September 9, 2024

Economic Commentary

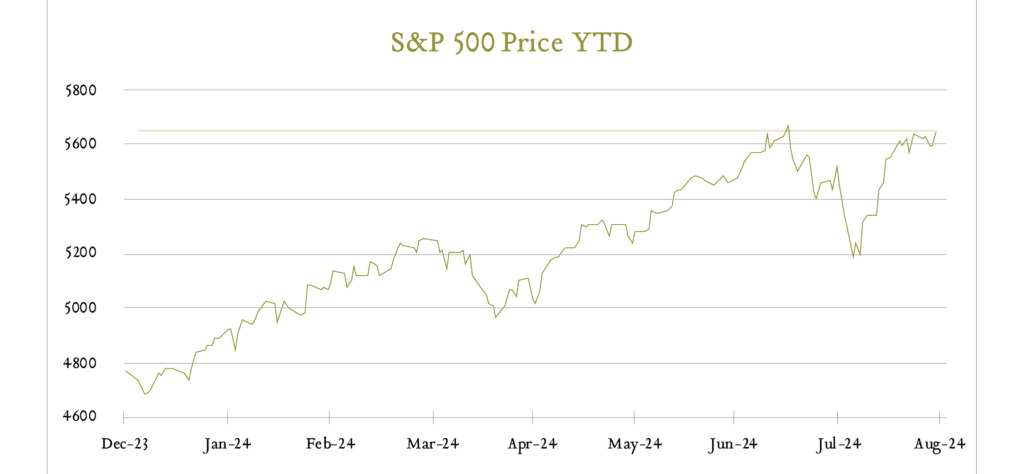

August was not for the faint of heart. Starting with a weaker-than-expected jobs report and exacerbated by the collapse of the yen carry trade, the S&P 500 fell 6.5% in the first three trading days of the month. The move placed the index within inches of correction territory – defined as a 10% decline from a recent peak. The risk-off trading caused U.S. government yields to drop precipitously as market participants forecasted an imminent recession. Disciplined investors were, however, rewarded. (They usually are, just not always so quickly.) When all was said and done, the hysteria faded and domestic stocks closed the month not only 2% higher than where they started, but also less than 1% from an all-time high.

The August narrative is truly interesting in retrospect. On July 31, Federal Reserve Chair Jerome Powell held a press conference following the FOMC’s July meeting. The message was clear, paraphrasing slightly: “We’ve been focused primarily on inflation, but now we’re focused on inflation AND the labor market. We’re not cutting rates today, but we’re going to at our next meeting in September (wink wink).” Investors rejoiced. Stocks closed the day more than 1% higher and traders priced in three 0.25% cuts (one per meeting) in the balance of 2024.

That was a Wednesday. On Friday morning, the Bureau of Labor Statistics released the monthly jobs report which, while not a complete disaster, came in softer than expected. The report showed that the U.S. labor market added just 114K jobs in July compared to expectations for +175K while the unemployment rate ticked up to 4.3% from 4.1% a month earlier. Despite positive payroll additions and a rise in unemployment largely due to a higher participation rate, doubt flooded in as investors questioned if the U.S. was moving from a “balanced” labor market to a “weak” one. Traders priced in a fourth 2024 interest rate cut and two days into August stocks were already down more than 3%.

On Monday, August 5, Japanese equity markets slid 13% as traders worked to unwind so-called carry trades. Yields in Japan have remained low in recent years and investors have been borrowing in low-yielding Japanese Yen and using the funds to buy higher-yielding U.S. Dollar investments. This works well when Japanese interest rates stay low and U.S. interest rates stay high – it also helps when the U.S. stock market is on the rise. But combine a Japanese rate hike to 0.25% – the highest level in more than 15 years – with hefty U.S. rate cuts on the horizon and all of a sudden, the jig was up. Unwinding these trades put technical pressure on both US and Japanese stocks which followed their 13% decline with a 10% rally the next day.

On that same Monday, U.S. markets opened 3.5% lower and bond traders priced for five 0.25% cuts in the remainder of 2024 as panic ensued. In my career, I have rarely seen the level of hysteria that erupted that day. Jeremy Siegel, a renowned economist and professor of Finance at Wharton Business school, went on CNBC declaring that the Fed needed to make an emergency rate cut of 0.75% immediately, with another 0.75% cut in September – essentially calling for six 0.25% cuts in less than two months. (He recanted his position a few days later.) A Bloomberg journalist opened an interview by asking a panel of experts how Monday, August 5 compared to Black Monday of 1987. For perspective, in 1987 the S&P 500 fell 23% in a single day. Considering the index closed Monday, August 5 down a little over 3%, it seems like the similarities stopped after “both were Mondays.”

On Thursday, August 8 weekly initial jobless claims, typically not a market moving data point, came in better than expected and suddenly all was well. The S&P 500 index rose 2.3% that day. By month end, it gained another 5% recovering to within basis points of the mid-July peak.

Looking forward, bond traders are pricing in four 0.25% cuts in the balance of 2024 including one to two cuts in September. Speaking in Jackson Hole, Wyoming on Friday, August 23, Federal Reserve Chair Jerome Powell declared that “the time has come for policy to adjust,” reinforcing market expectations. A patient Powell, apparently unmoved by calls for emergency rate cuts, noted that the labor market had recently cooled while inflation has continued to ease downward closer to the Fed’s 2% target.

Never a dull moment. After an eventful August, we can only hope for calmer waters in the months ahead. Despite an ever-changing landscape, our disciplined approach and long-term orientation serve us well as we endeavor to create comprehensive investment solutions that help our clients reach their financial goals. On behalf of the entire team, thank you for allowing us to serve on your behalf.