August 5, 2024

Correcting.

The U.S. stock market is approaching correction territory – a decline of 10% of more from a recent peak. After closing at a record high on July 16, the S&P 500 declined 5.6% through last Friday and is poised to fall another 2-4% today.

Over the last several years, investors have navigated an environment fraught with risks. Policymakers have balanced the need to address elevated inflation with the knowledge that tighter policy would eventually slow down the economy. Underpinned by a healthy labor market, the economy has held up better than most would have expected over the last two years and financial markets have performed well.

However, recent data suggests the US economy is slowing, igniting fears that a recession could be on the horizon. While the concern is valid and the market experience is uncomfortable in the short-term, we note that the Fed has room to accommodate and remind clients that a disciplined and patient approach has historically been rewarded.

What happened?

Last week (7/31), Fed policymakers held interest rates steady for a ninth consecutive meeting and pivoted in the updated policy statement to indicate that officials are now attentive to concerns about labor market weakening in addition to inflation risks. Stocks fell sharply on Friday (8/2) after U.S. jobs growth (+114k jobs) slowed for a third month in a row and the unemployment rate rose to 4.3% – the highest level in nearly three years. Weakness across other indicators including initial jobless claims, purchasing managers indices and durable goods and factory orders contributed to recession concerns.

Over the same period of time, investors drastically repriced their expectations for interest rates. In June, Fed policymakers communicated expectations for just one 0.25% cut in 2024 while investors were betting on two. In the last few days, traders ratcheted expectations up to five cuts in the remainder of the year including a 0.50% cut at the September meeting. In a very short period of time, investors’ perceptions of economic risk have gone from general malaise to acute concern.

Market reaction

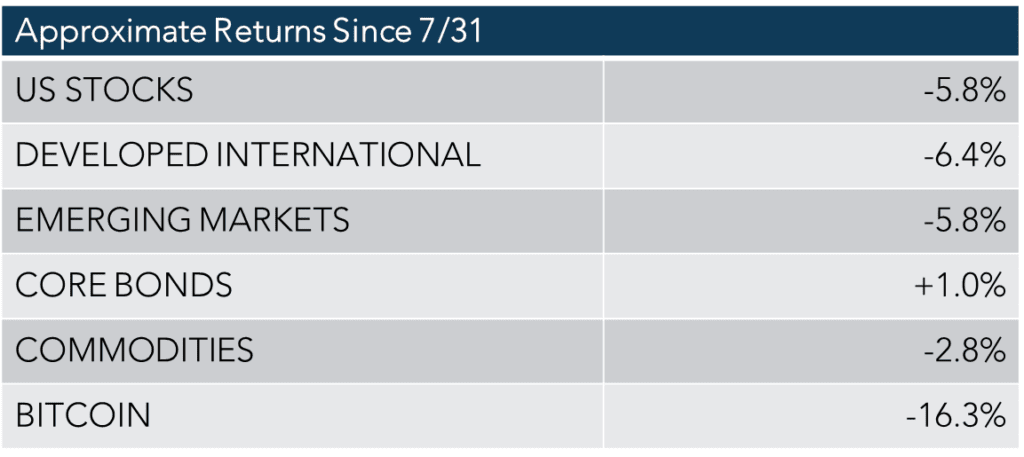

Since the FOMC meeting on July 31st, markets have been moving in a risk-off posture. Global stocks are down roughly 6%, commodities are down around 3% and, in a potential signal that sentiment is driving markets, Bitcoin is down around 16%. Safe havens like core bonds have been rallying and core bonds are up 1% in less than a week.

What happens next?

In the months ahead, Fed officials will adjust policy rates based on their assessment of the economy. We can debate whether the committee is behind the curve and whether it should have already started cutting, but the key is that policymakers are in a position to accommodate. Unlike the zero-interest-rate period that followed the 2008 financial crisis, today, with a Fed funds rate of 5.25%-5.50% (positive in real terms), the FOMC has the ability to take action that could positively influence our current economic trajectory.

Perspective

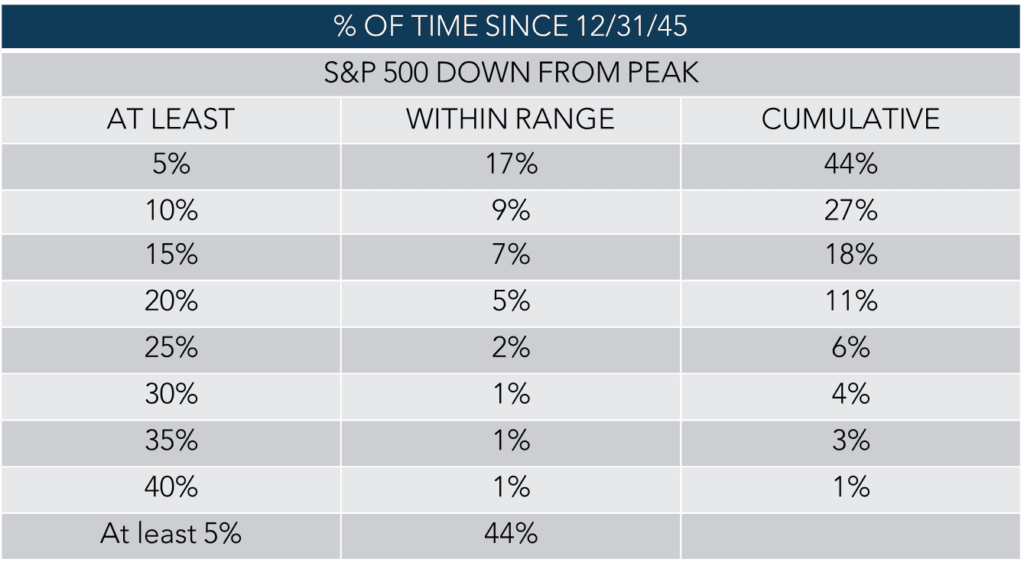

As always, some perspective is in order. On average market corrections occur once every one to two years. While corrections are never fun, they are very normal. Since 1945, the S&P 500 has spent 44% of the time at least 5% below its prior peak and nevertheless delivered 11.2% annualized returns. In today’s context, from an October 2022 low point, the S&P 500 gained over 60% through mid-July. The index moved higher in 16 of the last 22 months. One could argue we were due.

Discipline is key

In the short term, lots of things can and will come our way and there are always reasons to sell. However over longer periods of time, we have a much better idea of what to expect and we know that discipline has historically been rewarded. As unsettling as a market correction can be, we encourage our clients to stay focused on the longer-term and stay disciplined to the plan you have in place.

In the background, we are taking advantage of market opportunities where we see them, rebalancing to manage risk, and harvesting taxable losses where applicable. Despite an ever-changing landscape, our disciplined approach and long-term orientation serve us well as we endeavor to create comprehensive investment solutions that help our clients reach their financial goals. Please contact any member of our team if you have questions.