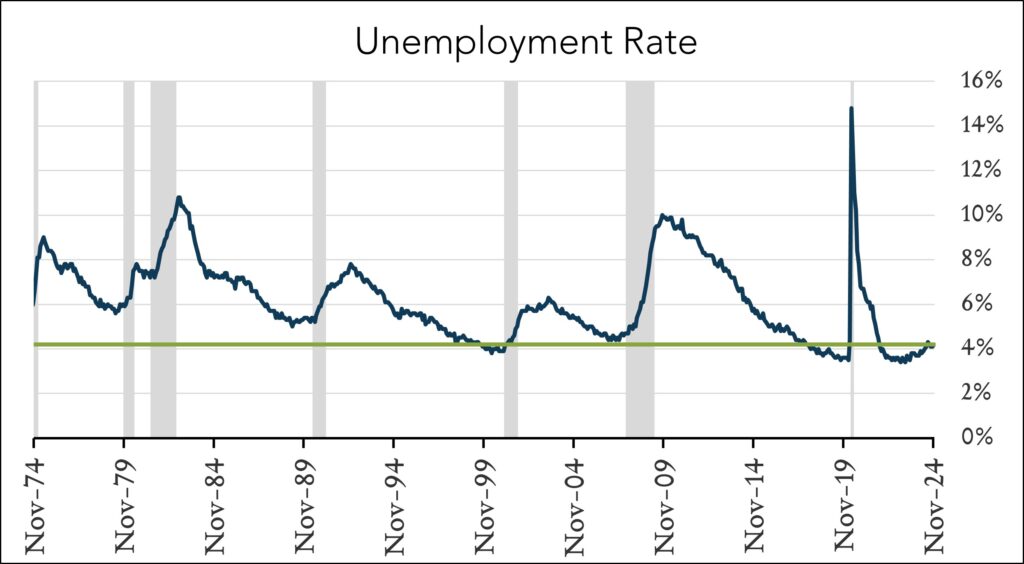

The U.S. job market rebounded from an anemic October clouded by strikes and storms. Nonfarm payrolls increased 227K in November following an upwardly revised 36K gain in October and contributing to a trailing three-month average of +173K. The advance should temper concerns over a worsening slowdown following the October print. Overall, the report lends credence to the idea that the job market remains on solid footing but is no longer a major driver of inflation. Earlier this year, Fed policymakers shifted from a laser-focus on inflation reduction to a more balanced consideration of the dual mandate. After holding rates steady for more than a year, the Fed cut rates 0.50% cut in September and 0.25% in November to get out ahead of a potential slowdown. With the next FOMC meeting set to conclude on December 18, investors are pricing in a high probability of another 0.25% cut.

· 227K jobs added in November – slightly above expectations. The U.S. labor market added 227K jobs in November compared to expectations for +220K marking a substantial rebound from an October report clouded by labor strikes and two hurricanes. October job gains were upwardly revised from +12K to +36K originally reported. Year-to-date, monthly payroll gains have averaged 180K – strong, but below the 2023 average of 250K.

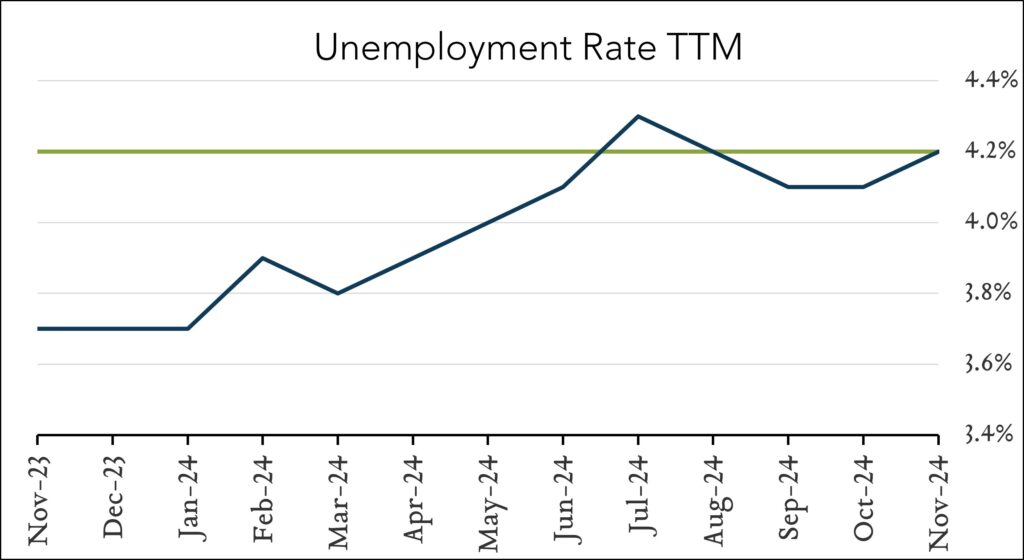

· 4.2% unemployment – up from 4.1% in October. The U.S. unemployment rate ticked up 0.1% in November to 4.2% – up from 4.1% in October and 3.7% to start the year. The labor force participation rate ticked down to 62.5% from 62.6% in October. Year-over-year, wage growth was steady at +4.0%. Wage growth was also steady month-over-month at +0.4%.