October 17, 2024

September Retail Sales - Above Forecast Again

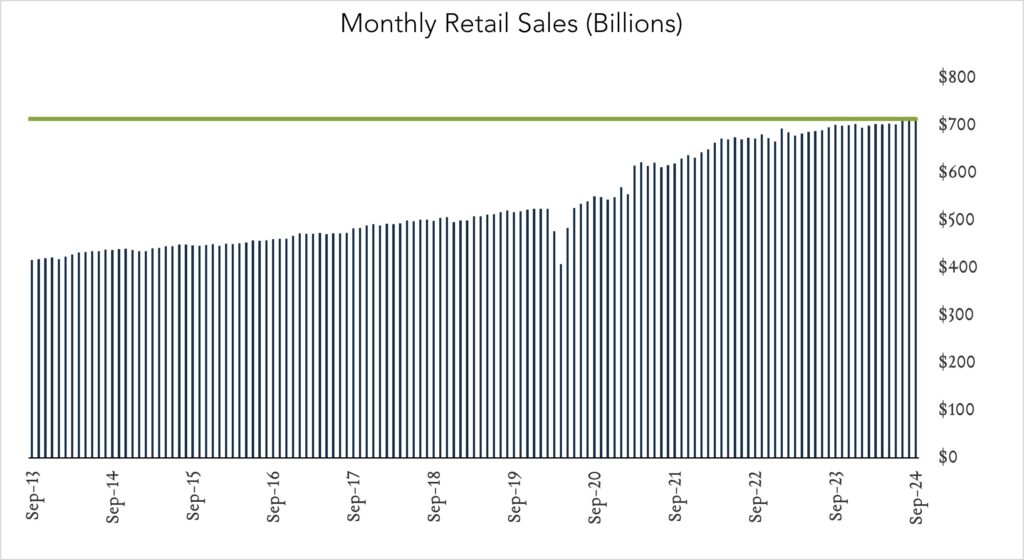

U.S. retail sales rose more than expected September in a broad advance highlighting resilient consumer spending in the third quarter. Retail spending, unadjusted for inflation, rose 0.4% topping expectations for 0.3% and accelerating from 0.1% in August. Today’s report indicates yet-resilient household demand even as hiring and wage growth have shown some signs of moderating. While the economy remains on solid footing, bond traders continue to price for a single 0.25% cut from the Fed next month.

- Real (inflation adjusted) retail sales declined 0.7% year-over-year. In September, retail sales grew 1.7% nominally netting a decline of 0.7% after adjusting for 2.4% inflation. Higher spending at online retailers (+7.1%) and restaurants (+3.7%) was partially offset by lower spending at gas stations (-10.7%). Six of thirteen categories declined in real terms.

- Real (inflation adjusted) retail sales expanded 0.2% month-over-month. In September, nominal retail sales levels increased 0.4% compared to August (consensus +0.3%) netting 0.2% growth after adjusting for 0.2% inflation. Higher spending on groceries (+1.0%) and restaurant dining (+1.0%) was partially offset by lower spending at and gas stations (-1.6%). Eight of thirteen categories increased in real terms.