October 10, 2024

September Inflation - Above Forecast

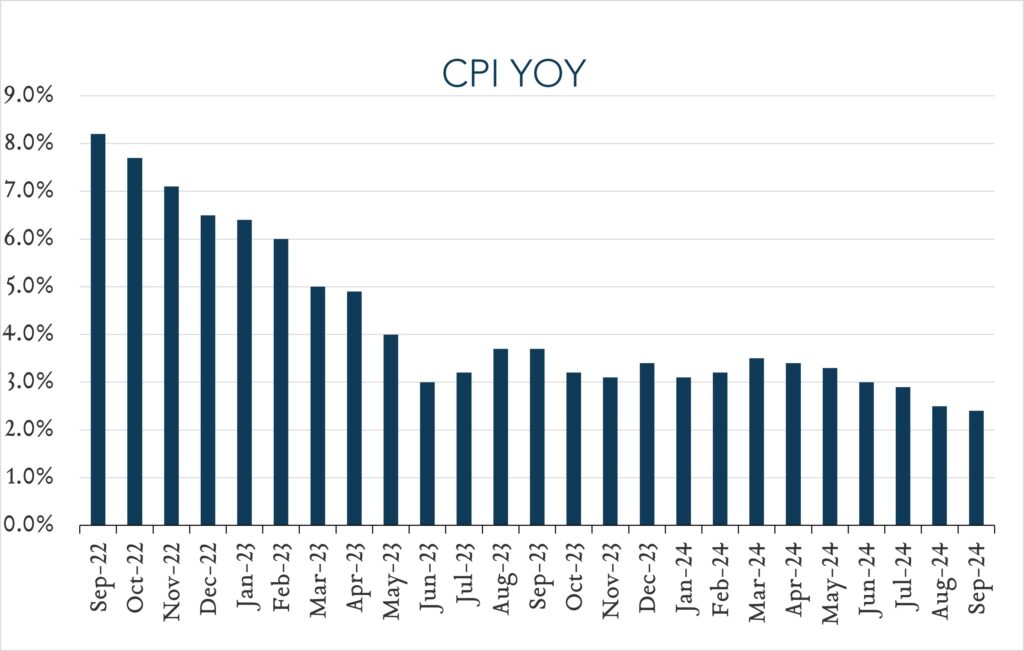

In September, consumer prices as measured by CPI, rose 2.4% compared to a year ago, decelerating 0.1% compared to August, but above expectations for 2.3%. Core CPI (excludes volatile food and energy prices) also rose more than forecast. After implementing an initial 0.50% cut in September, higher than expected inflation combined with last week’s surprisingly strong jobs report will fuel debate over whether Fed policymakers will opt for a smaller cut in November. At the moment, bond traders are pricing in 0.25% cuts at each of the two FOMC meetings remaining in 2024 – consistent with Fed projections.

