September 6, 2024

August Jobs Report - Slight Miss Sets Up September Rate Cuts

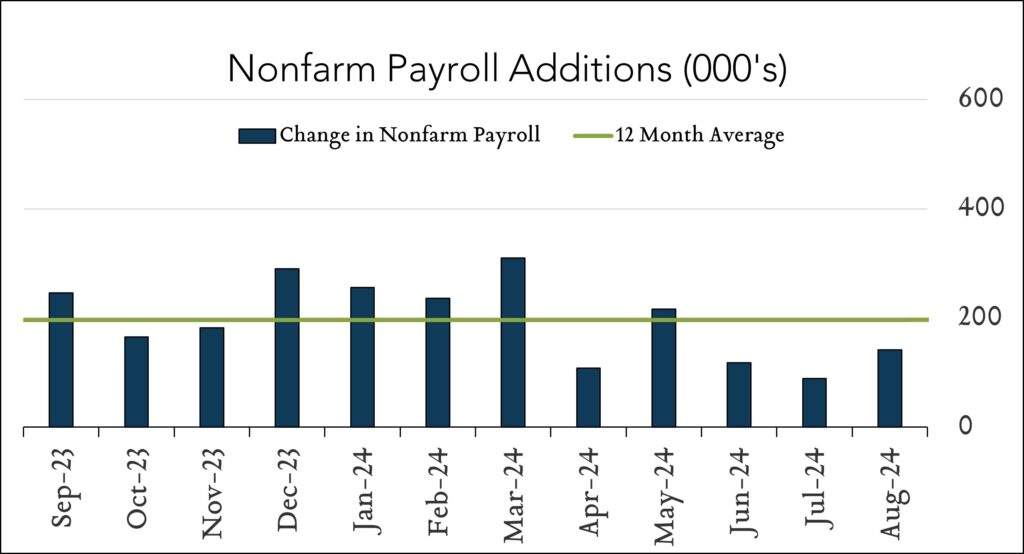

Job gains miss modestly; unemployment rate falls; revisions to prior months’ data were negative. Hiring improved from July’s weak report but missed expectations in August as wage growth rebounded slightly and the unemployment rate ticked down to 4.2%. The labor market added 142k jobs in August compared to 89k (revised) in July and 118k (revised) in June. The consensus forecast was for 165k additions and for the unemployment rate to tick down to 4.2%. This report is one of the last indications of the strength of the labor market that will arrive prior to the FOMC’s next meeting on September 18th. There is little doubt that the Fed will cut, the question is whether cuts will match the market’s expectations for 4 cuts by the end of the year and 7 cuts in the next 5 meetings. Bond yields moved lower today and the market is now pricing in a year-end rate of 4.00-4.25%, compared with today’s Fed Funds rate of 5.25-5.50%, requiring at least one 50bp cut along the way. Average hourly earnings rose 0.4% month-over-month and 3.8% year-over-year. Labor force participation was steady this month.

· 142K jobs added in August; July revised lower. The U.S. labor market added 142K jobs in August compared to expectations for +165K. July job gains were revised down by 25K to +89K from +114K originally reported. Hiring was more pronounced in health care (+31K), and construction (+34k) while manufacturing employment fell (-24k).

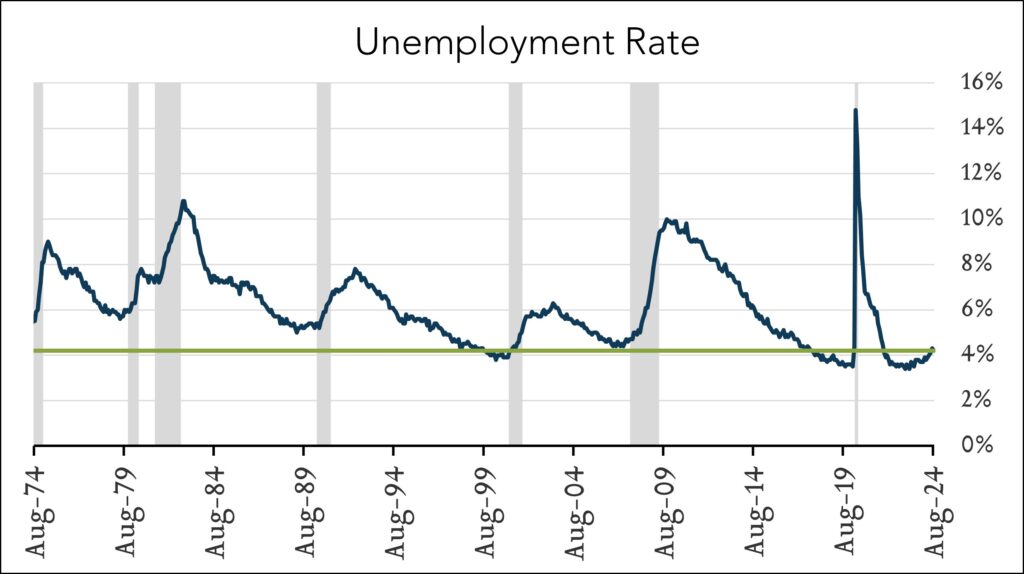

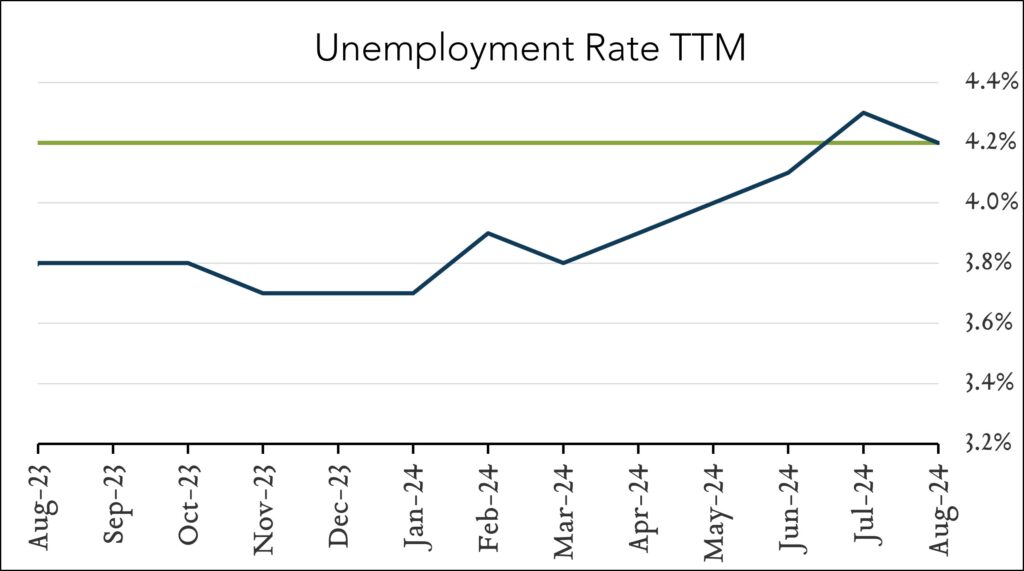

· 4.2% unemployment – down from 4.3%. The U.S. unemployment rate fell 0.1% to 4.2% in August, reversing the upward trend from the three prior months. Forecasts ranged from 4.1% to 4.4% with a median of 4.2%. The labor force participation was steady at 62.7%. Year-over-year, wage growth accelerated slightly to +3.8% from +3.6% in July. Month-over-month, wages increased 0.4% compared to +0.2% in July.