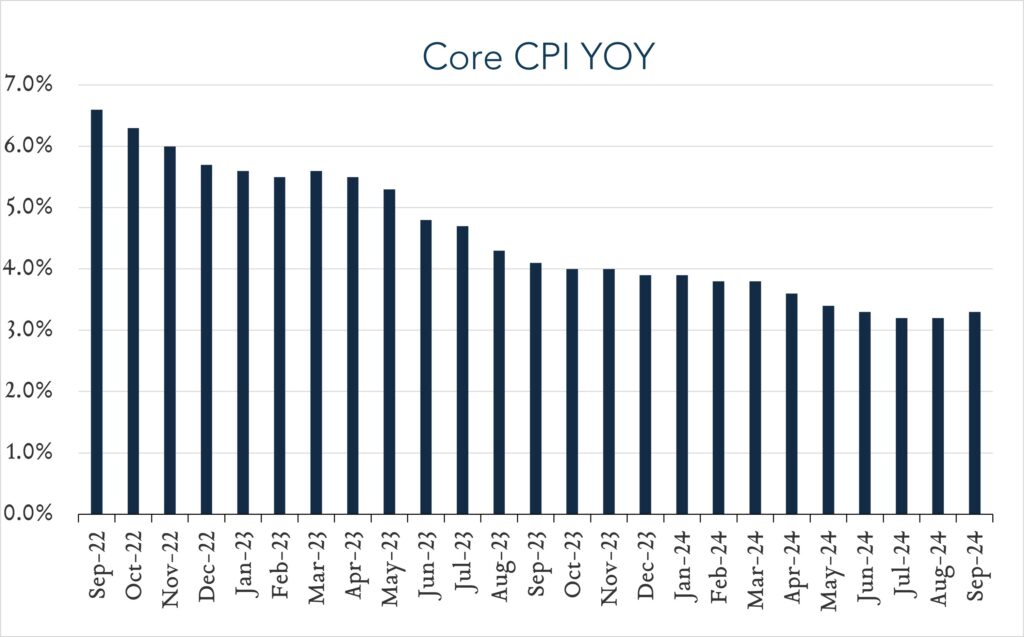

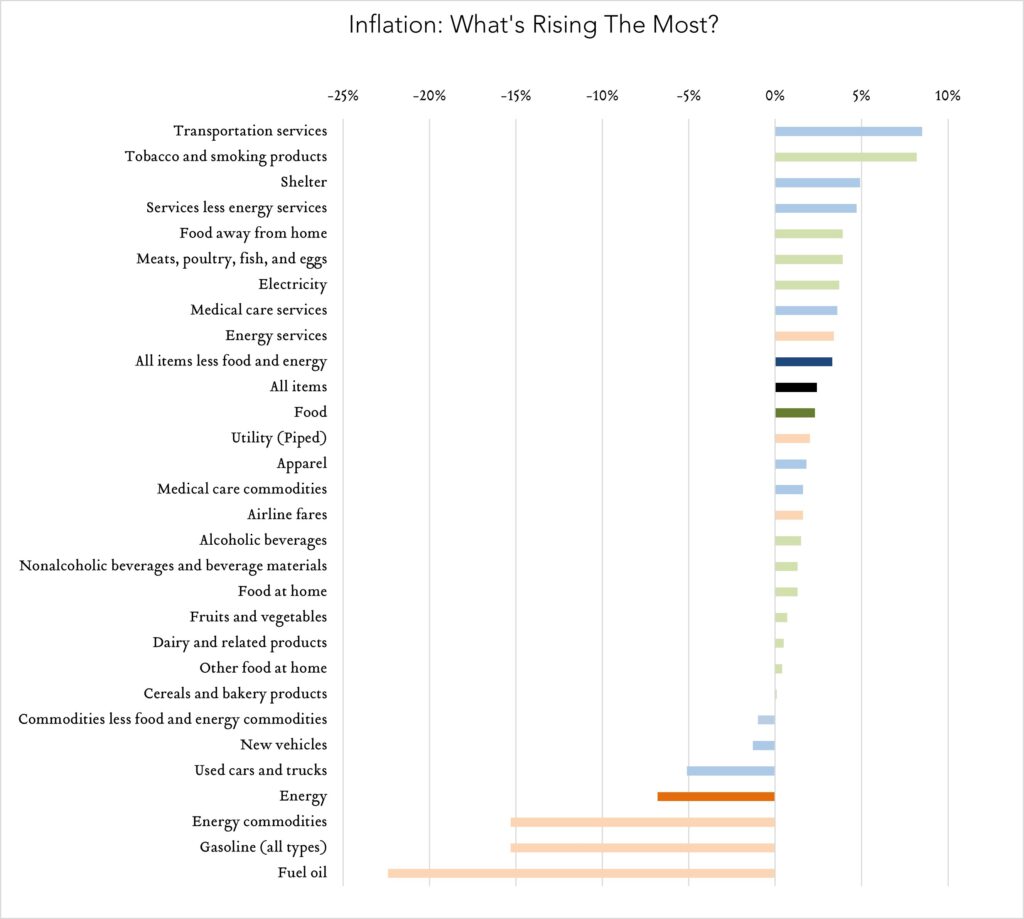

- Consumer prices (CPI) increased 2.4% year-over-year. In September, the consumer price index (CPI) increased 2.4%, down from 2.5% in August, but above expectations of 2.3%. Transportation services (+8.5%) and shelter (+4.9%) were key contributors to the overall increase, more than offsetting declines for used vehicles (-5.1%). We continue to keep a close eye on shelter costs, which represent nearly one third of the consumer price index and tend to impact the index with a lag. At +4.9% year-over-year, shelter costs decelerated 0.2% from August, down from a peak of 8.2% in March 2023. Core CPI (excludes food and energy) increased 3.3% year-over-year, up from 3.2% in August and above expectations for the same.

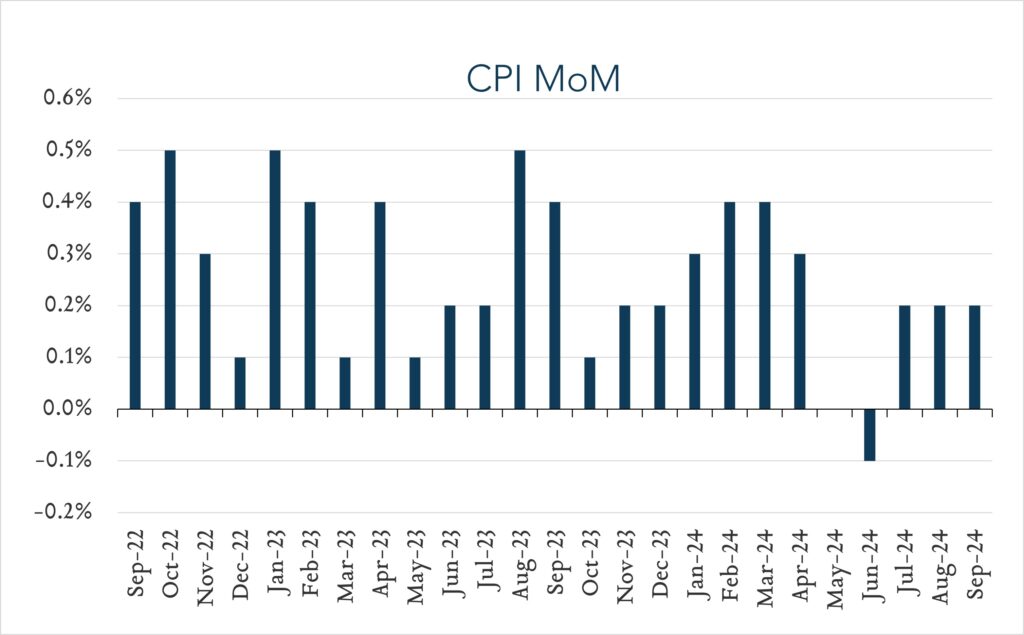

- Consumer prices (CPI) increased 0.2% month-over-month. In September, consumer prices rose 0.2% compared to August. Expectations ranged from +0.0% to +0.2% with a median of +0.1%. Shelter costs increased 0.2% (down from +0.5% in August and 0.4% in July). Core CPI (excludes food and energy) increased 0.3% month-over-month, unchanged from August and above expectations for +0.2%.